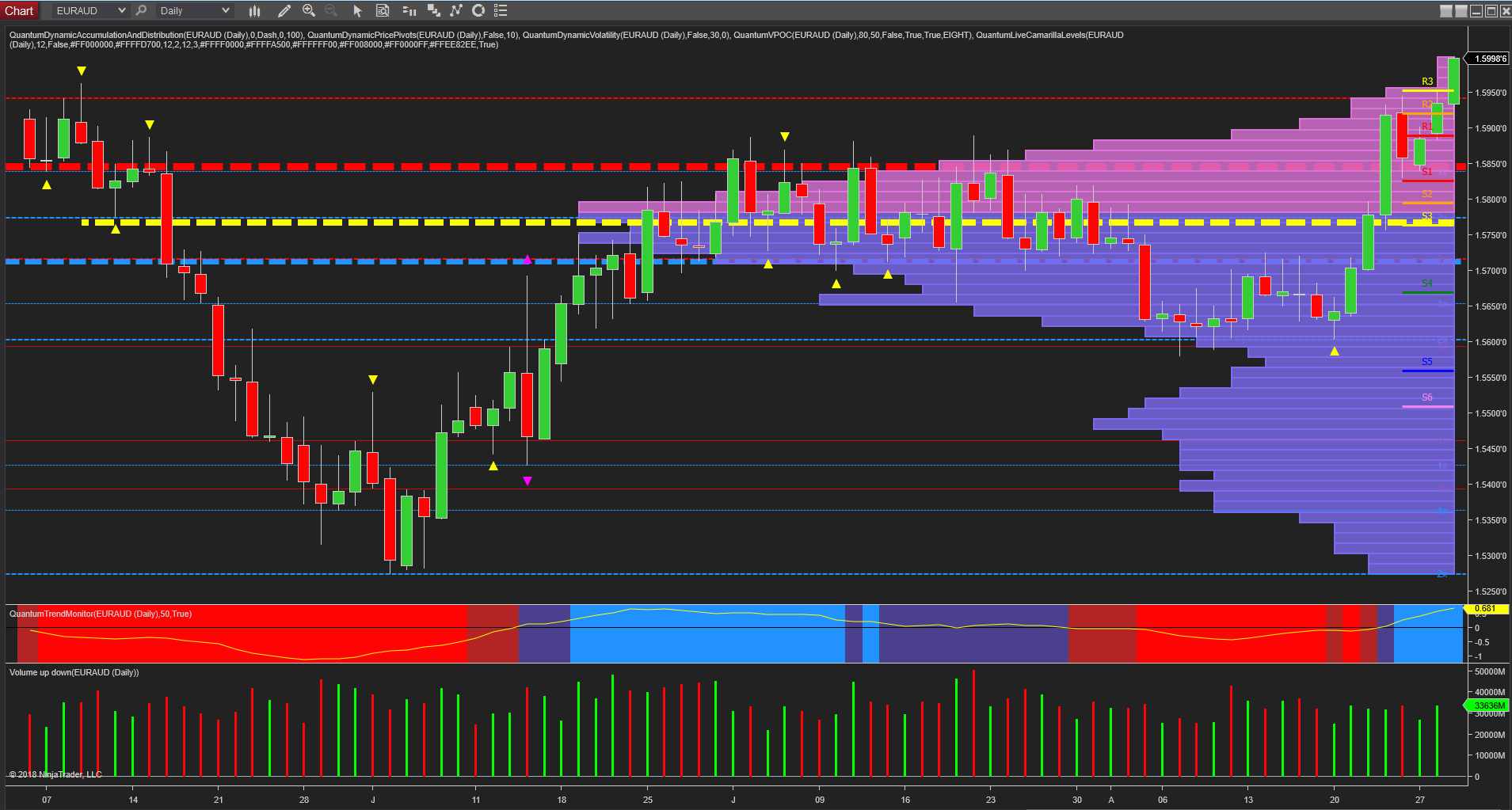

The strongly bullish sentiment we have seen over the past few days for the euro has been strongly mirrored in its cross pairs and in particular, with the EUR/AUD, which has been driven both by euro strength and a weak Aussie-dollar. For much of the summer the pair has been in the doldrums, trading in a narrow range testing support in the 1.5600 area as denoted with the blue dashed line, while building a strong ceiling of resistance in the 1.5850 level with the thick red dashed line defining this region. And as we might expect from such an extended period of congestion, the volume point of control has been established in the 1,5780 area where the concentration of volume is at its heaviest.

Sentiment

The volume point of control or VPOC acts as the fulcrum of the market where price agreement has been reached before bullish or bearish sentiment becomes dominant and drives the price away from the region. In this case, it is bullish sentiment now moving the pair firmly away and up to test some low volume nodes immediately ahead where volume concentration is light, and therefore we can expect the pair to move through here relatively quickly. The key price action of the past few days has been the breakout through the previous ceiling of resistance at 1.5850 and which now acts as strong support below and it is interesting how this was immediately retested in the subsequent two sessions following the wide spread up-candle of the August 23.

Today’s price action has also seen a move through the R3 level on the Camarilla levels indicator and if the R4 level is also taken out, it will open the way for a possible longer-term move to test the R5 level, initially at 1.6140 and thereafter on to the R6 level 1.6220.

Finally, notice also the transition of the trend monitor indicator to bright blue as we move higher coupled with the trend line also rising strongly.