The weekly December Euro declined to its lowest level in two-months on Monday amid renewed uncertainty about Greece’s struggle to secure the next tranche of bailout funds. Additionally, investors remained cautious while awaiting Tuesday’s U.S. presidential election.

With Greece set for a parliamentary vote on a round of tax hikes and budget cuts demanded by the country’s troika of international lenders – the European Central Bank, the European Commission and the International Monetary Fund, traders are worried that the inability to pass the necessary measures will risk the nation’s future in the European currency bloc.

The overnight weakness in the Euro against the dollar is a strong sign that the market is increasingly losing confidence that Greece might get its extended bailout money. Some see the unraveling of the governing coalition and the increasing disagreements as a signal that the euro will continue to fall as bearish sentiment takes over.

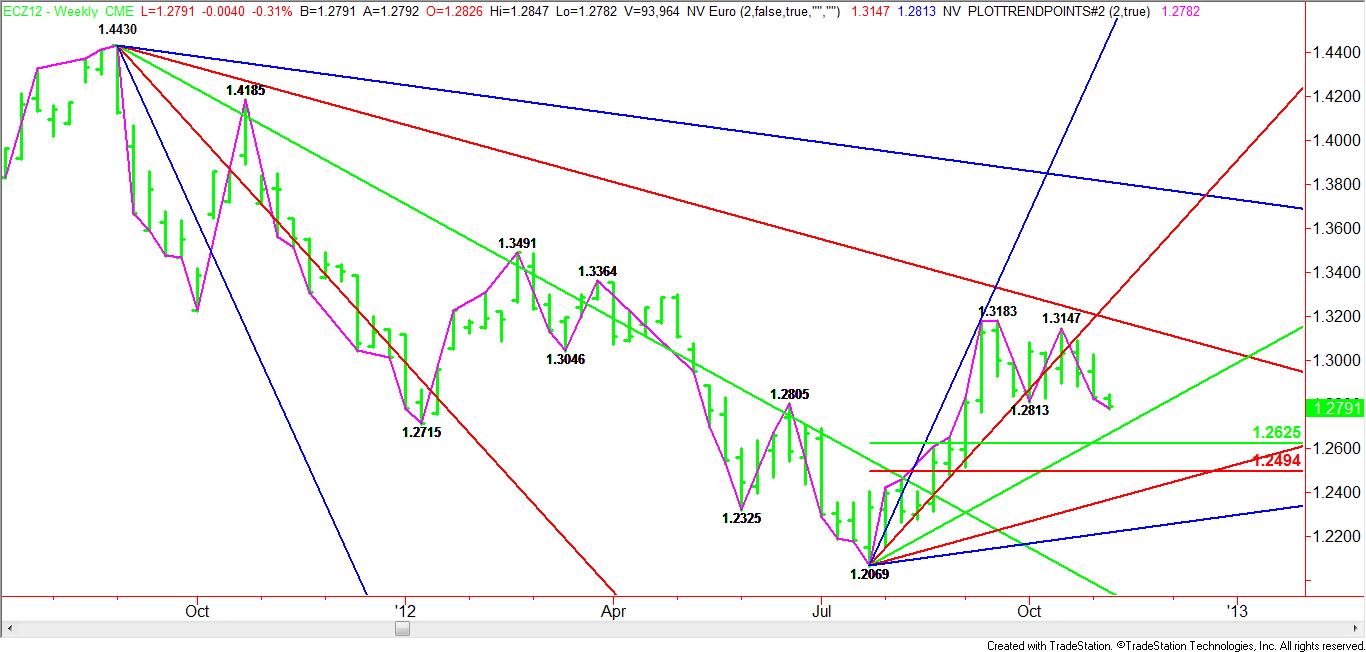

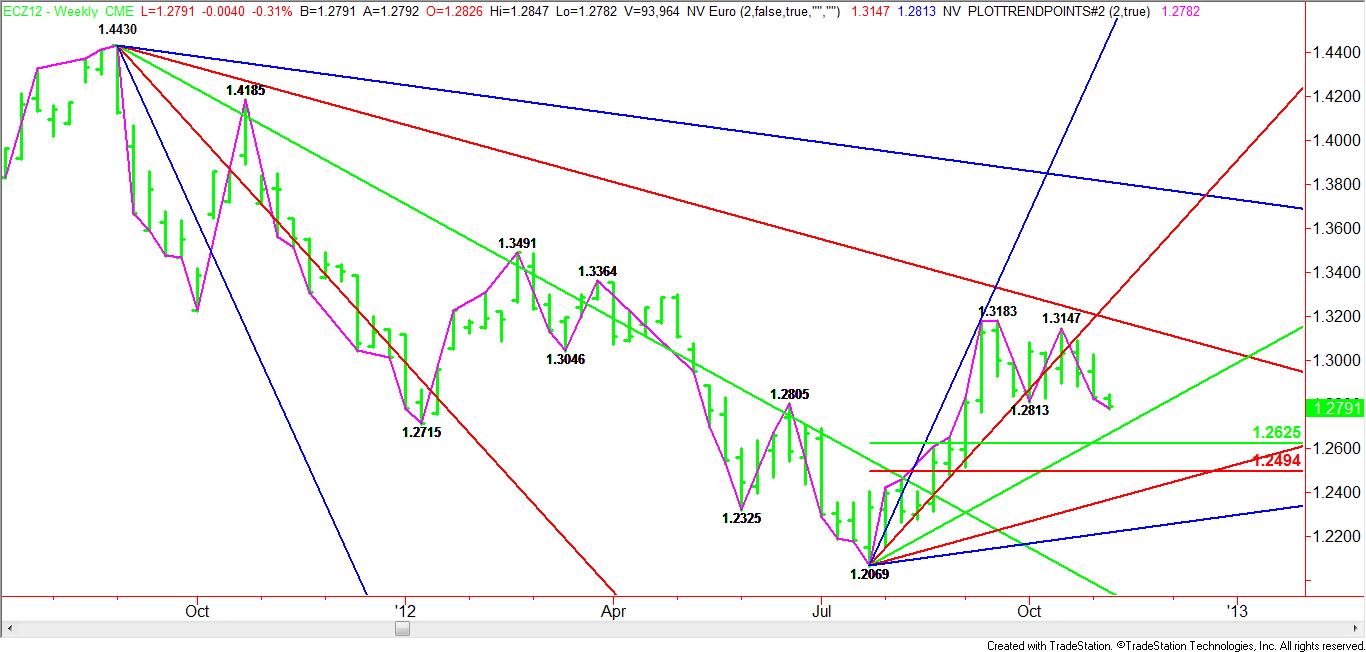

Technically, the December euro trend turned down on the weekly chart for the first time since the week-ending September 7. After posting two tops at 1.3183 and 1.3147, the euro confirmed this double-top when it broke through the swing bottom at 1.2813.

Technically, the December euro trend turned down on the weekly chart for the first time since the week-ending September 7. After posting two tops at 1.3183 and 1.3147, the euro confirmed this double-top when it broke through the swing bottom at 1.2813.

The downtrending Gann angle from the 1.4430 top from September 2011 stopped the market twice over the past two months and is now providing resistance at 1.3190. It is not expected to be a factor over the near-term.

The euro’s downside momentum indicates that an uptrending Gann angle from the 1.2069 bottom the week-ending July 27 is at 1.2669 this week. This is the first expected downside target. An early test of this angle could produce a short-term technical bounce.

If this angle fails to hold as support then traders should look for the euro to complete a normal retracement of its last major range. Based on the 1.2069 to 1.3183 range, traders should watch for a 50 to 61.8 retracement to 1.2625 – 1.2494.

Overall, it appears that a strong bias is developing to the downside in the December euro. Not only is the situation in Greece a huge factor in the currency’s weakness, but traders are still in limbo as to when Spain will make a formal request for financial aid.

Last Friday’s U.S. employment report was strong enough to warrant a rally in the greenback. This contributed to some of the euro’s weakness; However, the re-election of Obama as President of the United States could encourage long dollar traders to take profits. This could produce a short-term technical bounce in the euro, but overall, with the main trend down on the weekly chart, traders should look for the downtrend to continue over the near-term.

