The euro traded 0.1 percent from a six-week high versus the dollar before European Union finance ministers meet in Brussels today amid optimism the region can find solutions for its debt crisis. Euro sentiment has brightened and there is reason to be optimistic, I still can’t help but think that the missing ingredient for sustained gains is some improvement in the economic data out of Europe.

The euro held a three-day gain against the yen after Greece offered to spend as much as 10 billion euros ($13 billion) to buy back government securities and as Spain said it expects funds for bank recapitalization next week. The euro fetched $1.3056, from $1.3054 yesterday, when it touched $1.3076, the most since October 23.

GBP/USD

London house prices fell in November for the first time in a year as the prospect of a new tax on the most-expensive homes deterred buyers, Prices in the capital fell 0.2 percent from October, dragged down by a 1.2 percent drop in central London. Fears of an announcement in the forthcoming autumn budget statement of a possible annual charge on high-value homes.

The seasonally adjusted Purchasing Manages' Index (PMI) for the manufacturing sector rose to 49.1 in November from 47.3 in October. Economists were looking for a more modest rise to 48; an index reading below 50 indicates contraction in the sector, while a score above that level suggests growth. Although, the PMI edged up to near the 50-mark, the British manufacturing sector remained in negative territory for the seventh consecutive month.

USD/JPY

Stocks drifted lower in early trades in the Japanese market on Tuesday, tracking a weak lead from Wall Street. Picking up stocks at lower levels, the market regained most of the lost ground subsequently and is currently trading just marginally down from the unchanged line.

Electric power, gas, oil, foods and non-ferrous metals stocks are finding support, while marine transport, real estate, paper and warehousing stocks are a bit weak. In economic news, the monetary base in Japan was up 5.0 percent on year in November, at 124.444 trillion yen, the Bank of Japan said Tuesday. That follows the 10.8 percent annual surge in October.

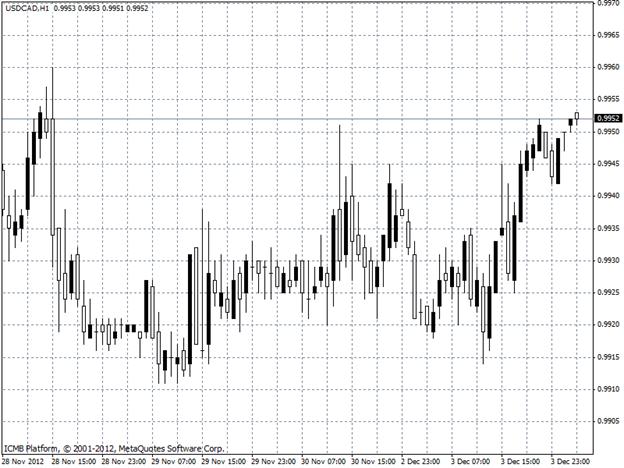

USD/CAD

Canadian stocks snapped a three-day winning streak to end lower Monday, mostly tracking global equity markets, driven by some soft manufacturing data from both Canada and the U.S. The decline was led by resource stocks. Investors also continued to worry about the stalemate in the U.S. budget talks which seem to have hit roadblocks.

Investors largely ignored China's manufacturing activity that rose to a seven-month high in November on improved new orders and production. Macroeconomic data from across the Atlantic also revealed a slower contraction in Europe.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Trades 0.1% From 6-Week High Vs. USD

Published 12/04/2012, 04:04 AM

Updated 04/25/2018, 04:40 AM

Euro Trades 0.1% From 6-Week High Vs. USD

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.