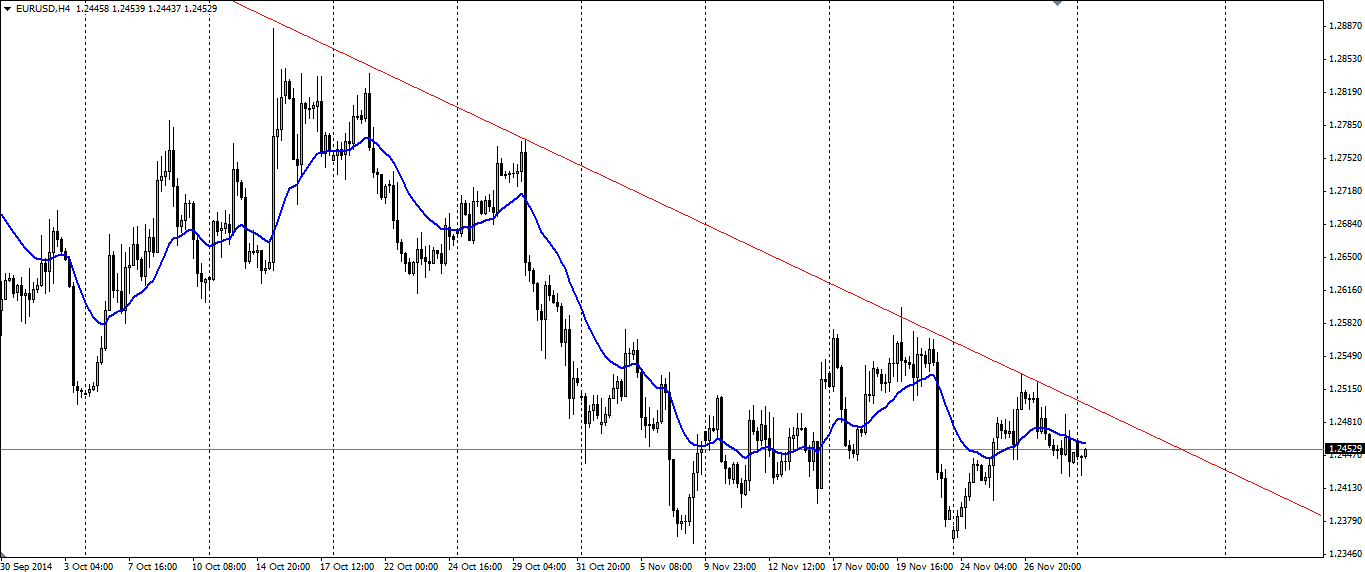

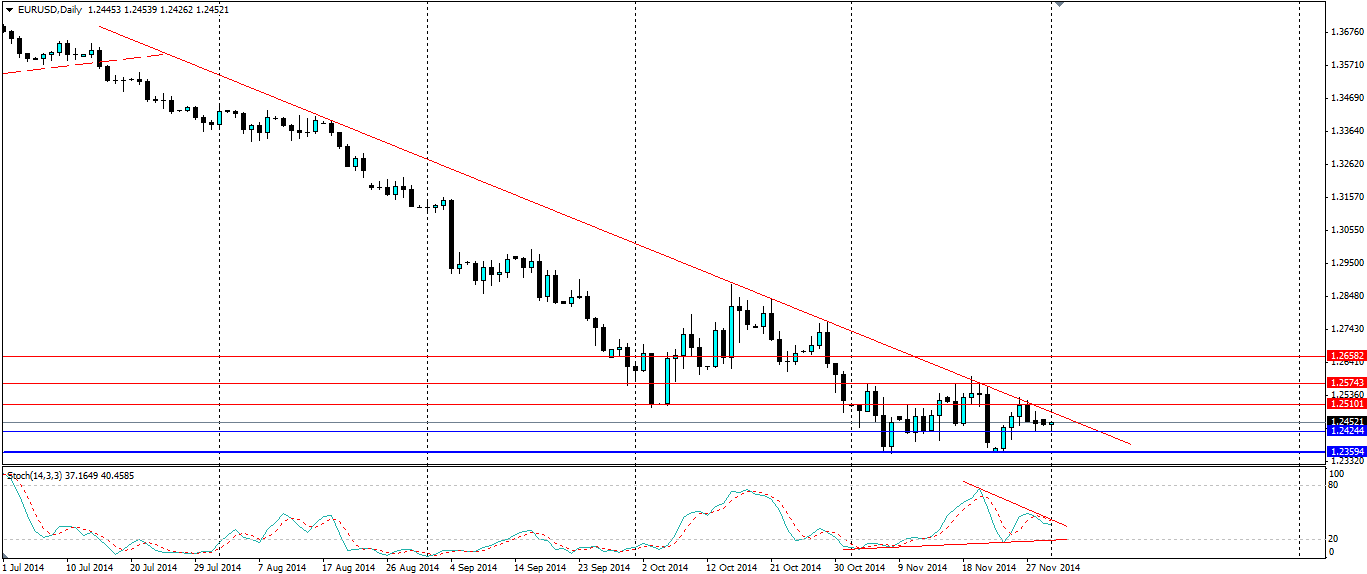

The Euro’s downward slide looks to continue as it once again found some tough resistance along the trend line. The support levels are likely to come under immense pressure as the trend line converges and some large movements could be on the cards.

The Euro had three straight days of gains against the US Dollar early in the week for the first time since October, almost erasing the losses from the week before. A large amount of profit taking took place after the drop which was caused by Draghi talking up the prospect of further stimulus.

The Economic news largely took a back seat as nothing much deviated from expectations. German CPI came in on the money at 0.0% m/m and the EU’s Flash CPI estimate also hit expectations at 0.3% y/y. German IFO business climate rose for the first time since April from 103.2 to 104.7. The gains couldn’t be held as Euro rejected off the trend line, helped by the strong US Thanksgiving sales data and an expectation of further stimulus from the ECB.

The week ahead is likely to be a big one in terms of news with plenty of PMI results to be published over the next 72 hours. Thursday is going to be a day to watch for anyone with interest in the Euro pairs as the ECB is meeting to set the minimum bid rate along with the subsequent press conference. There has been growing speculation that Draghi will announce a Quantitative Easing programme and if he does, the Euro will crash through the current support.

Technicals show a clear continuation of the bearish trend that has plagued the Euro. The pair is likely to consolidate further between the trend line and the support at 1.2359 and the Stochastic Oscillator on the daily chart further confirms the squeeze, indicating a breakout is not far away. In this case the breakout is likely to be a continuation of the bearish trend that is currently in play.

Support for the Euro is found at 1.2424, 1.2359 and 1.2290, with 1.2359 the key level to watch. Resistance is found at 1.2510, 1.2574 and 1.2658 with the trend line acting as strong dynamic resistance and is more likely to hold than the support levels.

The Euro will see some consolidation between the trend line and the support at the recent lows and a breakout lower is the likely outcome, especially if the ECB announces a QE programme.