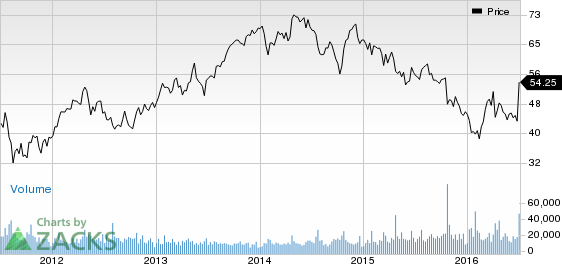

Share price of Harley-Davidson, Inc. (NYSE:HOG) surged 19.8% to $54.25 on Jul 1, 2016 due to the rumor that the company may be acquired by private equity firm, KKR & Co. L.P. (NYSE:KKR) . In 2010 too, rumors of a possible takeover of Harley-Davidson by KKR & Co. had surfaced.

Milwaukee, WI-based Harley-Davidson is the world’s leading designer and manufacturer of heavyweight motorcycles, and related products and merchandise. The company’s products are sold mainly in North America, Europe, Middle East and Africa (EMEA), the Asia-Pacific, and Latin America.

Harley-Davidson’s stock price has been declining since last year. This is the possible reason behind the takeover. The company is facing challenges due to a strong U.S. dollar and increased competition. In fact, these hurdles have resulted in the reduction of more than 200 workers and a $70 million investment for marketing and product development.

In addition, Harley-Davidson has been witnessing declining retail sales of new motorcycles. This has adversely affected its revenues and market share. In 2016, management expects stiff competition to hurt retail sales, as competitors rely on discounts and product introduction to boost sales. Further, it expects headwinds due to macro-economic challenges in some regions. Meanwhile, the company remains focused on successful penetration in foreign markets for future growth.

Harley-Davidson currently carries a Zacks Rank #4 (Sell).

Stocks that Warrant a Look

Some better-ranked automobile stocks include Commercial Vehicle Group Inc. (NASDAQ:CVGI) and Visteon Corporation (NYSE:VC) , both sporting a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

VISTEON CORP (VC): Free Stock Analysis Report

COMML VEHICLE (CVGI): Free Stock Analysis Report

KKR & CO LP (KKR): Free Stock Analysis Report

HARLEY-DAVIDSON (HOG): Free Stock Analysis Report

Original post

Zacks Investment Research