ForecastStocks:

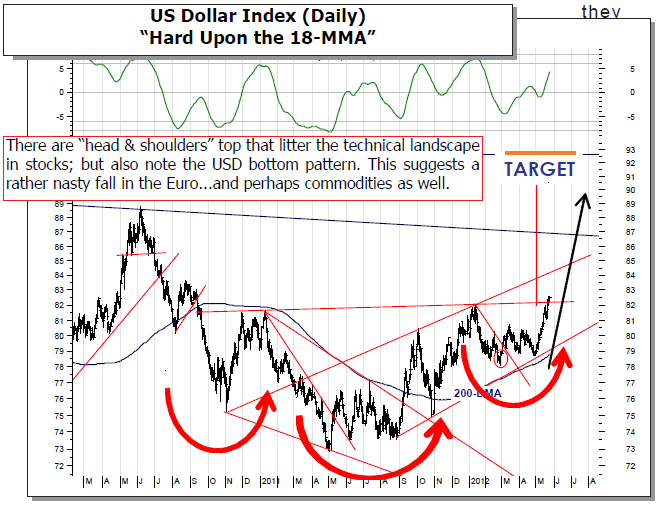

The European debt contagion remains front and center, with China “hard landing” concerns creeping into the conversation. Also, US economic data is starting to soften...surprising many. Collectively, given the the economic deceleration — it seems traders are looking for QEn+1, which has held up prices longer than is reasonable. Beware.

Strategy: The S&P 500 remains above long-term support at the 160- wma at 1182; which delineates bull/bear markets. But price action has turned atrocious, which suggests tenatively that a bear market has begun. However, we’ll watch the transports: a breakout higher would be bullish of equities in general.

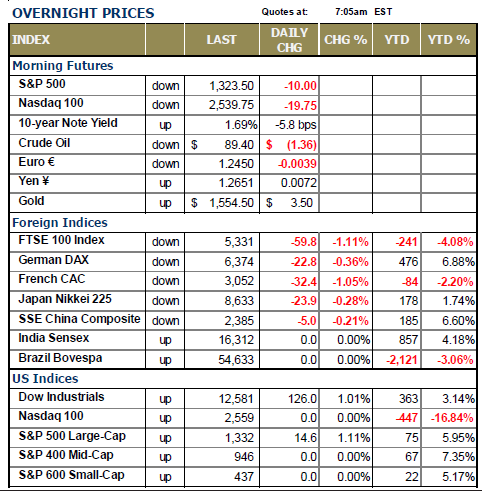

It's clearly a red day for stocks around the world as all the major bourses haven’t had the opportunity to trade in the “green” at all. There have been several that have bumped closed to the unchanged line, but to no avail in hurdling this level. This on the heels of yesterday’s rather volatile and sharp trade higher here in the US yesterday. This morning, a majority of those gains are evaporating as all things Europe are starting to come into view at a rather high rate of speed that is leaving everyone scrambling for an edge and managing risk much tighter than they might if the European situation weren’t so fluid.

That said, Germany is lower by -0.7%; the UK is lower by - 1.3%. But the real weakness again is in Spain, Italy and Greece, which are lower by -1.1%, 1.0% and -2.1% re spectively. As for this group’s 10-yr bond yields, which are perhaps the best indicator of stress in the markets – they are all higher. Spanish yields are up 18 bps 6.62%...awful close to the 7.0% level;Ital yields are up 17 bps at 5.93%...awful close the 6.0% level; and Greek yields up 45 bps 29.93%.

Major news out of Europe doesn’t really change; it is bad, and it is getting worse. EU has now said that France and Belgium must cut their budgets to meet deficit targets; Spain will sell bonds to recapitalize the Bankia failure – capacity it clearly doesn’t have given the yields on its debt; Spanish bank deposits fell rather sharply in April – slow jog bank run remains in place. The “good piece of news” out this morning is that European Commission called for a banking union in region and direct recapitalization of banks through the permanent bailout fund. This pushed European stocks off their lows and spiked the S&P futures rather sharply before giving way to weakness once again.

The market dearly wants to see good news. It wants to see the European ditherers put together a comprehensive plan to recapitalize the banks; it wants more of the ECB money printing drug; they want budget deficits to get into line – and they want it all by the end of the quarter. Such is the short attention span of Mother Market. This is a train wreck in slow motion and at the end of it – there will be a Northern currency and quite a few individual Southern currencies.

Trading Strategy: Nothing has changed in our viewpoint. We are remaining quietly patient for the current countertrend rally to run its course before we move once again to the short side of the market. It could very well be today, or tomorrow or a week from now. At this point, we are looking for clarity to act upon, which we believe is appropriate given the S&P futures are bouncing 10-to-15 points seemingly every other hour given the news flow.

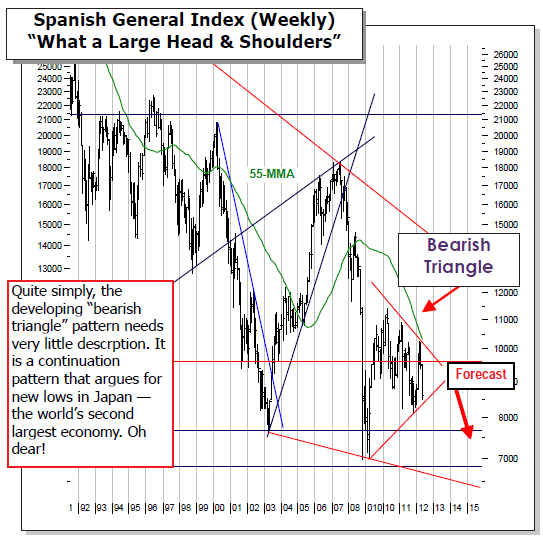

But make no mistake about: a bear market has begun in a number of important European and Emerging Market countries: notably Germany’s DAX, Brazil’s Bovespa and Hong Kong’s Hang Seng – each of which is below weekly and monthly moving average support levels that have led to bear markets and major losses in the past. Yesterday we showed Spain’s downside was on the order of -50%. Certainly one can’t reasonable expect to see Spain move this sharply lower without dragging the US and other regions down. Think about what “the end game” for Spain is under those circumstances? Just for a minute think about it.

Technically speaking for the S&P futures, they have rallied from 1288 to 1335 in what can only be described as a “halfhearted rally attempt,” but there still may be upside remaining towards the 1345 level. Thereafter, we’ll expect to see a swift move lower through the lows at 1288 and for the S&P cash to finally test its 200-day moving average at 1275…which is where the 200-dma/380-dema crosses. We would expect support to hold at that point initially – barring an foreseen cataclysmic European event that would carry prices sharply lower through level – a low probability bet on the first attempt to be sure.

We intend to remain patient in putting on our short position in TWM; it has returned to lower support at the $33.00, which also marks the neckline of the head & shoulders bottom pattern that targets $37-$38…the previous rally only allowed a print of $36. If prices cross above the $34.22 level today, then our propensity will be to start with another 20% position, then look to add another 10% to that position on a breakout above the highs at $36.03.

We should note that for today and the next several days, we are in the end-of-the-month/beginning-of-the-month buying period that tends to support prices. If prices can’t view the current correction as a bullish consolidation that shall ultimately be supported during this bullish time, then it will certainly provide further evidence that the proper position is be short on rallies. Until then, the sidelines are a nice place to be.