U.S. stocks and ETFs rallied strongly last week on the strength of positive economic and employment reports, but Europe poses an ever-growing threat to the global financial recovery.

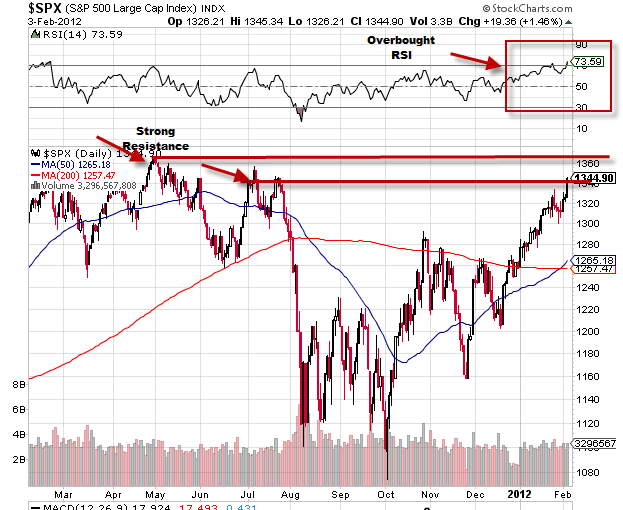

In the chart of the S&P 500 (NYSEARCA:SPY), above, we see that the major U.S. index has now reached very overbought levels as represented by a reading greater than 70 on RSI. It has also approached significant resistance levels reaching back to last spring and summer. Conditions like these typically lead to measurable and possibly significant declines.

The Economic View From 35,000 Feet

Global stock markets and major U.S. indexes and ETFs like the SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) made substantial gains last week, with the Dow Jones rising 1.6%, its best level in 3 1/2 years. The S&P 500 (NYSEARCA:SPY) followed suit with weekly gains of 2.2%.

Economic news was mixed. On the plus side we saw improvements in ISM, Construction Spending, and particularly the Non Farm Payrolls and Unemployment Report on Friday. On the down side, home prices continue to slide, Chicago PMI was down, consumer confidence declined and Factory Orders fell.

The Financial Sector ETFs like Financial Select SPDR (NYSEARCA: XLF) were supported by encouraging words from Fed Chairman Ben Bernanke and the hope for a speedy resolution to the Greek crisis.

However, as the weekend wore on, Greece continued its struggle to get to a deal with the “troika” of the European Central Bank, European Union and International Monetary Fund, and these ongoing delays put Europe and the world on the mountain’s edge of success or failure.

Major ETFs tracking Europe like iShares Euro 350 (NYSEARCA: IEV) and iShares Germany (NYSEARCA: EWG) rallied strongly last week but remain vulnerable to a “Greek shock,” as do our major indexes.

This week will be light on economic reports with job openings and consumer credit on Tuesday, weekly employment reports on Thursday and consumer sentiment on Friday. We’ll also get earnings reports from important companies like YUM, LinkedIn, Visa, Cisco, Pepsi, Coke and Disney which are always trend setters for future economic activity.

Bottom line: Conditions in the United States continue to improve in a slow and choppy manner while conditions in Europe deteriorate and Greece moves towards an impasse with the European Union. Failure to defuse the Greek crisis could well push global financial markets over the edge.

Disclaimer: Wall Street Sector Selector actively trades a wide range of exchange traded funds (ETFs) and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Europe, Global Markets On Edge

Published 02/06/2012, 01:44 AM

Updated 05/14/2017, 06:45 AM

Europe, Global Markets On Edge

After a strong week, global financial markets stand on the cliff’s edge of Europe.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.