Exactly 20 years to the day after the creation of the European Union (EU) and the Euro currency, German Chancellor Angela Merkel successfully secured an historic agreement from all 27 current members of the EU, except Britain, forging a deeper economic integration in the euro zone on Friday, 9 Dec.

The Euro crunch summit also came away with an agreement to provide up to €200 billion ($268 Billion) in bilateral loans to the International Monetary Fund (IMF) to help it tackle the crisis, with 150 billion euros of the total coming from the euro zone countries.

The date that the European Stability Mechanism (ESM), capped at €500 billion ($666 billion), operation was also pushed up, the pledge to make private investors absorb losses in any future bailout for a euro nation is also to be scrapped.

While this new pact might be better to prevent future such sovereign debt crisis, others (including the US, and the IMF) view is that the summit has failed to adequately address the more immediately and urgent issues.

Ticking Euro Debt Bombs

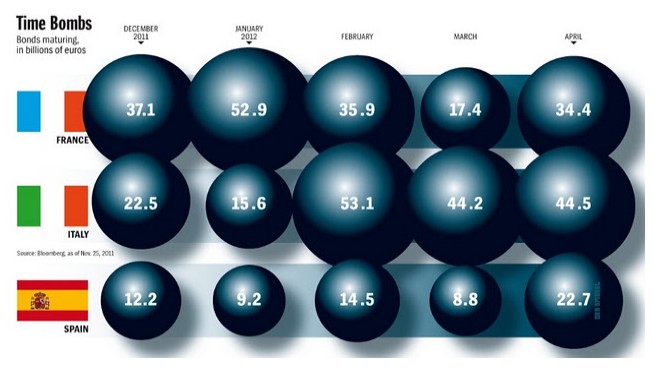

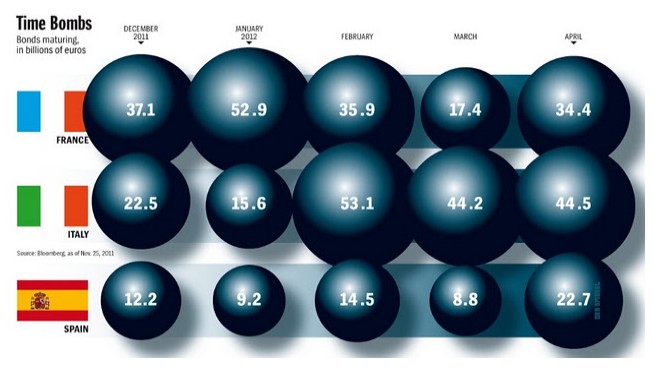

Euro zone has to repay or roll over more than 1.1 trillion euros, around $1.5 trillion, debt due in 2012, with about €519 billion, or $695 billion, of Italian, French and German debt maturing in the first half alone, according to Bloomberg. (See Graphic below from Spiegel with a shorter time frame sans Germany).

