- Euro inches higher, short squeeze brewing as ECB rolls out big guns

- Wall Street futures trade higher, but outlook remains challenging

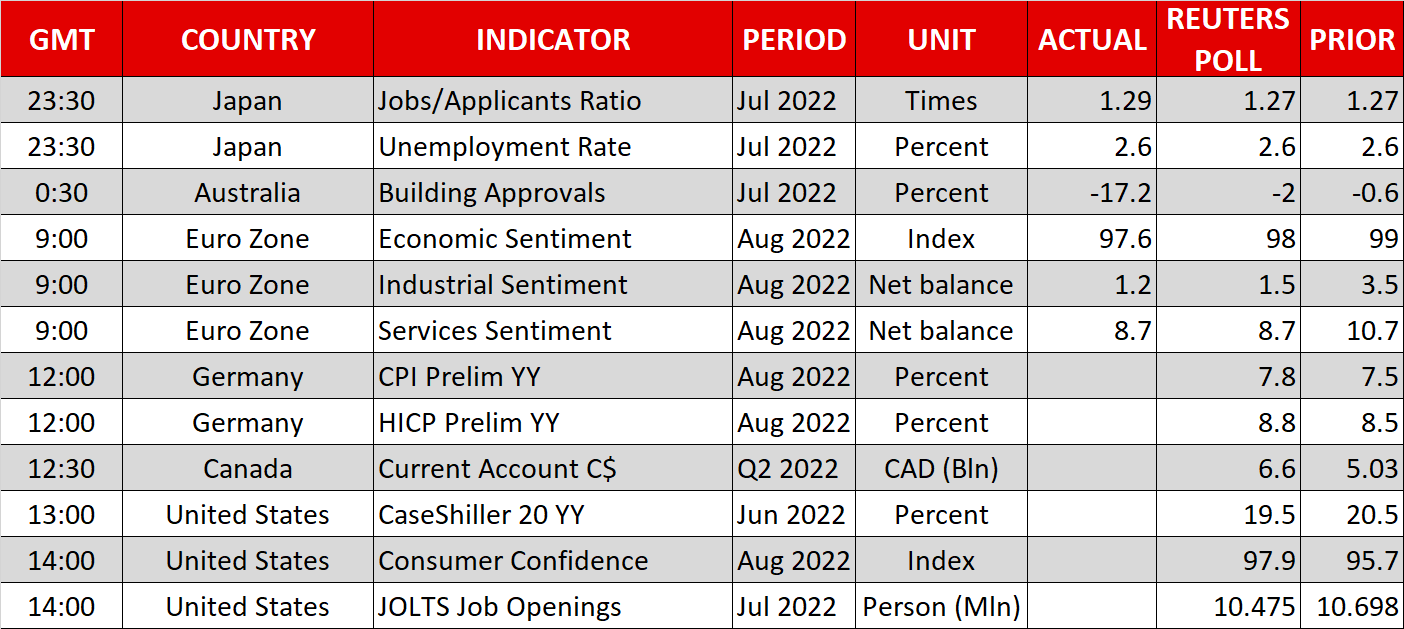

- German inflation and US consumer confidence data coming up

Euro squeeze?

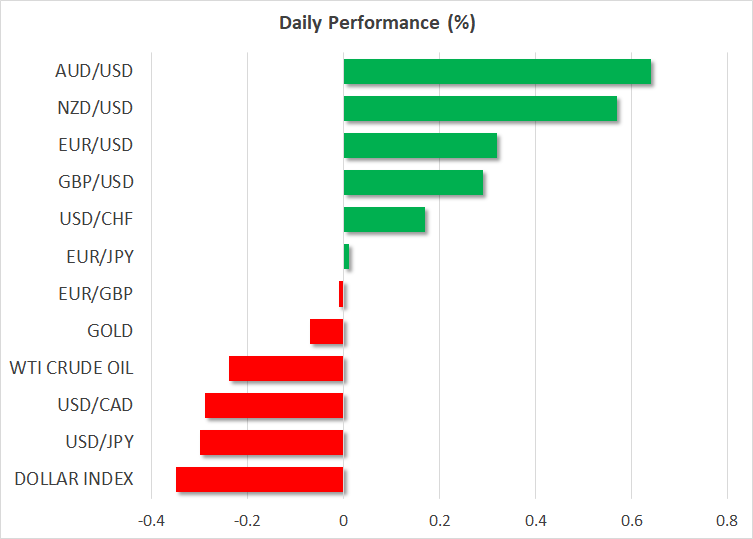

The week started off with a bang as the aftershocks of the Fed’s ‘whatever it takes’ message reverberated across the FX arena. A sharp spike in global bond yields dealt a heavy blow to the Japanese yen, which has been plagued by widening interest rate differentials, while the British pound suffered some collateral damage from the selloff in equity markets.

Meanwhile, a retreat in European natural gas futures after the Commission promised emergency intervention and reform in the power market came as a breath of fresh air for the euro, amid hopes that fiscal policy is finally riding to the rescue. Euro/dollar took one more stab at parity, piercing above it early on Tuesday.

Another striking shift came from the European Central Bank. Several policymakers have been beating the drums of ‘forceful’ rate increases, inviting speculation of a three-quarter-point hike next week. Most importantly, ECB officials have expressed grave concerns about the falling euro because as a net-importer of energy, a depreciating currency makes power more expensive, crippling growth and fueling inflation.

With EU politicians stepping up their game to alleviate the energy crunch and the ECB ready to roll out the big guns next week to defend the common currency, a short squeeze seems to be brewing in the euro. That said, even if euro/dollar rallies up to $1.0350, some 350 pips from current levels, it would still be trapped in a downtrend.

Stocks stabilize

It was another bruising session on Wall Street. The tech-heavy Nasdaq lost 1% as investors picked up where they left off on Friday, trimming their exposure to riskier assets after Powell crushed hopes of a Fed pivot. Buyers seem to be dipping their toes back into the market though, as futures point to a higher open on Tuesday that would more than erase yesterday’s decline.

Taking a step back, the outlook for equity markets remains rather gloomy. The Fed is committed to keeping rates high until inflation is squashed, the balance sheet reduction process will double in speed this week, earnings growth is already struggling to outpace inflation and earnings downgrades are on the horizon as the economic data pulse slows.

Valuations are still not cheap enough to reflect all these risks and lure cautious players back into the market, which implies that the path of least resistance is lower for now. Of course, investors should not lose sight of the bigger picture either - that over time, every crisis fades and stock markets move higher. Waiting for the right entry point is the holy grail in this environment.

Oil and economic data

In the commodity complex, crude oil prices rose sharply on Monday. Driving the surge was some political instability in the Middle East that reignited supply concerns as violent protests broke out in Iraq, armed clashes intensified in Libya, and the nuclear talks with Iran seemed set to drag on into next month.

As for today, the latest CPI readings from Germany will be under the microscope ahead of the inflation print for the entire Eurozone tomorrow. This will be a crucial piece of the puzzle for euro traders trying to decide whether the ECB will roll out a half-point or three-quarter-point rate increase next week, which money markets currently view as a coin toss.

The US consumer confidence index for August will also be released. While this is typically a second-tier data point, it is still a leading indicator of economic activity, so it may attract some attention as investors grapple with recession risks.