The market seems happy to take risky assets higher this morning with the euro looking bid and equity markets forecast to open the week in the green. This is mostly as a result of Italian President asking Mario Monti to head an emergency government. Monti is a well-respected economist and former EU commissioner and is therefore a technocrat in the form of the new Greek PM Lukas Papademos. He will not be a popular man however as it will be his job to enact the austerity measures that the Berlusconi administration vacillated over so much and has caused the issues that Italy now faces. Monti has not committed to taking on the Premiership and is casting around for ministers to help him; obviously the longer the time spent without Monti at the front then the more pressure will be seen on Italian assets and in particular bond yields.

The euro strength has pushed GBP/EUR below the 1.17 level while EUR/USD has stabilised above 1.37.

Those yields will once again be back in focus today as Italy tries to auction off around EUR3bn of 5yr debt. The last 2 auctions have seen yields rise from 5.32% to 5.81% between early and late October and they closed at 6.46% on Friday night. I think any result that gives a yield less close to 6% will be viewed as a positive and the euro will continue its slow rumble.

Holding back risky assets somewhat this morning is the Bundesbank’s rather firm denial that it will not be the lender of last resort to the Eurozone. The thing that the Bundesbank Chair Weidmann is leaning on is that it is illegal under European law for the ECB to step in and do such a thing. But then again it was illegal for countries to be bailed out a couple of years ago and at the recent G20 leaders admitted that a country may leave the euro in the future. We are living in a time when all bets are off it seems; the rules of the past cannot be the rules of the future otherwise the past is destined to repeat itself.

Today’s calendar will be focused on that Italian debt issue but we do get some GDP numbers from the PIIGS as well. Portugal’s GDP is due at 10am and is expected to show a contraction of around 0.7%. This would signal that there has been no growth in Portugal for 9 months with some analysts suggesting that growth may not return until 2013 in the country. This may not have too much impact on EUR however this morning as everyone will be focused on Italy.

We also receive European industrial production which is set to fall by around 2.3%.

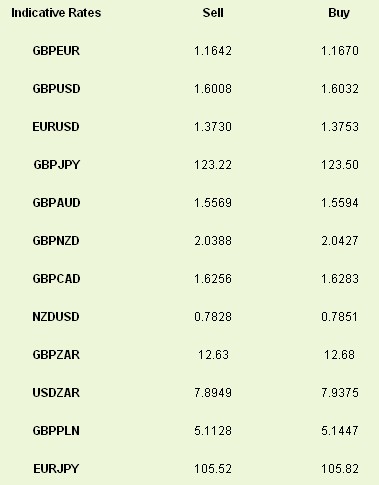

Latest

exchange rates at time of writing

The euro strength has pushed GBP/EUR below the 1.17 level while EUR/USD has stabilised above 1.37.

Those yields will once again be back in focus today as Italy tries to auction off around EUR3bn of 5yr debt. The last 2 auctions have seen yields rise from 5.32% to 5.81% between early and late October and they closed at 6.46% on Friday night. I think any result that gives a yield less close to 6% will be viewed as a positive and the euro will continue its slow rumble.

Holding back risky assets somewhat this morning is the Bundesbank’s rather firm denial that it will not be the lender of last resort to the Eurozone. The thing that the Bundesbank Chair Weidmann is leaning on is that it is illegal under European law for the ECB to step in and do such a thing. But then again it was illegal for countries to be bailed out a couple of years ago and at the recent G20 leaders admitted that a country may leave the euro in the future. We are living in a time when all bets are off it seems; the rules of the past cannot be the rules of the future otherwise the past is destined to repeat itself.

Today’s calendar will be focused on that Italian debt issue but we do get some GDP numbers from the PIIGS as well. Portugal’s GDP is due at 10am and is expected to show a contraction of around 0.7%. This would signal that there has been no growth in Portugal for 9 months with some analysts suggesting that growth may not return until 2013 in the country. This may not have too much impact on EUR however this morning as everyone will be focused on Italy.

We also receive European industrial production which is set to fall by around 2.3%.

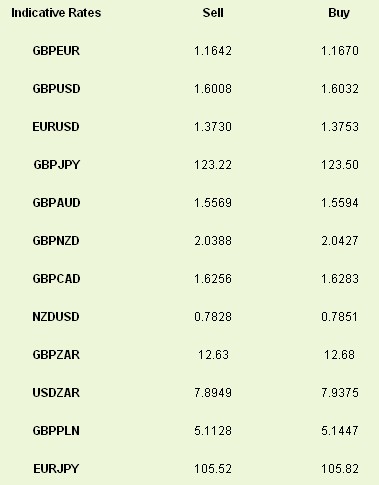

Latest

exchange rates at time of writing