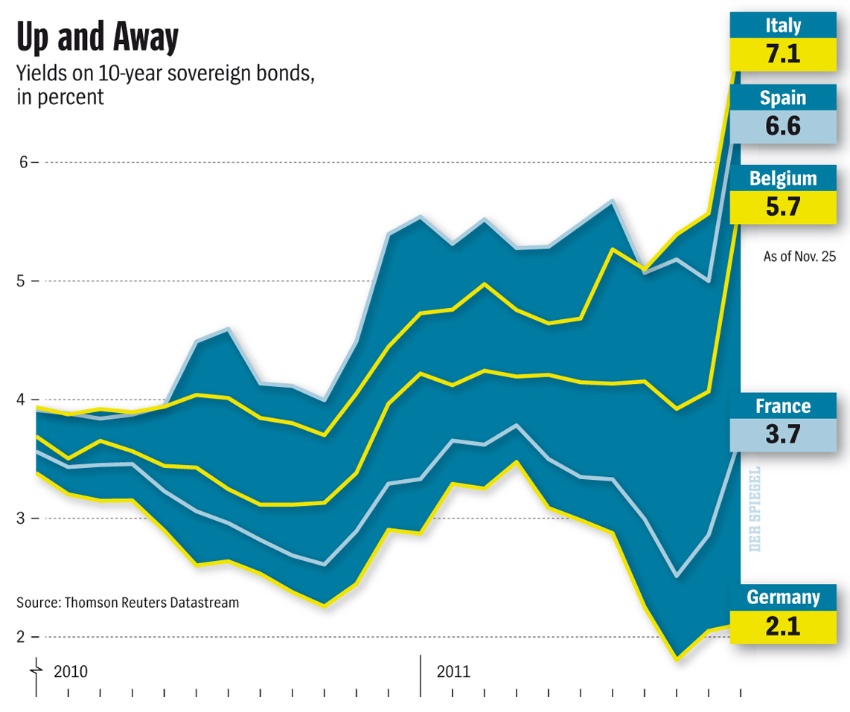

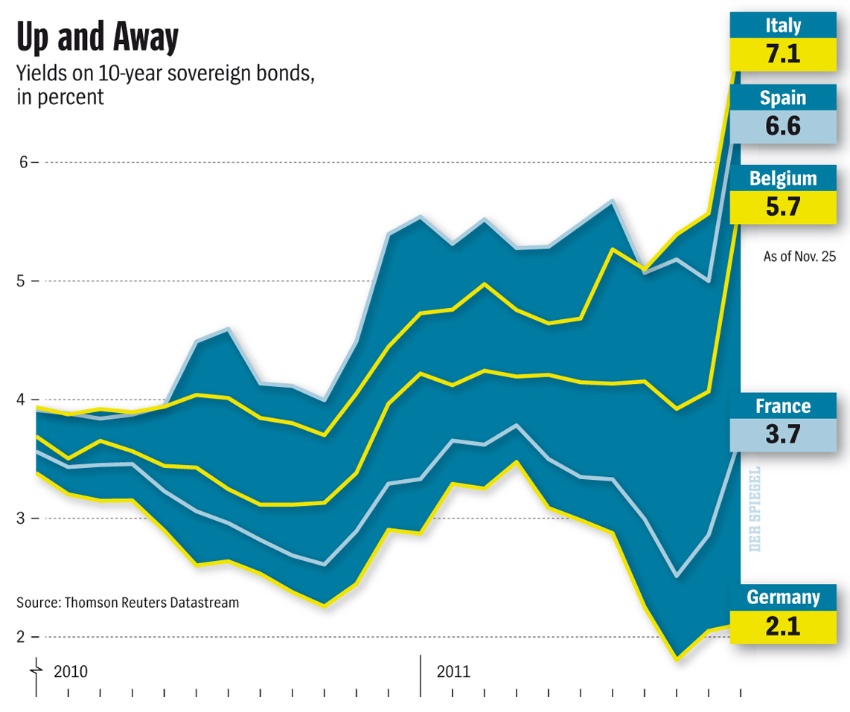

With Euro Zone sovereign bond yield spiking to record levels, probability is quite low for Italy and Spain to refinance next year at a sustainable rate going forward as there's not an effective backstop firewall

Germany, France would most likely need to pay a much higher interest rate due to this debt crisis contagion. Belgium is no GIIPS yet, but its sovereign bond interest rate is closing on the 7% threshold that could require external bailout aid.

European Banks Need $153 Billion in Fresh Capital

There are also problems at the heart of the European banking system.

According to the European Banking Authority (EBA) in London (from BusinessWeek),

"....Banks in the European Union must raise €114.7 billion ($152.8 billion) in fresh capital as part of measures introduced to respond to the euro area’s sovereign-debt crisis."

Back in July, eight European banks failed the regularly scheduled stress tests with a combined capital shortfall of €2.5 billion. And things have deteriorated since then. The updated figures from EBA take into account bank's sovereign holdings through the end of September.

Step-by-step Is Killing The Euro Zone

Europe, even with the aid from the IMF, would have a very difficult time covering between the sovereign debt rollover and shoring up the banks capital structure. Essentially, the 'step-by-step' crisis solution as described by Merkel is a killing the Euro Zone.

The European Union of course is fully aware that markets are unlikely to be in the forgiving mood without some 'bazooka'.

The inaction could suggest

1. The actual 'hole' is a lot more substantial than figures floating in public out there. Kicking the can down the road as far as possible is probably the only viable option in the short-to-medium term.

2. Politics truly trumps economics as Germany could be using this crisis as a cudgel to gain power and control over the EU and on the global stage. This also seems to indicate Germany has plenty of resource for this step-by-step waiting game.

Another Backdoor Taxpayer Bailout Across the Pond?

Germany is reportedly still against the idea of a collective Euro Bond (although Italy's Monti seems confident that Germans would eventually see the light), and does not like the European Central Bank (ECB) embarking on large-scale bond purchases, like the U.S. Federal Reserve have been doing, either.

