- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Euro Turns The Year In Style

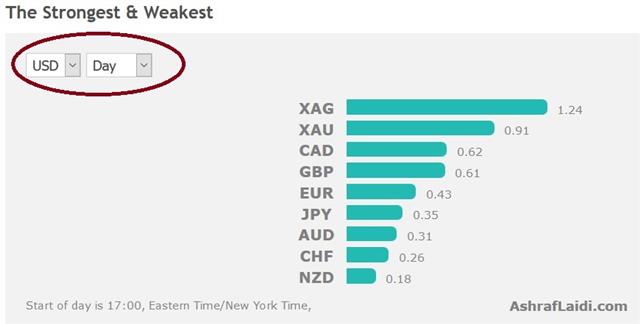

After ending 2017 as the top currency performer, the euro built further gains towards the 1.2080s, joined by gold and silver. But it was the GBP and CAD that took the mantle in the first full day of trading of 2018, with GBP/USD reaching 1.3590s and USD/CAD testing 1.2500. The long GBP/USD trade from late Nov remains open. A new strategic trade in EUR/USD will be released later this evening.

Eurozone normalization and recovery will be a major 2018 theme if it isn't derailed by another Italian election. A look at the long-term chart shows that the 14% rise in the past 12 months could be followed by more advances ahead.

Underscoring that theme was a weekend comment from the ECB's Mersche who warned against exiting QE too slowly. Coeure, meanwhile, said the latest QE extension can be the last.

In geopolitics, Iran tops headlines amid anti-government protests. Economic malaise and corruption have contributed to unrest. Trump added his voice, calling for change in 'failing' Iran.

Early in the week, Bitcoin is up 2% to $14,555 and Ethereum up 19% to a new record high of $887. Expect the year ahead in crypto currencies to be as drama-filled as 2017.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +92K vs +86K prior GBP +12K vs +20K prior JPY -116K vs -114K prior CHF -13K vs -17K prior CAD +17K vs +45K prior AUD -14K vs -13K prior NZD -17K vs -16K prior

There was a fairly dramatic swing in AUD positioning at the end of the year as it switched to negative 13K from +40K in a single week two weeks ago. A large swing also hit CAD in the final week of the year as the market soured on commodity currencies (despite the late-year rally). That could have been year-end shifts or a long-term repositioning. The week ahead will offer clues. In any case, specs betting on the euro and against the yen into 2018.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.