On the money

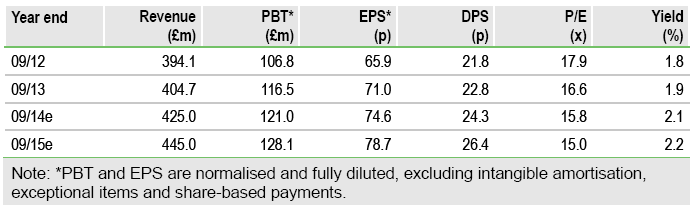

Euromoney’s recent finals were a touch ahead of consensus, with a steady flow of smaller acquisitions bolstering the top line and good central cost control driving greater pre-tax gains. With only modest organic increases likely in pricing and penetration, further substantive progress depends on deals (for which a new $160m debt facility is in place) and on leveraging the new content management platform, Project Delphi. The premium rating is justified by the balance street strength and earnings record.

Acquisitions giving incremental growth

Top-line progress of 3% was around half attributable to the recent additions to the group, with a better Q4 for advertising revenues and subscriptions compensating for weaker performance earlier in the year. The new debt facility, again from DMGT, is smaller than that it replaces but on slightly more advantageous terms at the lower end. Without any further purchases, Euromoney should move into a net cash position during the current financial year (despite deferred payments and the recent Infrastructure Journal purchase), but this outcome would be disappointing given the corporate expansion strategy. Larger acquisitions would be considered subject to sensible pricing, with funding potentially supplemented by more conventional debt. The group has built an enviable record on deal execution and integration, with five purchases in the last 12 months at a combined cost of around £60m.

Infrastructure investment

The new content management platform, Project Delphi, adds potential to further leverage the IP and data library, with BCA the first group company to transfer across. The total cost of £9.4m over three years implies a higher amortisation charge, but should allow for higher margin and more flexible products that can facilitate more advantageous pricing while also delivering added value for clients. The group’s strong cash flow profile easily supports this investment without compromising the ability to fund the normal investment and acquisition programmes as well as fund the payment of a progressive dividend.

Valuation: Justifiable premium

The B2B media sector has performed strongly over the last year as some of the economic clouds have started to lift. Euromoney’s shares trade at the top end of the peer group at a 16% P/E premium to the peer group CY13 adjusted average and at a 19% premium on EV/EBITDA. We feel this is justified on the basis of the strong balance sheet, the so far-successful transition to a digital delivery model and management’s consistent record of delivering on market expectations.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euromoney Institutional Investor

Published 11/29/2013, 04:50 AM

Updated 07/09/2023, 06:31 AM

Euromoney Institutional Investor

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.