The short term trend on the EUR/USD H1 chart has been solid over the last few days, but an increase in the volatility could lead to a bearish breakout that will quickly retrace much of the gains made recently.

The short squeeze in the euro has been gaining momentum over the last two weeks as seen by the recent bullish trend becoming steeper in nature. The price action has moved much faster than the fundamentals with trouble in europe persisting. Granted the timeline for US Interest rate rises may not be as soon as many expected a month ago, but the Fed is still keen to raise rates, so downside risk remains in the EUR/USD pair.

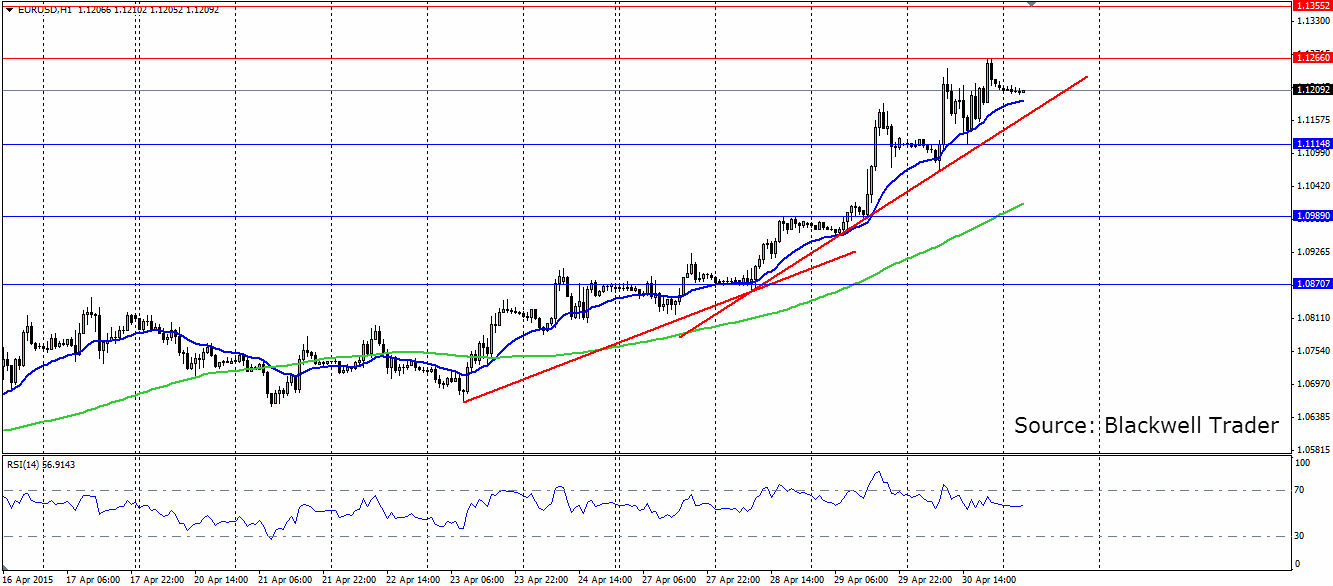

The H1 chart above clearly shows the short term bullish trend the euro has been following, with several bounces off it. The trend started off relatively stable, but has become increasingly volatile, with 100pip swings at the top not uncommon. It will not take much for this volatility to lead to a push through the trend line and once a lower low is formed, the bears will come pouring in.

The past two higher highs in the price have not been met with higher highs in the RSI in a classic case of divergence. This generally denotes the trend could be coming to an end, but it also highlights just how volatile the euro has been over the last few days. Watch for a close under the 20EMA and a push through the trend line to confirm a reversal is underway, and as stated above a lower low will be crucial.

If we see a reversal in the euro, look for support to be found at 1.1114, 1.0989 and 1.0870. Also keep an eye on the 100 Hour SMA as this will likely act as dynamic support as the price moves lower. If we are to see a continuation of the bullish trend, look for the resistance at 1.1266 to fail as the price moves higher. Further resistance will be found at 1.1355 and 1.1447, with the bullish trend acting as dynamic support as it moves higher.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Trend Becoming Volatile

Published 05/01/2015, 01:24 AM

Updated 05/14/2017, 06:45 AM

Euro Trend Becoming Volatile

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.