EUR/USD broke higher last week on the back of a an upbeat press conference following the ECB opting to hold steady with current monetary policy. ECB leader Mario Draghi cited positive contagion in the euro zone as a reason to be optimistic, and this was certainly the case in the region’s bond market last week. The decision to hold rates at 0.75% rather than cut was unanimous, an improvement from last month’s split decision.

Spain along with Ireland and Italy drew healthy demand at lower yields in the longer term bond auctions, with yields on Spanish debt falling below 5%, while Italy edged closer to 4%. EUR/USD has long help an inverse correlation to yields in the periphery with the rallying as yields decline and vice versa.

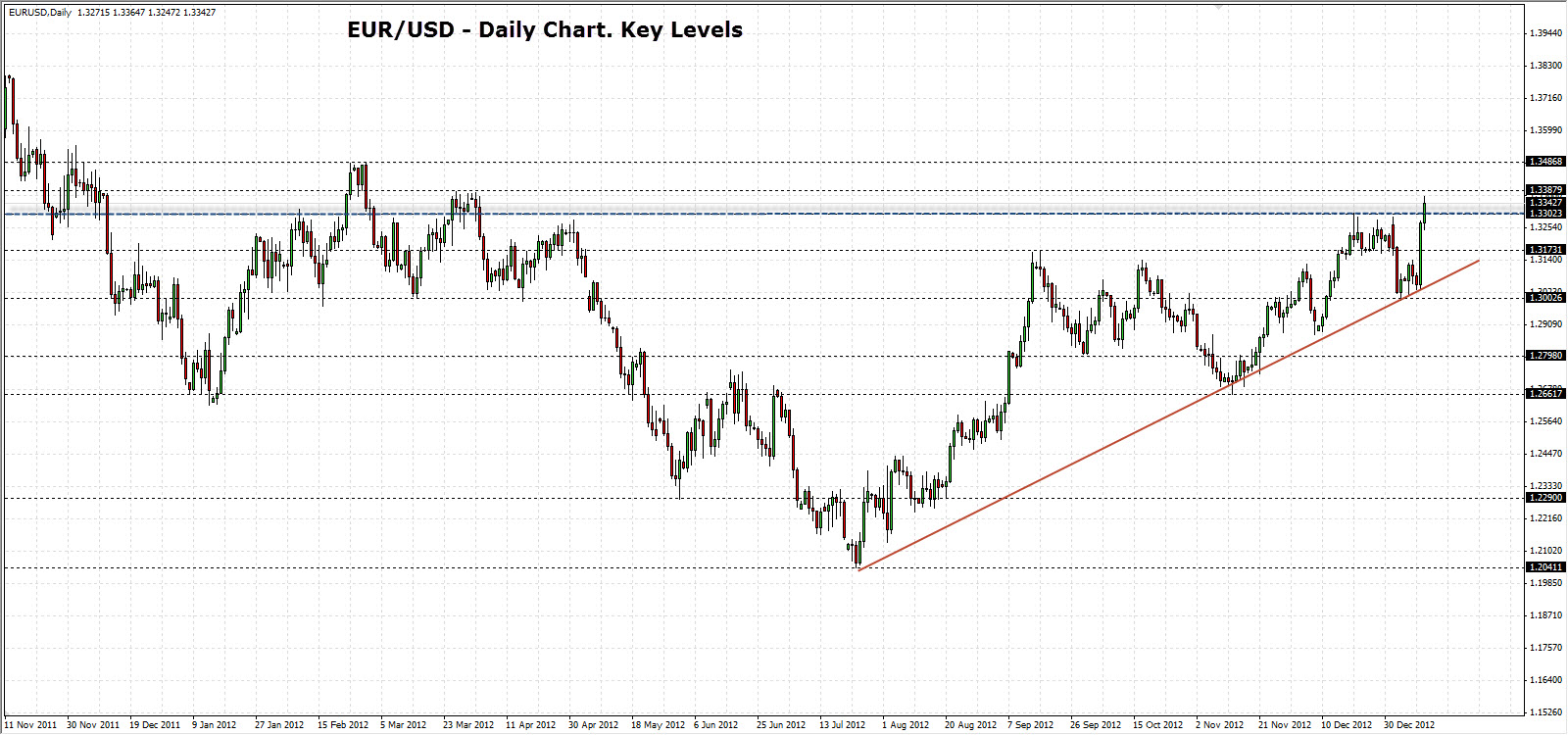

EUR/USD broke above resistance and the 1.3300 key level, making the technical outlook for the pair slightly more bullish. Expect a test of resistance at 1.3387, bringing the 1.3486 ley level in to play.

On Monday we’ll see regional Industrial Production where the forecast is for a rebound of 0.2% after last month’s -1.2% drop. Wednesday’s CP and Core CPI are expected to show price remain stable around 2.2%y/y. Thursday’s Spanish bond auction looks to be the highlight. Investors will be on the look out to see if this ‘positive contagion’ Mario Draghi mentioned is a real phenomenon. EUR/USD" title="EUR/USD" width="800" height="482">

EUR/USD" title="EUR/USD" width="800" height="482">

- EUR/USD looks to have reversed its longer term downtrend.

- Friday’s break above 1.3300 is expected to have bullish implications.

- Recent break higher effectively sets a fresh higher high, indicating an improvement in the longer term decline.

- A sustained break above the 1.3384 level will completely invalidate bearish scenario from a price action perspective

Bullish Bias