The new year started off with a bang; not just with a strong global stock market rally belittling S&P’s European ratings downgrades, but also with significant announcements on both sides of the Atlantic. The Federal Reserve set the tone by extending by a full year to late 2014, the period over which it sees interest rates remaining low. That was followed in late January, by the announcement that European leaders (excluding UK and the Czech Republic) had agreed on a fiscal compact.

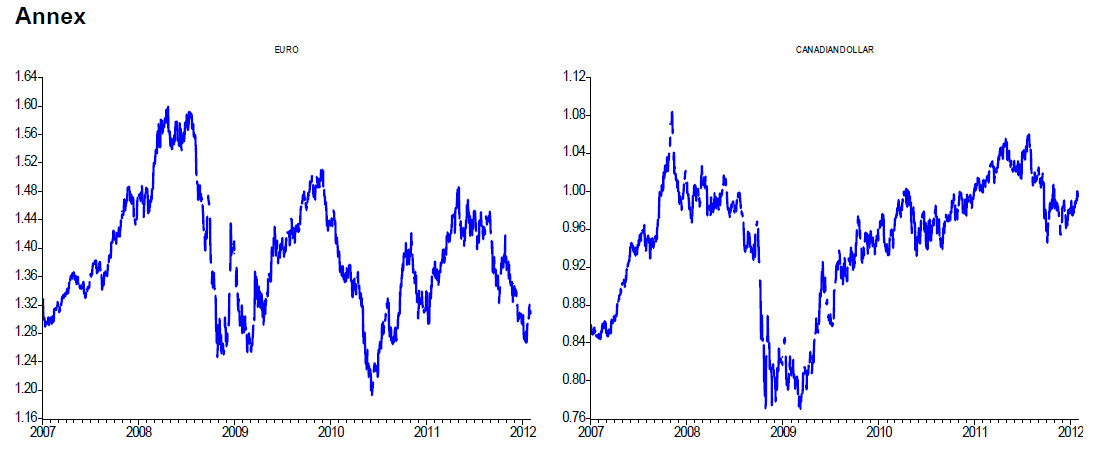

Those announcements should, in principle, have boosted the euro at the expense of the US dollar. But markets had other ideas, seemingly sharing our scepticism regarding the European plan, and cutting short a brief euro rally. While the common currency may again pass our 1.32 end-of-Q1 target, we’re maintaining that target for now, expecting headwinds ahead for the euro area.

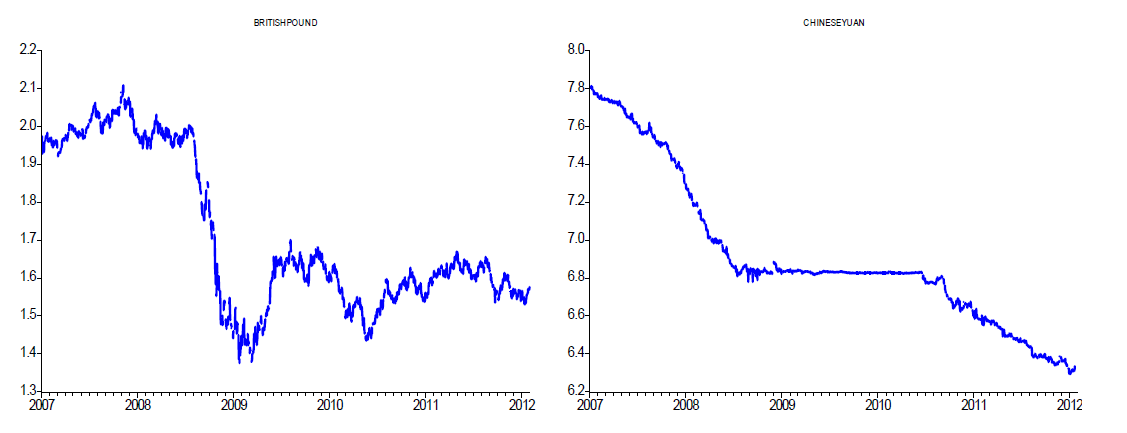

Assuming that it’s approved by the parliaments of member countries, the European fiscal compact is a step in the right direction in terms of the long term sustainability of the zone. But it does little to address near to medium term problems such as financing pressures faced by sovereigns. Bond yields for Portugal, Italy, Ireland and Spain remain unsustainable, while Greece simply remains shut out of markets. The zone’s recession is adding further pressures on government coffers, making it less likely that deficit targets will be met. Clearly, the negative spiral of austerity, recession and more austerity, isn’t working well for either the UK or mainland Europe.

