Solid consumer confidence data and easing geopolitical tensions pushed US equities higher overnight. S&P 500 closed at 2000.02, above 2000 handle for the first time on record. Dow 30 also rose slightly by 29.8 pts to close at 17106.70. In the currency markets, EUR/USD remains the weakest major currency this week on easing speculations.Dollar is mixed, though, as it failed to extend recent rally against commodity currencies. In particular, USD/CAD reversed after hitting 1.0997 and is possibly heading further south in near term. The economic calendar continues to be rather light today. German Gfk consumer sentiment for September dropped more than expected to 8.6. Swiss UBS consumption indicator dropped to 1.66 in July.

Hamas and Israel agreed on a longer-term ceasefire. Brokered by Egypt, the terms of the agreement was similar to those set at the end of 2012 conflict. For instance, Israel will open crossings on its border to allow humanitarian aid and construction materials to enter Gaza, and will extend the permitted fishing zone to six miles off the coast of Gaza. Tensions between Ukraine and Russia remained. Despite the meeting between Petro Poroshenko and Vladmir Putin met at a trade summit in Minsk, there was no sign of progress being made.

Draghi last Friday unveiled his concerns over deflationary risks in the Eurozone and pledged that the central bank would take action to remedy this. According to the president, “over the month of August financial markets have indicated that inflation expectations exhibited significant declines at all horizons" and the central bank members “stand ready to adjust our policy stance further". The replacement of the language “should it become necessary" was interpreted as a sign of increasing urgency of further stimulus. Several investment banks have adjusted their forecasts of ECB's QE timeline. Deutsche Bank forecasts that the ECB would introduce ‘private' QE in September, compared with previous forecast that any QE program would begin early next year. Nomura now expects the ECB to cut the main refi rate and the deposit rate by -10 bps in either September or October. It noted that there is now a 30% chance of QE this year, up from previous estimate of 25%.

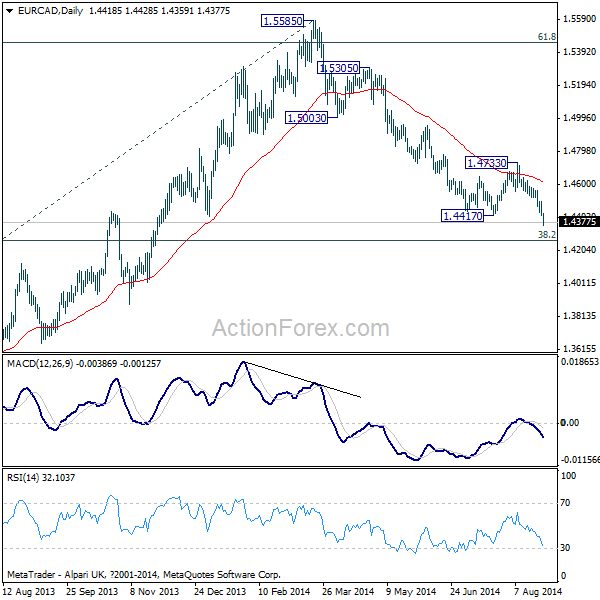

EUR/CAD took out 1.4417 support this week and confirmed resumption of whole decline from 1.5585. Near term outlook is turned bearish again. Further fall should now be seen to medium term fibonacci level of 38.2% retracement of 1.2126 to 1.5585 at 1.4264. As the cross is possibly in the fifth wave of the five wave structure from 1.5585, we'd be cautious on strong support from 1.4264 to bring a corrective rebound.