Markets are staying in tight range in Asia today in holiday mood. Europe will remain the focus in otherwise quiet trading. Italy's 10 year bond yield breached 7% again last Friday, after Senate gave final approval to the EUR 30b austerity package. Italian bonds would likely remain pressured ahead of the auction of 2014, 2018, 2021 and 2022 bonds later this week and thus, limit Euro's rebound attempt. Also, traders would remain cautious on taking too much position in Euro, either long or short, as S&P could downgrade Eurozone nations any time this week.

China and Japan agreed to promote direct trading of the Chinese Yuan and the Japanese Yen, without involving US dollar after a meeting between Chinese Premier Wen and Japan Prime Minister Noda. The governments said that direct yuan-yen settlement should reduce currency risks and trading costs. Also such arrangement should benefits the ease of trade and investments between the two nations and strengthen the region's ability to protect against global risks. Separately, China announced a USD 11b currency swap agreement with Thailand last week. meanwhile, Japan also unveiled a currency swap line with India of around USD 10b. Japan will also start buying Chinese bonds for its foreign exchange reserves.

Talking about Japan, BoJ November minutes unveiled that some board members noted "weakness in share prices and real estate investment trusts, the yen's rise and climbing dollar funding costs" and "instability in global financial markets" are affecting Japan's market "to some extent". Some members pointed to increasing downside risk to the economy. Meanwhile, the bank noted that the lack of full subscriptions to the corporate debt buying offers is a sign that quantitative easing has been effective.

On the data front, Japan corporate service price index dropped -0.2% yoy in November. Housing starts dropped -0.3% yoy in November. Swiss UBS consumption indicator, US S&P Case-shiller 20 cities house price and consumer confidence will be featured later today.

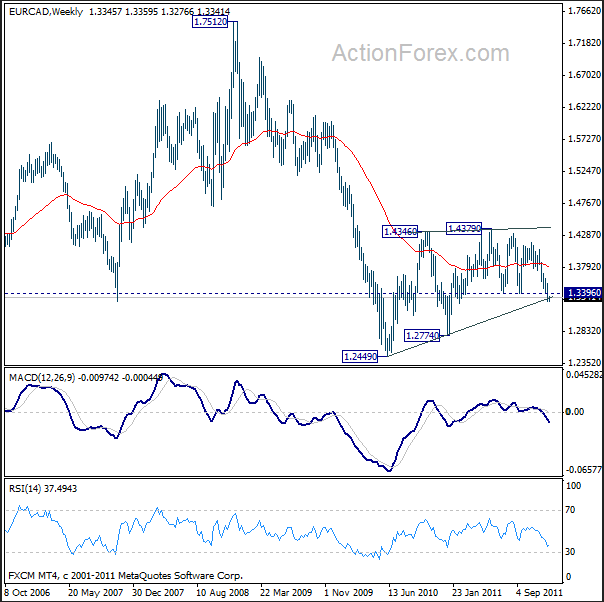

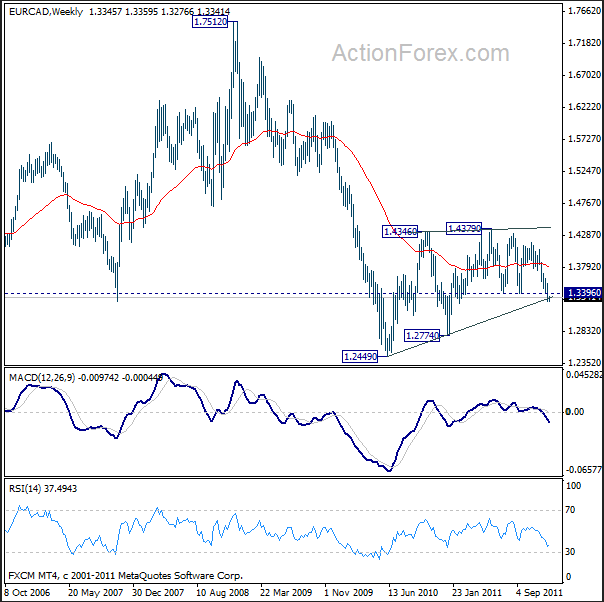

Next to EUR/USD, EUR/CAD was the weakest currency pair this month. The break of 1.3396 support last week suggests that the choppy fall from 1.4379 has resumed. Recent development is inline with the view that price actions from 2010 low are merely consolidation to the whole decline from 1.7512. Such consolidation might be finished with three waves to 1.4379 already. Bias will now remain on the downside for a 1.2774 support first. Break will raise the odds that whole down trend from 1.7512 is resuming for a new low below 1.2449.

China and Japan agreed to promote direct trading of the Chinese Yuan and the Japanese Yen, without involving US dollar after a meeting between Chinese Premier Wen and Japan Prime Minister Noda. The governments said that direct yuan-yen settlement should reduce currency risks and trading costs. Also such arrangement should benefits the ease of trade and investments between the two nations and strengthen the region's ability to protect against global risks. Separately, China announced a USD 11b currency swap agreement with Thailand last week. meanwhile, Japan also unveiled a currency swap line with India of around USD 10b. Japan will also start buying Chinese bonds for its foreign exchange reserves.

Talking about Japan, BoJ November minutes unveiled that some board members noted "weakness in share prices and real estate investment trusts, the yen's rise and climbing dollar funding costs" and "instability in global financial markets" are affecting Japan's market "to some extent". Some members pointed to increasing downside risk to the economy. Meanwhile, the bank noted that the lack of full subscriptions to the corporate debt buying offers is a sign that quantitative easing has been effective.

On the data front, Japan corporate service price index dropped -0.2% yoy in November. Housing starts dropped -0.3% yoy in November. Swiss UBS consumption indicator, US S&P Case-shiller 20 cities house price and consumer confidence will be featured later today.

Next to EUR/USD, EUR/CAD was the weakest currency pair this month. The break of 1.3396 support last week suggests that the choppy fall from 1.4379 has resumed. Recent development is inline with the view that price actions from 2010 low are merely consolidation to the whole decline from 1.7512. Such consolidation might be finished with three waves to 1.4379 already. Bias will now remain on the downside for a 1.2774 support first. Break will raise the odds that whole down trend from 1.7512 is resuming for a new low below 1.2449.