The euro remains soft, in particular against Canadian dollar, as markets await ECB president Draghi's speech today. It's widely expected ECB will act in June to overcome low inflation. But, markets are so far kept in the dark on what package tools would ECB uses. Traders will look for clues from Draghi today. So far, there are speculations of interest rate cuts, liquidity injections and even quantitative easing. Meanwhile, the common currency is also reacting mildly negatively on news that the right-wing eurosceptic parties stormed to victory in European Parliament elections in the UK and France.

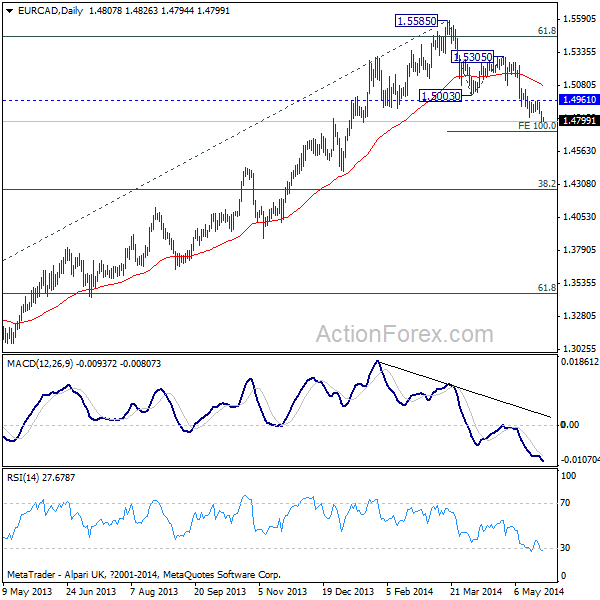

The EUR/CAD dips to 1.4794 so far today as the corrective fall from 1.5585 extends. Such decline is expected to extend to 100% projection of 1.5585 to 1.5003 from 1.5305 at 1.4723. As oversold condition is seen in daily RSI, we'd be cautious on bottoming after hitting 1.4723, on loss of downside moment. Meanwhile, break of 1.4961 resistance is needed to confirm short term bottoming. Otherwise, outlook remains bearish in case of recovery.

The minutes of BoJ meeting on April 30 showed that board member Sato proposed to change the assessment of prices. He suggested to mention that risks to inflation are tilted to the downside. But that was voted down by 8-1. Kirai and Kuichi also proposed to loosen the time frame for achieving the 2% inflation target but was voted down too. While there was clearly disagreement among board members, BoJ governor Kuroda still expressed his optimism on the economy and inflation after May's meeting.

On the data front, New Zealand trade surplus came in narrowed than expected at NZD 534m in April. German Gfk consumer sentiment was unchanged at 8.5 in June. The UK and US will be on holiday today and there is no more data to watch. Focus will mainly be on ECB Draghi's speech. Looking ahead, the economic calendar is also rather light this week. Some important data will be released from US including durables, GDP revision and personal income. major focus would likely be on Japan inflation data on Friday. Here are some highlights:

- Tuesday: Swiss trade balance, employment; US durable goods, consumer confidence

- Wednesday: Swiss GDP; German unemployment, Eurozone M3

- Thursday: Japan retail sales; US GDP revision, pending home sales

- Friday: Japan CPI, unemployment; German retail sales; Swiss KOF; Canada GDP; US personal income and spending, Chicago PMI