The euro enjoyed a decent correction phase earlier this week, as it traded above 1.1000 against the US dollar. However, it looks like the EUR/USD pair found sellers that ignited a downside reaction in the near term. There is a lot of bearish pressure emerging on the pair, which is likely to continue moving ahead. There were a couple of releases lined up today in the Euro Zone. The outcome of reports was mixed, which at the end helped the shared currency to recover some ground. The most important one was the German unemployment report, which missed the mark and ignited a downside reaction.

German Unemployment Report

Earlier during the London session, the unemployment change data, which is a measure of the absolute change in the number of unemployed people in Germany using seasonally adjusted data was published by the German Statistics Office. The market was expecting the Unemployment Change to come in at -5K in July 2015. However, the outcome was disappointing, as the change was +9K. The German unemployment rate stayed at 6.4%, which was in line with the forecast. The report stated that “Compared with the previous month, employment rose just slightly. According to provisional results of the employment accounts, the number of persons in employment was up by just 32,000, or 0.1%”.

Overall, the data was not encouraging, which at the end resulted in a downside reaction. The EUR/USD pair was seen trading lower after the release. However, there were some other releases as well in the Euro Zone that helped the shared currency to recover after losses.

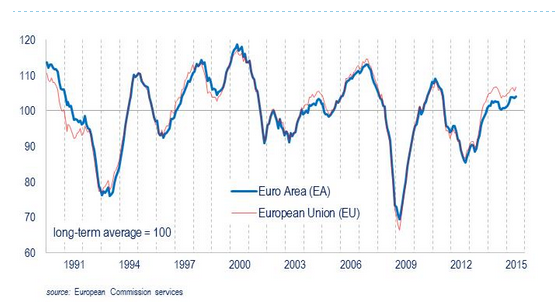

The Euro Area Consumer Confidence, a leading index that measures the level of consumer confidence in economic activity, was released by the European Commission. The outcome was in line with the forecast, as it came in at -7.1.

Technically, the EUR/USD pair traded lower earlier during the London session and tested the 1.0940 support area. Buyers appeared around the stated area and pushed the pair back higher. The pair is currently trading around 1.0980 and looks set for more gains. However there is no denial that the pair is under bearish pressure and if sellers manage to clear 1.0940 more losses are likely. On the upside 1.1100 can be seen as a hurdle moving ahead.