As we are getting closer to an eventful few weeks (thanks to central banks), I wanted to review some of the charts that will be important in our decision making.

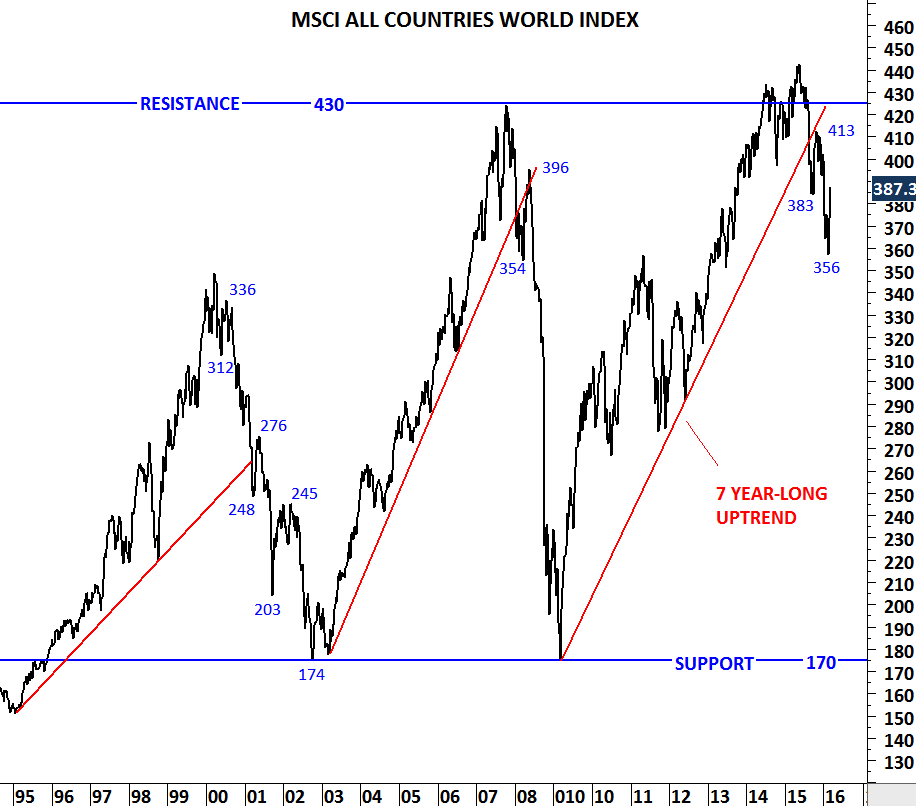

For those who trust the validity of long-term trend lines; most of the global equity indices breached +7 year-long upward sloping trend lines. These are major technical breakdowns, not minor violations.

The last few week's counter-trend moves didn't reverse the negative technical outlook on the long-term charts. Indices continue to make lower lows and lower highs and breaking down previous reaction low levels.

8-10% rallies can take place in bear markets. For reference I plotted the line chart of the MSCI All Countries World Index. Major bear markets over the past two decades show counter-trend moves exceeding 8% in price appreciation. In fact, during 2001-2002, bear market MSCI ACWI rebounded from 203 levels to 245 levels, a 20% rally, followed by another 35% drop.

Wide price swings and of course mood swings are characteristics of market correction. Since the beginning of the correction in mid-2015, there have been two counter trend price movements. One has taken the index from 383 levels to 413 levels (7.8%) during September-November 2015 and the other one is ongoing. So far the reaction resulted in 8.8% appreciation from the low of 356 levels.