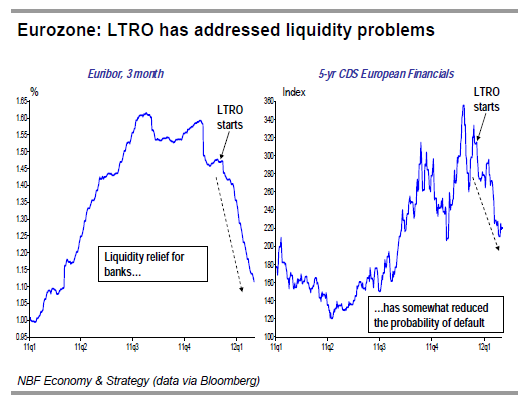

In addition to sovereign and economic woes, the threat of financial crisis complicates things. The European banking sector remains plagued by exposure to a real estate crash or weak sovereigns True, the ECB’s long term refinancing operations (LTRO) have helped in relieving the banking sector’s liquidity problems. But the LTRO is incapable of addressing solvency problems.

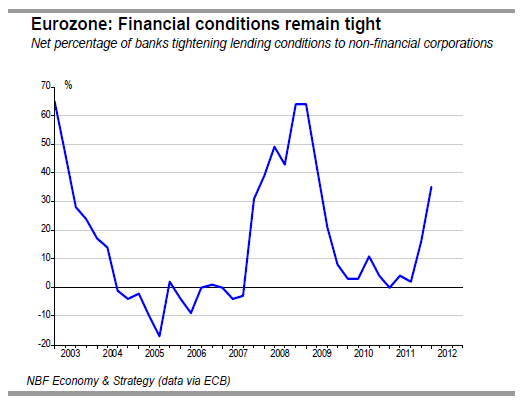

With Greece reneging on its debt, European banks will be taking a significantly larger haircut than the 50% that was agreed back in October. While a larger haircut is imperative to allow Greece any chance of sustaining itself, that doesn’t help already stretched bank balance sheets. The concern is that others follow Greece’s lead in demanding debt forgiveness. So, bank balance sheets across Europe should remain under pressure over the next several quarters. Even if a credit crunch is averted, credit conditions will remain difficult. January’s bank lending survey showed a significant tightening of credit standards for non-financial corporations, a situation

that is expected to persist through the spring despite the LTRO. Under those circumstances, we expect the European recession to get worse before we start seeing an improvement in financial and economic conditions on the old continent.

…but that’s mostly a solution for the long term Despite its lack of tools to address immediate problems, the fiscal compact should make the common currency area stronger over the longer term. The new treaty on stability, coordination and governance is indeed aimed at strengthening fiscal discipline and introducing more automatic sanctions and stricter surveillance within the eurozone, in particular by introducing a "balanced budget rule".

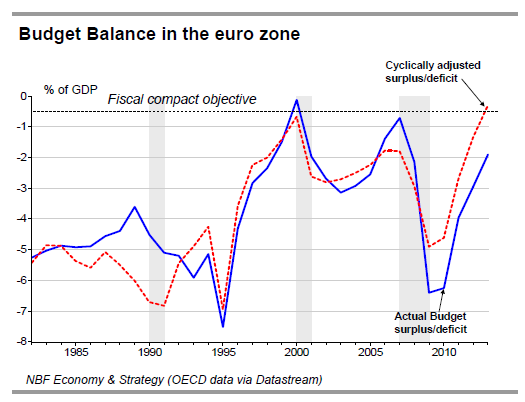

According to the new fiscal compact, “national budgets are required to be in balance or in surplus, a criterion that would be met if the annual structural government deficit (i.e. one that accounts for the business cycle) does not exceed 0.5% of nominal GDP”. This balanced budget rule must be incorporated within one year into the member states' national legal systems, at constitutional level or equivalent. The EU Court of Justice will be able to verify national transposition of the balanced budget rule. Its decision is binding, and can be followed up with a penalty of up to 0.1% of GDP, payable to the European Stability Mechanism.

A target for the structural deficit (rather than the overall budget deficit) provides some room to manoeuvre. For example, in a large recession, the rule would still allow a country to run actual deficit of say 5% (due to rising unemployment spending and lower tax revenues) as long as the structural deficit does not exceed 0.5% after accounting for the cycle. Moreover, structural deficits will reportedly be calculated net of one-off and temporary measures. The treaty allows for further deviation from a balanced budget if a downturn is more severe.

In our view, this measure provides enough flexibility to make it palatable to the politicians that must get the accord ratified by their respective governments. This rule is unlikely to provoke a worsening of current austerity measures. For the zone as a whole we note that the current cyclically adjusted deficit is currently expected to be around 1.5% in 2012 and to be near the target of 0.5% in 2013 according to the OECD.

