For the 24 hours to 23:00 GMT, the EUR declined 0.2% against the USD and closed at 1.0722.

Data indicated that the Euro-zone’s seasonally adjusted flash gross domestic product (GDP) climbed by 0.3% on a quarterly basis in 3Q 2016, meeting market expectations and compared to a similar rise in the prior quarter. Additionally, the region’s ZEW survey of economic sentiment index climbed more-than-expected to a level of 15.8 in November, compared to a reading of 12.3 in the previous month. Further, the region’s seasonally adjusted trade balance surprised with a wider than expected surplus of €24.9 billion in September, against a revised trade surplus of €23.4 billion in the previous month, while markets expected the region to post a trade surplus of €22.1 billion.

Elsewhere, preliminary GDP data showed that Germany’s economic growth slowed to 0.2% on a quarterly basis in 3Q 2016, expanding at the slowest pace in a year, compared to an advance of 0.4% in the previous quarter while investors had envisaged the nation to grow by 0.3%. Moreover, the nation’s ZEW survey of economic sentiment index rose to a level of 13.8 in November, advancing for a fourth consecutive month and notching its highest level in five months, thus indicating that investors in the Euro-zone’s power house economy are getting increasingly optimistic about the nation’s growth outlook. Markets expected the index to advance to a level of 8.1, following a reading of 6.2 in the previous month. On the contrary, the current situation index unexpectedly eased to a level of 58.8 in November, after recording a level of 59.5 in the previous month and against market anticipation for an advance to a level of 61.6.

The US Dollar gained ground against its key counterparts, after stronger-than-expected US retail sales data renewed optimism about the strength of the nation’s consumer spending, thus paving the way for a Fed interest rate hike in December. Meanwhile, the nation’s business inventories climbed by 0.1% MoM in September, less than market expectations for an advance of 0.2% and after recording a rise of 0.2% in the previous month.

Advance retail sales in the US rose by 0.8% on a monthly basis in October, surpassing market expectations for a rise of 0.6% and following a revised rise of 1.0% in the previous month.

Separately, the Boston Fed President, Eric Rosengren, expects a Fed rate hike in December, barring any unexpected developments. Further, he added that the Fed would likely hike interest rates more aggressively if the newly elected US President significantly stimulates the economy and restated his concerns that waiting too long to raise rates could disrupt the US economic recovery and that he would like to see the Fed raise rates gradually.

In the Asian session, at GMT0400, the pair is trading at 1.0744, with the EUR trading 0.21% higher against the USD from yesterday’s close.

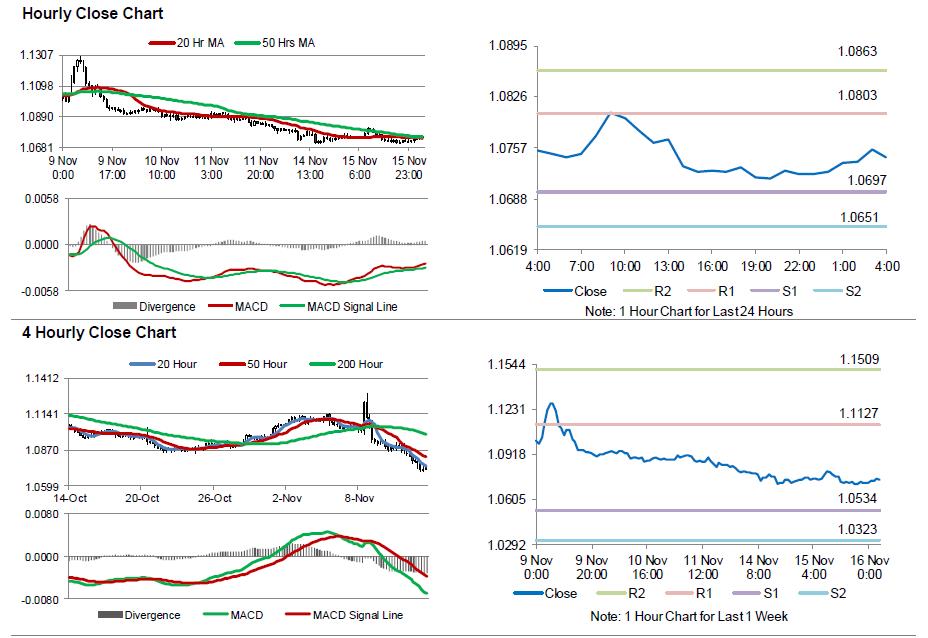

The pair is expected to find support at 1.0697, and a fall through could take it to the next support level of 1.0651. The pair is expected to find its first resistance at 1.0803, and a rise through could take it to the next resistance level of 1.0863.

Amid a lack of economic releases in the Euro-zone today, investors would focus on the release of US industrial and manufacturing production, both for October coupled with NAHB housing market index for November, all due later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.