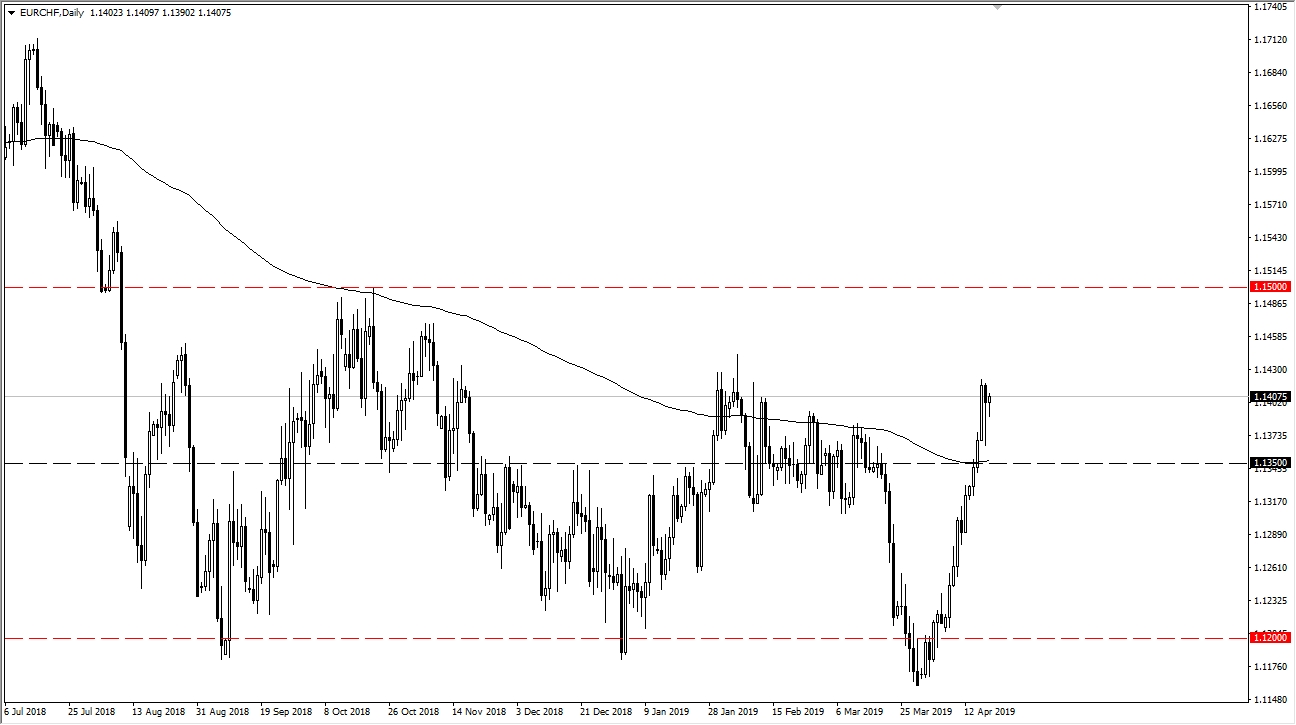

The euro rallied rather significantly against the Swiss franc over the last several weeks, slicing through the 200-day moving average without even hesitating. That, of course, is a very bullish sign and after an impulsive move like this one would have to think that there are plenty of people out there waiting for some type of pullback to take advantage of value.

We have clear the 200-day EMA a few days ago and have since then pulled back during two sessions that saw buyers come back in to pick up value. There was a significant amount of resistance around the 1.1350 level, extending 50 pips in each direction. That is now just about broken through and it looks as if the buyers are continuing to press to the upside. What makes this particularly interesting is just how strong the euro is in this market, considering how it has done very little against the US dollar, which is the way that most people measure of the overall strength of the currency. That being said, it shows just how soft the Swiss franc is.

Pullbacks at this point will more than likely be thought of as value the people are willing to take advantage of, especially near the 1.1350 level which currently is the place where the 200-day EMA is sitting. To the upside, the 1.15 level would make a significant resistance barrier and a very likely target. However, there’s always a possibility of an alternate scenario. In this case, a break down below the 1.13 level would not only wipe out what should be massive support but break through the 200-day EMA to send this market back down to the 1.12 level. It’s very likely if we get that move, we will also see the EUR/USD break the 1.1150 level.