Both The Greenback And The Euro Held Steady As Investors Look Forward To The Conclusion Of The ECB Policy Meeting Set Tomorrow.

Even with recent news that brought the euro to a 20-month slump on Monday, the currency was able to recover quickly in Wednesday’s session as the highly-anticipated conclusion of the European Central Bank’s policy meeting made investors position ahead.

“People had gone into the referendum with a very pessimistic view and I think the last five years have taught us that, as far as the euro is concerned, political issues often don't have a lasting impact,” said DZ Bank currency analyst Sonja Marten in Frankfurt.

Alongside the euro, the US dollar also held steady. Demand for the dollar continued to be supported by prospects that the Federal Reserve will raise interest rates this month. 100% of traders forecast the US central bank to hike rates at its December 13-14 meeting.

EUR/USD was barely changed at 1.0721, up by 0.07% as of 10:24 GMT.

Euro had previously plummeted to multi-month lows— $1.0505, its lowest since March 2015— after Italian Prime Minister Matteo Renzi's referendum defeat and consequent confirmation that he would resign from his position on Monday. Qualms over Italy’s suffering banking sector remained in focus as well; The Italian government was preparing to take a €2 billion controlling stake in Monte dei Paschi, one of the country’s many troubled lenders in late Tuesday.

However, anticipation surrounding the ECB meeting outcome lifted the currency, quickly climbing back to a 3-week high of $1.0797. It also rebounded as worries over the political risk factors for Italy seemed to have been exaggerated.

The ECB appears to lean towards announcing an extension of its quantitative easing program, but any sign that it could initiate tapering asset purchases could counterbalance the effect of extending its stimulus program.

According to analysts, should the ECB say it will begin to scale back its asset purchases, the euro would be likely to rally following a 4% plunge against the dollar over the past month.

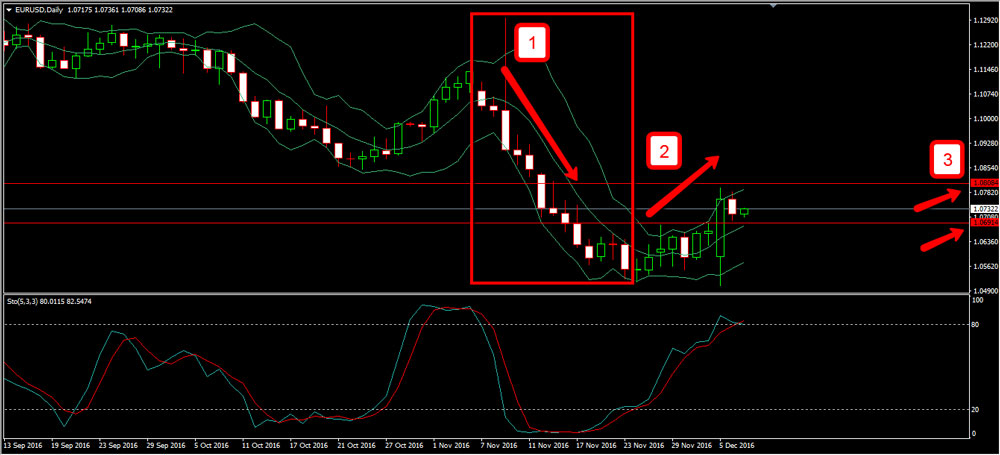

On the given chart, EUR/USD has been on a bearish tone since the beginning of November, eventually having a steep dive on the US presidential election on November 9 [1]. This began the strong rally of the dollar until it took a breather on the last week of the previous month [2].

As for the direction of the EUR/USD pair, it seems quite dependent on the outcome of the ECB meeting. “There are not many factors for the market to trade on ahead of Thursday's ECB meeting, which remains the week's focal point,” said Junichi Ishikawa, senior FX strategist at IG Securities. “It could spell the beginning of the end of the Trump rally.”

Currently, 1.0691 is providing weak support, and 1.0808 is the next resistance line [3]. EUR/USD ratio is showing gains in long positions. Short positions have a majority of 57%, suggesting trader bias towards EUR/USD breaking out and moving lower.

However for long positions, technical analysis supports the currency pair with bull hammer on December 5 and monthly RSI biased up.