As the largest risk event of the year nears in the form of a UK Exit from the European Union the Eurozone is facing never before seen levels of risk. The outcome of the pending Brexit vote could very well determine the medium term trend of the currency pair which makes a review of the week ahead highly salient.

The euro declined through most of past week as the pair reacted to the ongoing uncertainty inherent within the pending Brexit vote. However, despite price action sliding towards the bottom of the channel, the pair managed to rise late in to the week as the latest Brexit polls seemed to indicate that the pro-exit vote lead had largely evaporated. Subsequently, the pair rose to finish the week around the 1.1263 mark. In addition, the Eurozone CPI figures also helped, coming in on target at 0.8% y/y.

Looking ahead, the week will be strongly volatile as the Brexit risk event looms upon the horizon. Subsequently, expect plenty of swings and variability in the lead up to the referendum result as the polls are updated. In addition, keep a watch on US Fed Chair Yellen’s speech, due on Tuesday, as it could bring about some changing rhetoric from the central bank. However, it is likely to remain largely overshadowed by the UK referendum result.

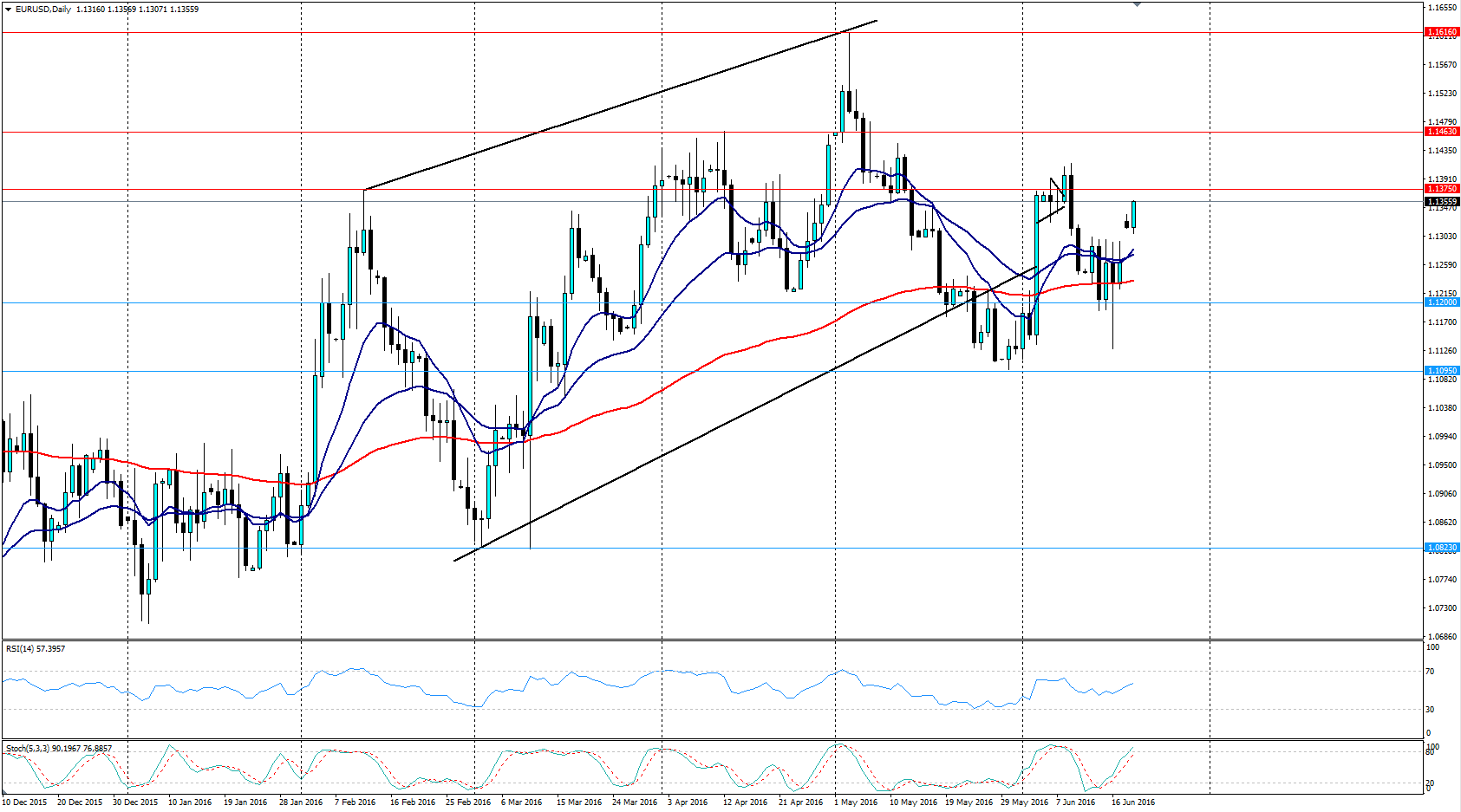

From a technical perspective, the EUR/USD fought to push through the bottom of the near term channel during most of last week. However, the failure to break lower largely predisposes the pair to more sideways price action from a technical perspective. The RSI oscillator remains relatively flat, whilst it meanders within natural territory, while Stochastics are indicating an overbought status.

Although price action currently remains above the 100-day moving average the pair is likely to remain neutral until a strong trend direction is formed post-Brexit. Support is currently in place for the pair at 1.1200, 1.0950, and 1.0823. Resistance exists on the upside at 1.1375, 1.1463, and 1.1616.

Ultimately, the Brexit vote is likely to be a watershed for not only cable but also the Eurozone as a whole. Any move by Britain to exit the EU is likely to cause some strong volatility around currencies and potentially damage the fabric of the EU indelibly. Subsequently, consider limiting your risk and monitoring the polls closely in the lead up to the event.