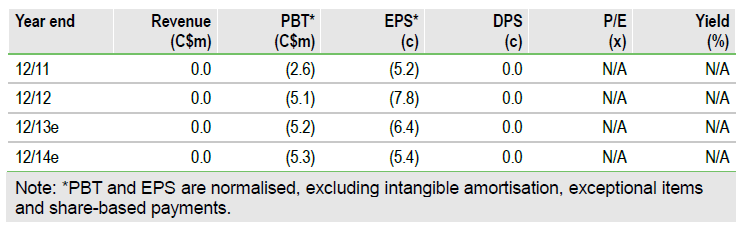

Euromax Resources (EOX.V) is a Canadian resource company with a strategy to become a mid-tier European gold producer by developing mining assets in Southeast Europe. Euromax’s flagship project, Ilovitza, is at the pre-feasibility stage and will require capex of US$476m to bring it into production in 2017. Euromax’s key competitive advantages relate to proximity to the European Union market and management’s considerable local operating experience. Risks relate to commodity pricing and access to finance. Based on our sum-of-the-parts analysis, we value Euromax at C$0.40 per share on a fully diluted basis.

Key advantage: Location and management

Euromax believes that its asset locations offer a distinct competitive advantage. Southeast Europe is relatively underexplored compared with the rest of Europe and is geologically prospective. The project potentially has preferential access to the European market and its proximity to Europe should result in lower transport costs. The region has well-developed infrastructure reducing the need for Euromax to invest in bespoke road, water and power systems. Euromax’s management team has considerable experience developing projects in Southeast Europe. The team was involved in the operation and development of European Goldfields and has geological and regulatory knowledge of the region.

Funded for the year, but risks remain

At end-June 2013, the group had cash of C$6.2m and no debt. The group is funded for the remainder of this year, but is likely to require additional financing of C$10-15m next year. The company’s ability to develop its assets will depend on its access to the equity market to raise cash. The project is sensitive to commodity price and market sentiment changes. The group is considering a London listing, which would provide an additional potential funding source.

Valuation: C$0.40 (on a diluted basis)

We value Euromax using a sum-of-the-parts methodology to reflect its portfolio of projects. Ilovitza is valued using a DCF, while Trun is valued on a market cap per resource ounce basis and KMC is included at book value. The valuation indicates Euromax is worth C$0.40/share relative to a share price of C$0.29. This valuation includes the full cost of financing, tax and dilution (based on debt/equity of 50%) at the corporate level. Euromax appears cheap relative to its peers on a market cap per gold-equivalent resource ounce basis, suggesting there is scope for re-rating as the projects are progressed up the value chain.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euromax Resources: Funded For The Year, But Risks Remain

Published 09/15/2013, 05:36 AM

Updated 07/09/2023, 06:31 AM

Euromax Resources: Funded For The Year, But Risks Remain

European gold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.