Eurodollar Non-Commercial Speculator Positions:

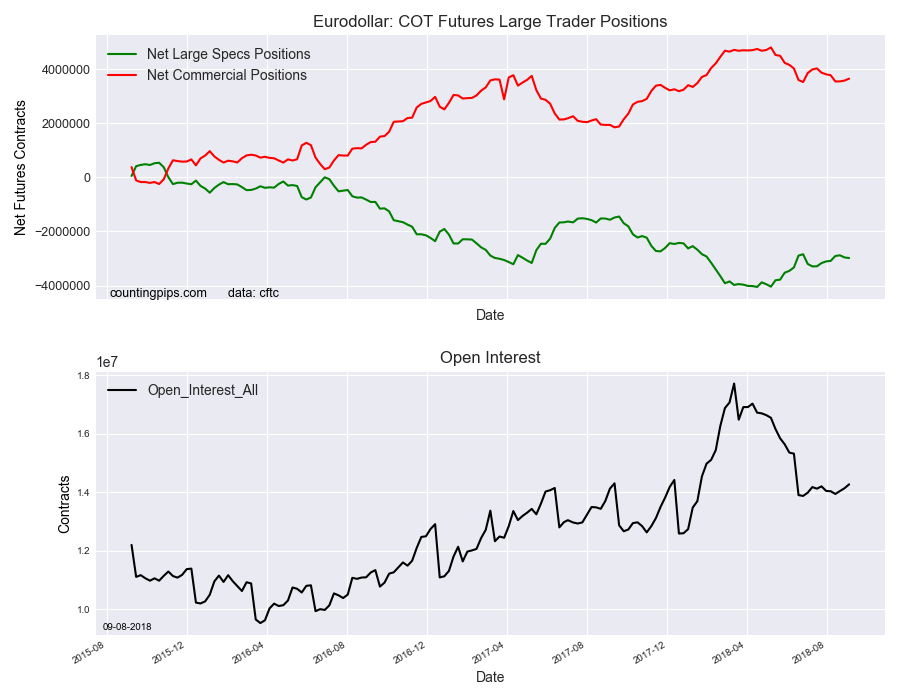

Large interest rate speculators raised their bearish net positions in the Eurodollar Futures markets for a second straight week this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Eurodollar futures, traded by large speculators and hedge funds, totaled a net position of -2,981,708 contracts in the data reported through Tuesday September 4th. This was a weekly fall of -21,164 contracts from the previous week which had a total of -2,960,544 net contracts.

The overall bearish speculator position had fallen for six straight weeks before rising over the past two weeks. The current standing remains below the -3,000,000 net contract level for a fourth straight week while the Eurodollar spec position has continued to be in a bearish position for the one hundred and fourteenth straight week.

Eurodollar Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 3,654,477 contracts on the week. This was a weekly gain of 71,463 contracts from the total net of 3,583,014 contracts reported the previous week.

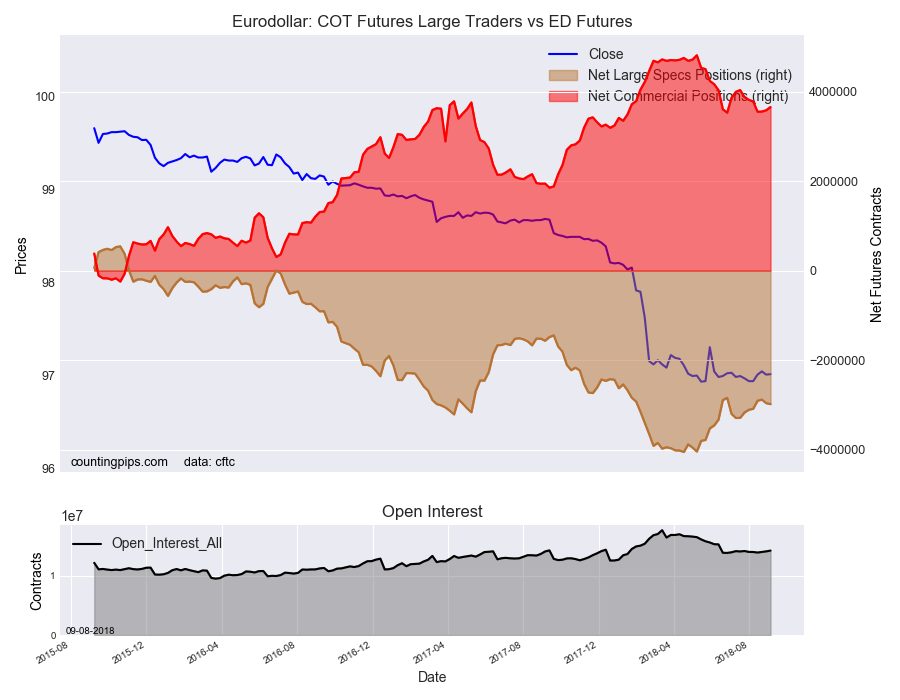

ED Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Eurodollar Futures closed at approximately $97.015 which was a boost of $0.005 from the previous close of $97.01, according to unofficial market data.