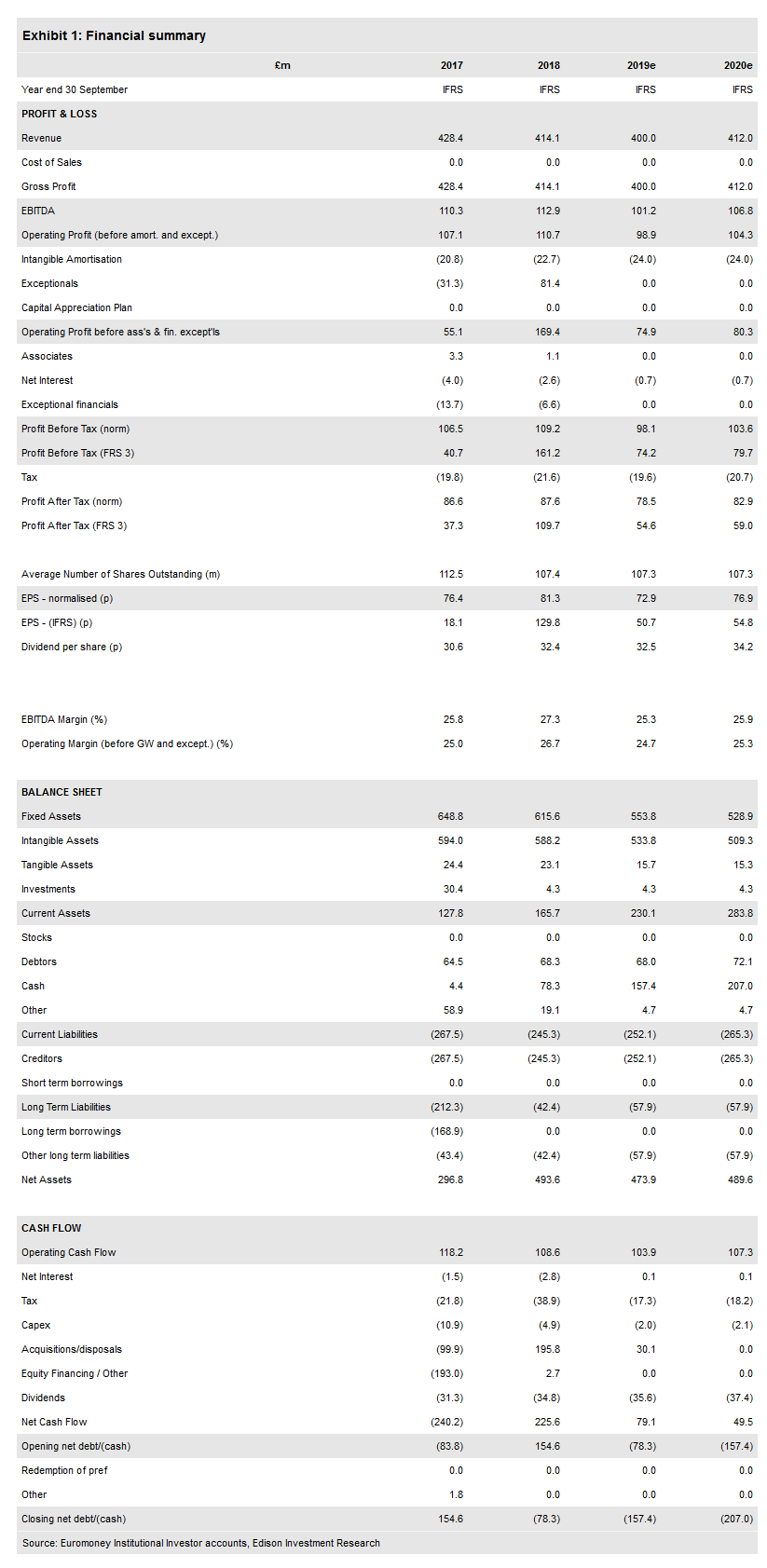

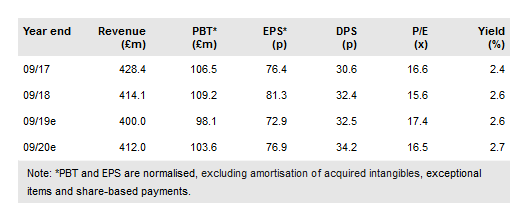

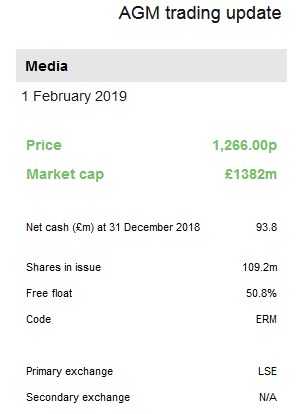

Euromoney Institutional Investor (LON:ERM) Q1 update demonstrates the value of management’s focus on Pricing, Data and Market Intelligence, where 9% growth has more than offset well-flagged weakness in Asset Management, down 4%. Full year guidance is unchanged, but we point out that our forecasts do not reflect December’s acquisitions of BoardEx and The Deal yet to complete. Management expects these to be earnings enhancing in their first year. Net cash at end December of £93.8m is prior to payment for these deals of $87.3m (£66.6m), leaving ample resource for further deals.

Balance shifts further to pricing

Management has been clear on the attractions of being the authoritative voice in opaque and semi-opaque markets. ERM’s Fastmarkets brand is clearly gaining traction, with the news that it will set the reference prices of the LME’s three new cash-settled derivatives in aluminium, alumina and cobalt. Pricing, Data & Market Intelligence was 42% of FY18 group revenues, and is set to be markedly higher in FY19 given the premium growth over the rest of the group. The issues in Asset Management are well documented and the subscription revenue decline of 4% was in line with FY18 trends, but improved from the 6% decline in Q118. The product suite and cost base here were addressed in Q418, taking out £7m of annualised cost. The Events business, focused in earlier periods on fewer, larger events, has continued to perform well, with revenues up 3%. Although this is slower than FY18’s 7% growth, it is against tougher comparatives. The statement refers to advertising trends consistent with FY18 (down 5%), but this is now less than 10% of group total.

Cash resource remains strong

The growth in subscription and content revenues helps the already strong cash conversion characteristics of the group. The £98.3m end December cash figure is prior to the acquisitions referred to above (as is our current forecast end FY19 figure of £157.4m). With the committed RCF of £240m and uncommitted accordion of £130m, there is plenty of firepower for further acquisitions. The group has a clear preference for off-market deals of non-core assets within other groups rather than high-profile auctions where private equity interest inflates prices.

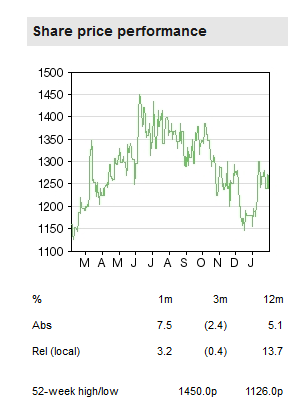

Valuation: Undeserved discount

Euromoney’s shares continue to trade at a notable discount to global financial data peers, currently valued at an CY19 EV/sales of 4.1x, EV/EBITDA of 17.4x and P/E of 22.6x. Given the resilience of the earnings, high level of subscription income and attractive cash conversion, this discrepancy appears to us to be excessive.

Business description

Euromoney Institutional Investor is a global, multi-brand information business that provides critical data, price reporting, insight, analysis and must-attend events to financial services, commodities, telecoms and legal markets.