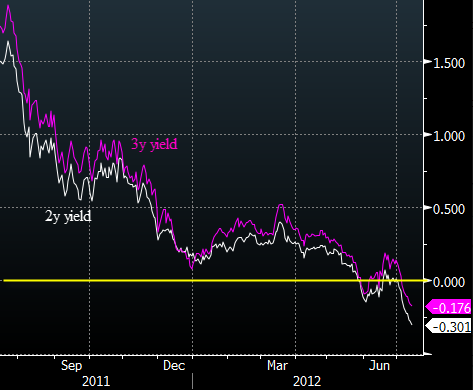

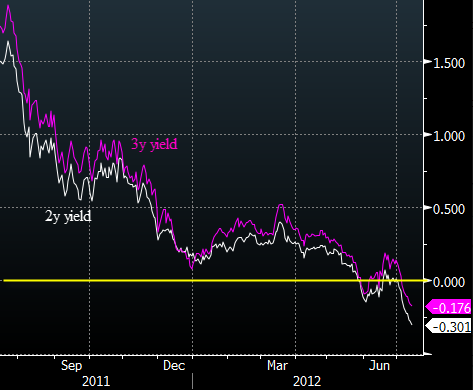

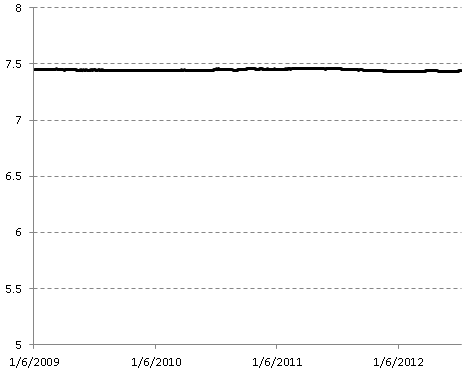

Would you pay Denmark's government 0.6% to hold your money for two years? Sounds strange, but that's exactly what investors are doing. Denmark's government paper yields just hit new lows. And it's not only the short-term bills with the negative yield (short term bills sometimes go negative when investors seek immediate liquidity). The two- and three-year notes are also comfortably in the negative territory as euro-zone investors can't get enough.

Why do the investors love Demark's bonds so much that they're willing to lock in negative yields for two-to-three years? Here are three key reasons:

1) Euro-zone based investors are not taking much FX risk because Denmark keeps the EUR/DKK exchange rate tightly pegged.

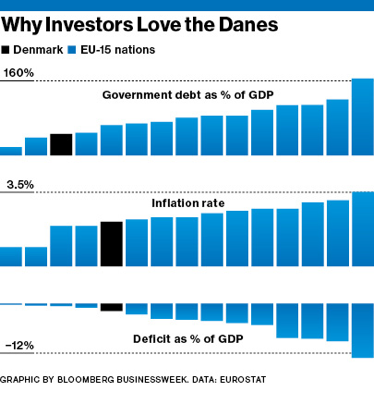

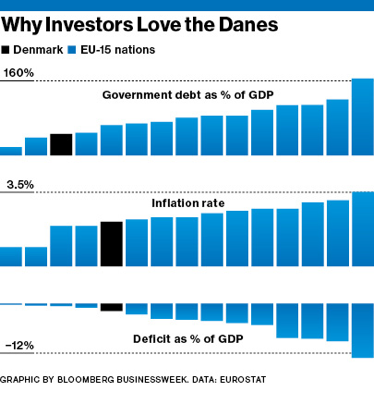

2) Investors love Denmark's economic fundamentals, particularly the relatively low government debt and deficit.

3) Keeping funds outside the euro zone may provide a hedge against potential problems associated with the monetary union's stability.

Bloomberg/BW:

If the euro crisis worsens, foreign capital may keep pouring in, negative rates or no. Says Ian Stannard, chief European currency strategist at Morgan Stanley in London, “For an international investor with euro zone exposure, buying Danish assets can be a hedge against the extreme scenario of the euro breaking up.”

Why do the investors love Demark's bonds so much that they're willing to lock in negative yields for two-to-three years? Here are three key reasons:

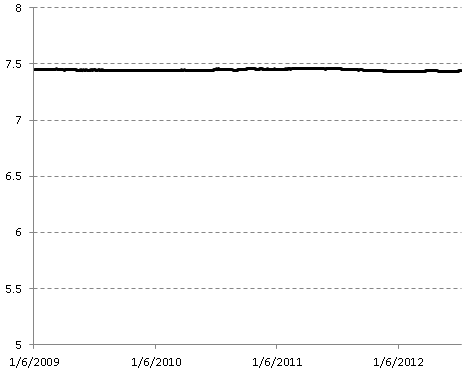

1) Euro-zone based investors are not taking much FX risk because Denmark keeps the EUR/DKK exchange rate tightly pegged.

2) Investors love Denmark's economic fundamentals, particularly the relatively low government debt and deficit.

3) Keeping funds outside the euro zone may provide a hedge against potential problems associated with the monetary union's stability.

Bloomberg/BW:

If the euro crisis worsens, foreign capital may keep pouring in, negative rates or no. Says Ian Stannard, chief European currency strategist at Morgan Stanley in London, “For an international investor with euro zone exposure, buying Danish assets can be a hedge against the extreme scenario of the euro breaking up.”