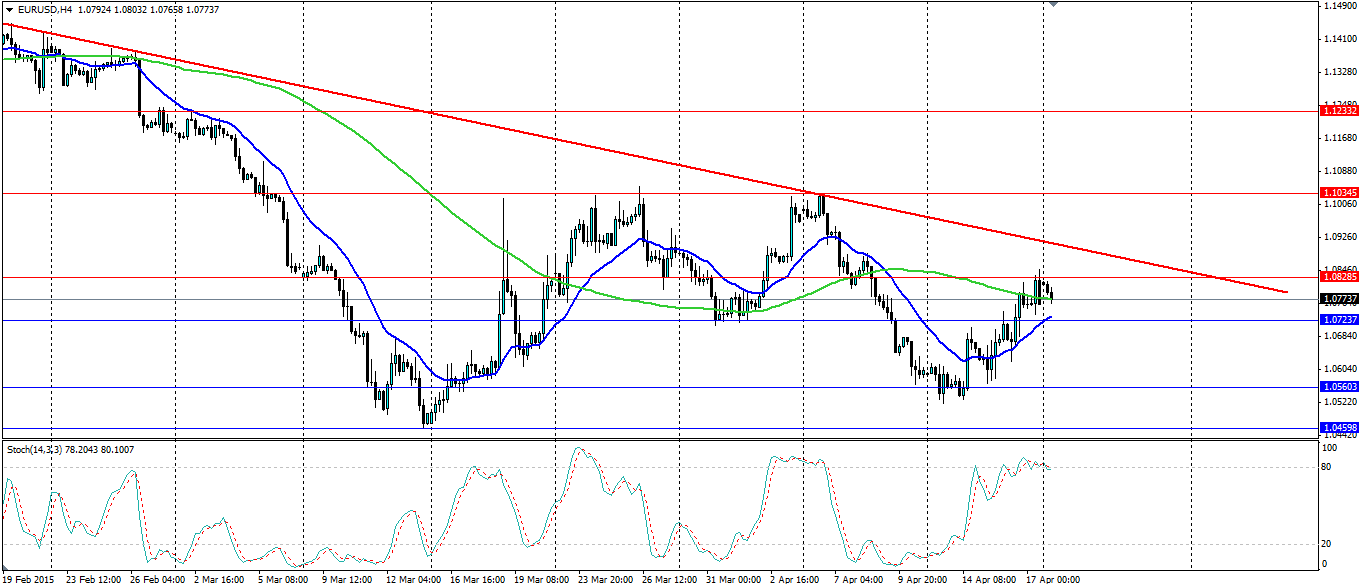

The euro has been on a rather solid bullish run over the last week but that looks to be coming to an end. If it does continue for another leg higher, the long term bearish trend is likely to come back into play and the bears will fancy their chances in defending this.

Source: Blackwell Trader

The euro has been buoyed recently with the latest release of US economic data painting a mixed picture. The Fed committee members have also been split on whether interest rates should rise in June or not which makes the market think they will lean towards the ‘not’ side. Adding bullish pressure was the ECB not releasing any more stimulus and this could be a sign we have seen all we are going to from the ECB.

The latest up leg for the euro has met some rather solid resistance at the 1.0833 mark which has acted as a reversal point on a number of occasions. We saw a brief push up through the 100 SMA on the H4 chart but this looks to be short lived with price dipping back below recently. If we see this level hold as support we could see a push up to the long term bearish trend. This will be a real test for the EUR/USD pair and will determine if the euro stays in its ranging pattern or can break free to recover some of the losses over the past year.

In the short term watch for the 20EMA as any close below would be a good signal that the current bullish trend has given way and a bearish leg is forming. The Stochastic Oscillator certainly believes so as it looks to head down from oversold. Watch for support at 1.0723, 1.0560 and 1.0459 if the pair heads lower. Resistance for a push higher will be found at 1.0828, 1.1034 and 1.1233 of course with the bearish trend line likely to act as heavy dynamic resistance.