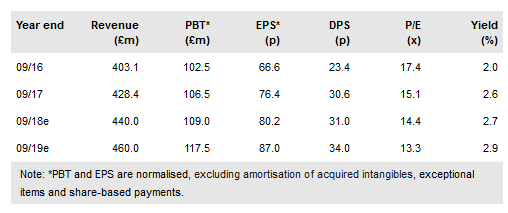

Euromoney Institutional Investor’s (LON:ERM) FY17 results were as indicated at the year-end update, “perhaps a little better”, with FY18 having started on track. Our forecasts are broadly unchanged on these figures, adjusted for the disposal of Adhesion/WBWE. The strategic transition put in place over the last two years is driving stronger underlying growth, with ongoing recycling of capital into better businesses. The overhanging cloud remains MiFID II, which is deterring new business from asset managers. This should work its way through and meanwhile the pricing-based businesses are making good progress. Strong cash flow makes further acquisitions likely. The rating does not reflect the improving underlying earnings quality.

Dealogic a logical deal

Euromoney has also announced that it is to sell on its minority stake in Dealogic for approximately $135m (retaining the use of required data). This was bought for €59.2m in November 2014, equivalent to a 32% pa return on capital uplift plus the profits that it has earned in the interim period - £3.9m at the pre-tax level in the year just ended. The disposal will be reflected in our figures once the deal completes. At the balance sheet date, the group categorised two businesses as held for sale (CEIC and EMIS), having been previously subject to strategic review. It is clear that there will be a meaningful reduction in net debt, with the intended CEIC and EMIS disposals putting the group back into a substantial net cash position. Holding cash at current interest rates would be earnings’ dilutive and we would anticipate that acquisitions are front of mind, although timing will always be uncertain.

To read the entire report Please click on the pdf File Below: