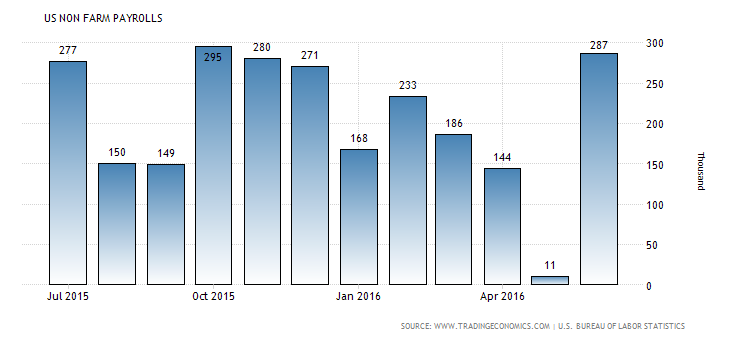

The euro drifted lower throughout most of last week as the stronger than expected US ADP NFP data saw capital flowing into the greenback. The ADP figure came in well above forecasts at 172k which was followed by the official NFP figure of 274k.

Subsequently, the end of the week was all about dollar strength with the pair finishing around the 1.1037 mark. Subsequently, it is salient to take a look at the week ahead given the risk of increased volatility.

The euro saw some selling as capital flowed into the greenback and the pair finished the week down around the 1.1037 mark.

However, last week also contained some concerning statements about the relative health of Deutsche Bank (NYSE:DB, DE:DBKGn) with the IMF stating that the institution posed the greatest risk to global financial stability.

Looking ahead, the week will primarily focus upon the US and EU CPI results, which are both due out on Friday. In particular, the US result will be closely watched for any signs of slipping inflation which could influence Fed policy in the upcoming FOMC meeting.

In contrast, the Eurozone result is forecast at an anaemic 0.1% y/y which it is likely to meet. However, any negative surprises from either figure could cause plenty of volatility as the market would need to adjust to changing probabilities around rate hikes.

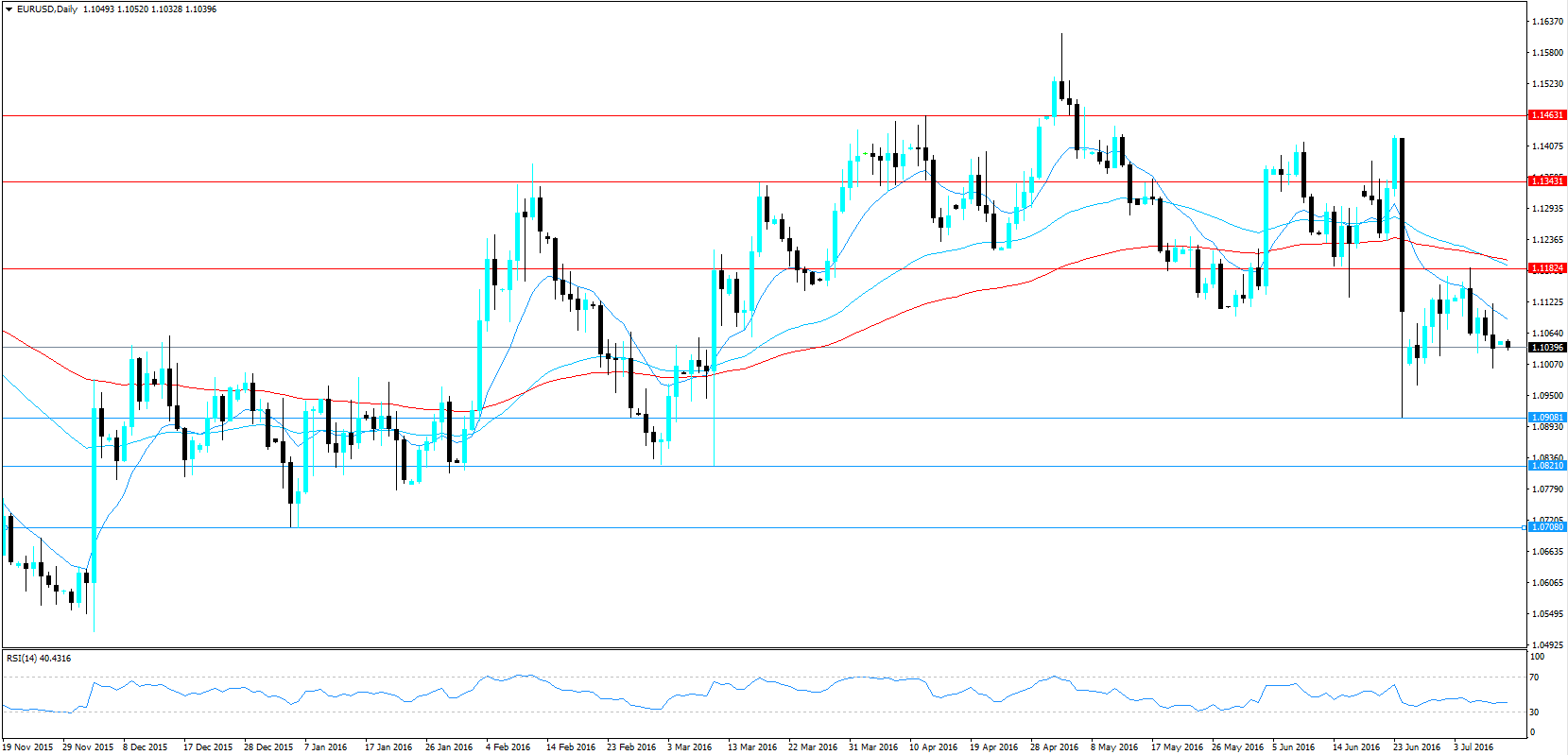

From a technical perspective, the EUR/USD has continued to maintain its position above the key 1.10 handle but continued to drift lower throughout the week. However, the RSI Oscillator continues to meander without a strong trend, within the neutral zone. In addition, the 12, 50, and 100 EMA’s have started to trend lower and price action is now firmly below the 100-day MA.

Subsequently, our initial bias remains neutral for the week but with a caveat that any break below the 1.10 handle could quickly move to challenge the 1.0821 support level. Support is currently in place for the pair at 1.0908, 1.0821, and 1.0708. Resistance exists on the upside at 1.1182, 1.1343, and 1.1463.

Ultimately, the euro-dollar is likely to face additional selling pressure if the US CPI shows any form of strength of robustness in the result. However, it remains to be seen if the key 1.10 handle can be convincingly breached to the downside. Subsequently, keep a close watch on the pair in the coming days as if it’s going to happen…it will be rapid indeed.