One of the messages out of the crunch summit is that private investors would not 'absorb losses in any future bailout for a euro nation,' which could suggest banks would get 100 cents on the dollar of the future troubled sovereign debt of Italy and Spain, etc.

So we could also be looking at yet another backdoor taxpayer bailout of the banks -- similar to the U.S. Fed's '$1.2 trillion secret loan to banks, with repayment optional) --so banks would support buying the European sovereign bonds, while keeping the banking financial system afloat.

Somebody, somewhere has to put up the money and take the loss of the Euro Zone, and it does not look like EU would rise up to the occasion. Eventually the markets would get past the Euro crisis and the world would move on. But it seems the European taxpayer, just like their American counterpart, could end up being the last hero standing saving the global financial system, along with the world as we know it.

The Euro crunch summit also came away with an agreement to provide up to €200 billion ($268 Billion) in bilateral loans to the International Monetary Fund (IMF) to help it tackle the crisis, with 150 billion euros of the total coming from the euro zone countries.

The date that the European Stability Mechanism (ESM), capped at €500 billion ($666 billion), operation was also pushed up, the pledge to make private investors absorb losses in any future bailout for a euro nation is also to be scrapped.

While this new pact might be better to prevent future such sovereign debt crisis, others (including the US, and the IMF) view is that the summit has failed to adequately address the more immediately and urgent issues.

Ticking Euro Debt Bombs

Euro zone has to repay or roll over more than 1.1 trillion euros, around $1.5 trillion, debt due in 2012, with about €519 billion, or $695 billion, of Italian, French and German debt maturing in the first half alone, according to Bloomberg. (See Graphic below from Spiegel with a shorter time frame sans Germany).

With Euro Zone sovereign bond yield spiking to record levels, probability is quite low for Italy and Spain to refinance next year at a sustainable rate going forward as there's not an effective backstop firewall

Germany, France would most likely need to pay a much higher interest rate due to this debt crisis contagion. Belgium is no GIIPS yet, but its sovereign bond interest rate is closing on the 7% threshold that could require external bailout aid.

European Banks Need $153 Billion in Fresh Capital

There are also problems at the heart of the European banking system.

According to the European Banking Authority (EBA) in London (from BusinessWeek),

"....Banks in the European Union must raise €114.7 billion ($152.8 billion) in fresh capital as part of measures introduced to respond to the euro area’s sovereign-debt crisis."

Back in July, eight European banks failed the regularly scheduled stress tests with a combined capital shortfall of €2.5 billion. And things have deteriorated since then. The updated figures from EBA take into account bank's sovereign holdings through the end of September.

Step-by-step Is Killing The Euro Zone

Europe, even with the aid from the IMF, would have a very difficult time covering between the sovereign debt rollover and shoring up the banks capital structure. Essentially, the 'step-by-step' crisis solution as described by Merkel is a killing the Euro Zone.

The European Union of course is fully aware that markets are unlikely to be in the forgiving mood without some 'bazooka'.

The inaction could suggest

1. The actual 'hole' is a lot more substantial than figures floating in public out there. Kicking the can down the road as far as possible is probably the only viable option in the short-to-medium term.

2. Politics truly trumps economics as Germany could be using this crisis as a cudgel to gain power and control over the EU and on the global stage. This also seems to indicate Germany has plenty of resource for this step-by-step waiting game.

Another Backdoor Taxpayer Bailout Across the Pond?

Germany is reportedly still against the idea of a collective Euro Bond (although Italy's Monti seems confident that Germans would eventually see the light), and does not like the European Central Bank (ECB) embarking on large-scale bond purchases, like the U.S. Federal Reserve have been doing, either.

One of the messages out of the crunch summit is that private investors would not 'absorb losses in any future bailout for a euro nation,' which could suggest banks would get 100 cents on the dollar of the future troubled sovereign debt of Italy and Spain, etc.

So we could also be looking at yet another backdoor taxpayer bailout of the banks -- similar to the U.S. Fed's '$1.2 trillion secret loan to banks, with repayment optional) --so banks would support buying the European sovereign bonds, while keeping the banking financial system afloat.

Somebody, somewhere has to put up the money and take the loss of the Euro Zone, and it does not look like EU would rise up to the occasion. Eventually the markets would get past the Euro crisis and the world would move on. But it seems the European taxpayer, just like their American counterpart, could end up being the last hero standing saving the global financial system, along with the world as we know it.