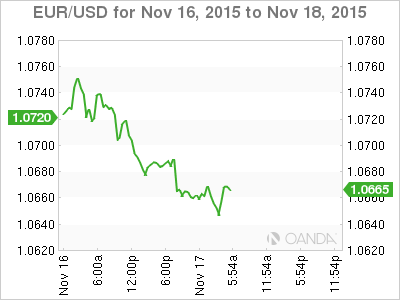

EUR/USD is showing limited movement on Tuesday, as the pair trades at 1.0650 in the European session. In economic news, Italian Trade Balance improved to EUR 2.19 billion, but this was short of expectations. We’ll also get a look at German and Eurozone ZEW Economic Sentiment. In the US, today’s key events are CPI and Core CPI. On Wednesday, the Federal Reserve will release the minutes of its October policy meeting, and the markets will be keenly interested in the comments of policymakers regarding a rate hike.

The terror attacks and bombings in Paris, which killed 132 people and injured another 350, have sent shock waves around the world and hurt market risk sentiment in the process. EUR/USD remains under pressure, and is currently trading at 7-month lows. The euro has been on a steep slide over the past month, losing some 800 points against the US dollar. The weekend attacks in the heart of one of Europe’s biggest financial centers could add to the currency’s recent woes.

ECB head Mario Draghi signaled last week that the ECB was considering further easing measures as early as December, and this has put downward pressure on the euro. Draghi made note of weak inflation in the Eurozone and stated that the ECB would “reexamine the degree of monetary policy accommodation”. Even if the central bank doesn’t make a move next month, we’re likely to see the current stimulus program extended beyond September 2016. With the Federal Reserve contemplating a rate hike in December, monetary divergence has sharpened and could push the struggling euro even lower.

The Fed watch continues, as speculation has increased that the Federal Reserve will begin a series of rate hikes, commencing in December. Fed Chair Janet Yellen has called the December meeting a “live possibility” of a rate hike. With the US economy close to full employment and many economic indicators pointing upwards, one of the last pieces in the puzzle is consumer inflation, which will be released later on Tuesday. The October CPI and Core CPI reports could play a crucial factor in determining whether the Fed makes a move and raises rates next month, and should be treated by traders as market-movers. Strong CPI readings could win over Fed policymakers who are concerned about whether the economy is strong enough to withstand a rate hike, while figures below the forecast would dampen expectations of a rate move before 2016. Traders should be prepared for volatility after the CPI releases.

EUR/USD Fundamentals

Tuesday (Nov. 17)

- 9:00 Italian Trade Balance. Estimate 2.24B. Actual 2.19B

- 10:00 German ZEW Economic Sentiment. Estimate 6.7 points

- 10:00 Eurozone ZEW Economic Sentiment. Estimate 35.2 points

- 13:30 US CPI. Estimate 0.2%

- 13:30 US Core CPI. Estimate 0.2%

- 14:15 US Capacity Utilization Rate. Estimate 77.5%

- 14:15 US Industrial Production. Estimate 0.1%

- 15:00 US Mortgage Delinquencies

- 15:00 US NAHB Housing Market Index. Estimate 64 points

- 21:00 US TIC Long-Term Purchases

Upcoming Key Events

Wednesday (Nov. 18)

- 13:30 US Building Permits. Estimate 1.15M

- 19:00 US FOMC Meeting Minutes

*Key releases are highlighted in bold

*All release times are GMT

EUR/USD for Tuesday, November 17, 2015

EUR/USD November 17 at 9:10 GMT

EUR/USD 1.0652 H: 1.0691 L: 1.0643

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0287 | 1.0359 | 1.05 | 1.0659 | 1.0732 | 1.0847 |

- As EUR/USD continues to lose ground, the pair continues to break below support levels. On Tuesday, the pair has posted slight losses in the Asian and European sessions.

- 1.05 is a strong support line. This line has held firm since March.

- On the upside, 1.0652 is under pressure.

- Current range: 1.05 to 1.0659

Further levels in both directions:

- Below: 1.05, 1.0359 and 1.0287

- Above: 1.0659, 1.0732, 1.0847

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged, reflective of the lack of significant movement from the pair. The ratio is evenly split between long and short positions. This indicates a lack of trader bias as to what direction the pair will take next.