So, as much as we’re bearish about the euro this year, we’re more positive about its prospects over the longer term. Assuming of course that the common currency area survives the next couple of years, the eurozone would then have leaner governments, a more stable financial system and a more sustainable debt load. Those should help support the euro come 2013/14, particularly with the greenback struggling as the spotlight returns on the major economy that has yet to undertake credible measures towards fiscal sustainability – the U.S.

U.S. dollar has near term support

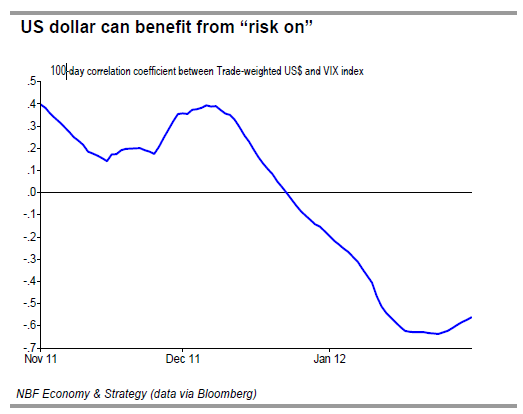

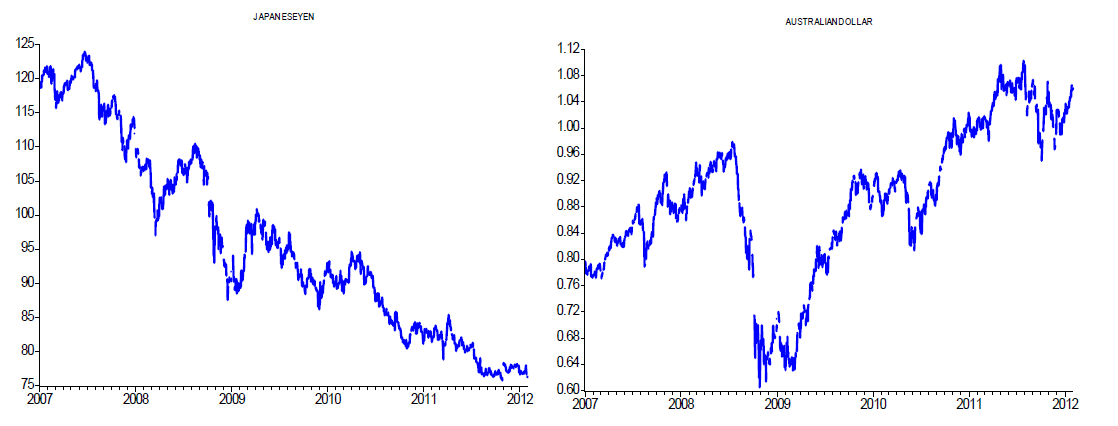

True, the long term fundamentals aren’t exactly bullish for the US dollar. Delayed fiscal actions and the Fed’s policies reinforce the US dollar’s long-term depreciating trend. That, however, doesn’t preclude bouts of US$ strength, particularly this year. While historically, the US dollar tended to underperform in periods of risk taking, the euro’s woes have turned this correlation on its head in recent months. The correlation between the trade-weighted US dollar and the VIX index has indeed been negative for the past several weeks. So, good data out of the U.S. need not be dollar negative.

The US economy is accelerating at a time that the eurozone is mired in recession. The 2.8% print for the final quarter’s GDP growth was the best of 2011. Consumers, the main engine of the American economy, seems to be revving up, helped by a labour market that’s on the ascendancy. Business investment has decent fundamentals in the form of strong corporate profits and record cash positions. The housing market generally seems to weighing less on the economy, with residential construction in

fact contributing to growth in the last three quarters.

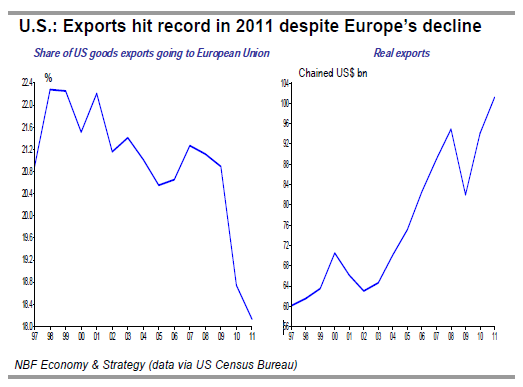

Complementing domestic demand is a trade sector that’s clearly benefiting from productivity enhancements and a competitive US dollar. While the European recession won’t help, note that the US is becoming less dependent on the old continent for its exports. The share of U.S. goods exports that went to Europe last year was the lowest in decades. Meanwhile, real exports hit a new record in 2011.