With Greece set for a parliamentary vote on a round of tax hikes and budget cuts demanded by the country’s troika of international lenders – the European Central Bank, the European Commission and the International Monetary Fund, traders are worried that the inability to pass the necessary measures will risk the nation’s future in the European currency bloc.

The overnight weakness in the Euro against the dollar is a strong sign that the market is increasingly losing confidence that Greece might get its extended bailout money. Some see the unraveling of the governing coalition and the increasing disagreements as a signal that the euro will continue to fall as bearish sentiment takes over.

Technically, the December euro trend turned down on the weekly chart for the first time since the week-ending September 7. After posting two tops at 1.3183 and 1.3147, the euro confirmed this double-top when it broke through the swing bottom at 1.2813.

Technically, the December euro trend turned down on the weekly chart for the first time since the week-ending September 7. After posting two tops at 1.3183 and 1.3147, the euro confirmed this double-top when it broke through the swing bottom at 1.2813. The downtrending Gann angle from the 1.4430 top from September 2011 stopped the market twice over the past two months and is now providing resistance at 1.3190. It is not expected to be a factor over the near-term.

The euro’s downside momentum indicates that an uptrending Gann angle from the 1.2069 bottom the week-ending July 27 is at 1.2669 this week. This is the first expected downside target. An early test of this angle could produce a short-term technical bounce.

If this angle fails to hold as support then traders should look for the euro to complete a normal retracement of its last major range. Based on the 1.2069 to 1.3183 range, traders should watch for a 50 to 61.8 retracement to 1.2625 – 1.2494.

Overall, it appears that a strong bias is developing to the downside in the December euro. Not only is the situation in Greece a huge factor in the currency’s weakness, but traders are still in limbo as to when Spain will make a formal request for financial aid.

Last Friday’s U.S. employment report was strong enough to warrant a rally in the greenback. This contributed to some of the euro’s weakness; However, the re-election of Obama as President of the United States could encourage long dollar traders to take profits. This could produce a short-term technical bounce in the euro, but overall, with the main trend down on the weekly chart, traders should look for the downtrend to continue over the near-term.