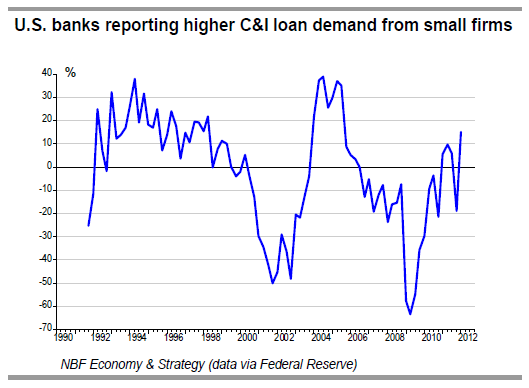

As important as the macro fundamentals are, the smooth functioning of financial markets is also crucial. And here too the news is encouraging. The latest Fed senior loan officer survey confirms that credit markets remain functional in the U.S. Demand for commercial and industrial loans from small businesses is picking up at a brisk pace.

Recall that 45% of total U.S. employment is accounted from small corporations. The continued uptrend for credit suggests support for the jobs market. With the domestic economy and trade both in relatively good shape, the U.S. economy is in pole position to achieve growth of around 2.5% in 2012, the first time in six years that it will be above potential.

Dollar Canada holds firm near parity

While the U.S. economy is headed toward cruising speed, Canada’s is shifting down a notch. Recent data have been generally bearish, with soft data for Q4 including a sputtering labour market. The theme for 2012 will be similar to what we saw in the last quarter of 2011, with growth of around 2% and a tepid employment picture, taking steam out of the housing market. That said, modest economic growth doesn’t necessarily equate to a weak Canadian dollar.

The loonie moves in lockstep with commodity prices which are determined by global growth. The latter should remain solid above 3% this year as growth in the U.S., and emerging economies including the BRIC’s, more than offset the drag from Europe. Those doubting the global economy’s staying power just need to look at January’s factory PMI for the world’s largest two economies, the U.S. and China. A rising U.S. economy will also help boost trade related inflows and hence provide support to CAD.

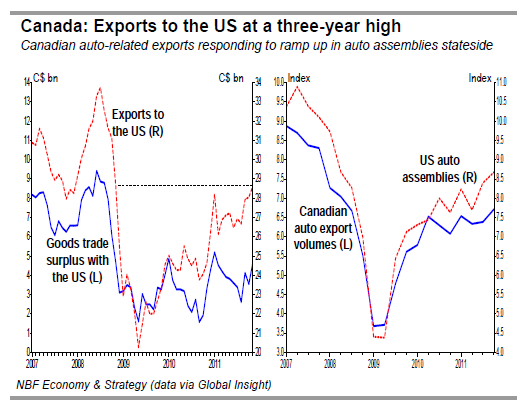

Note that our exports to the world’s largest economy reached a three-year high last November, helped in part by a ramp-up of U.S. automotive output. Expect that uptrend to continue through 2012, something that should turn trade into a contributor to GDP, albeit a modest one (given the offsetting lagged impacts of prior C$ appreciation).

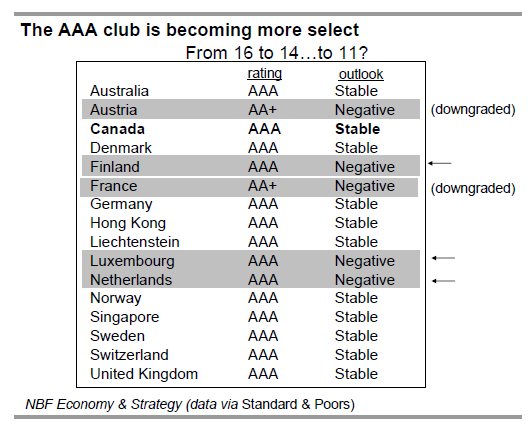

Moreover, Canada’s AAA status will be a draw for foreign institutional investors wishing to diversify away from the shaky European sovereigns. Inflows will also come from foreign direct investment particularly in the resources sector where we continue to see keen interest from China as it seeks to make more productive use of its massive reserves of foreign exchange. All told, the conditions are conducive for the C$ to remain close to parity with the US dollar through much of 2012.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Zone Leaders Agree on Fiscal Compact

Published 02/03/2012, 02:19 AM

Updated 05/14/2017, 06:45 AM

Euro Zone Leaders Agree on Fiscal Compact

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.