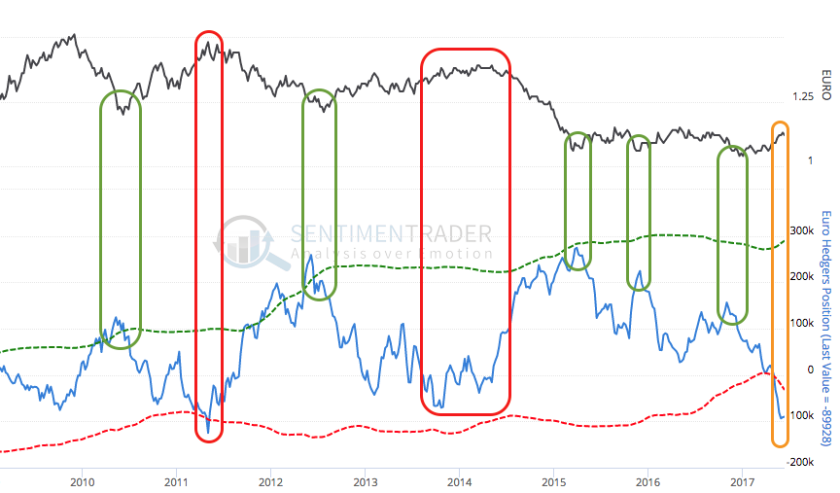

In line with our bullish forward view on USD, behold the very bearish state of the Commercial Hedger positions in the euro (courtesy of Sentimentrader). Recent historical data speaks for itself. It appears a decline in the euro is imminent, which in market terms, means ‘relax, it could be a while yet’.

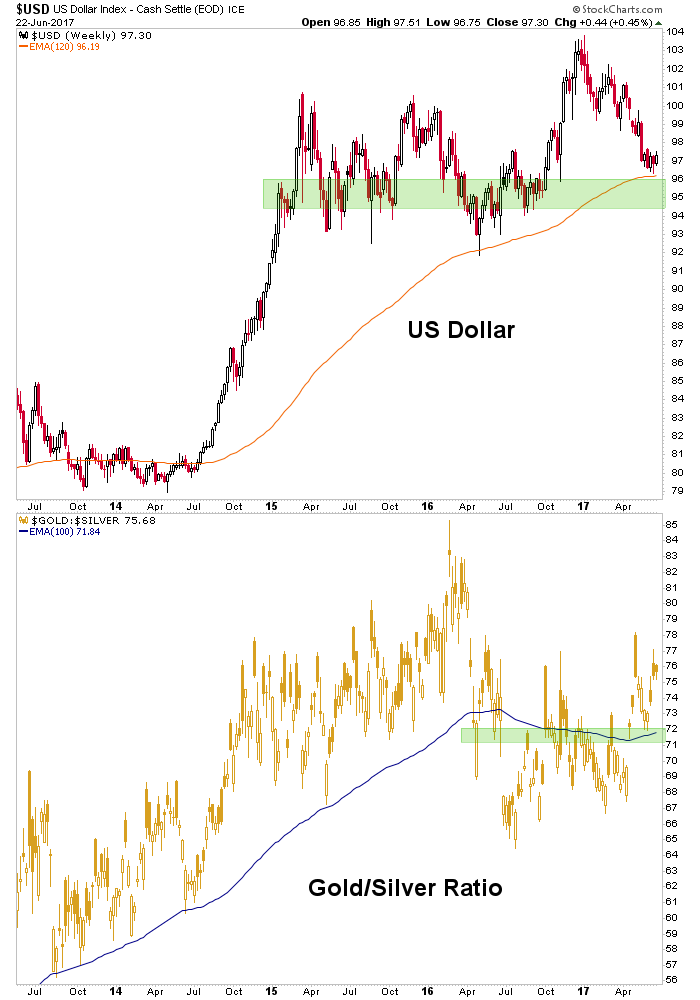

The next question is, when Uncle Buck rides will he ride alone or will he have the other rider at his side? The 2 Horsemen would bring the pain in the form of liquidity removal from a range of markets (the gold/silver ratio indicates anti-inflation and market stress).

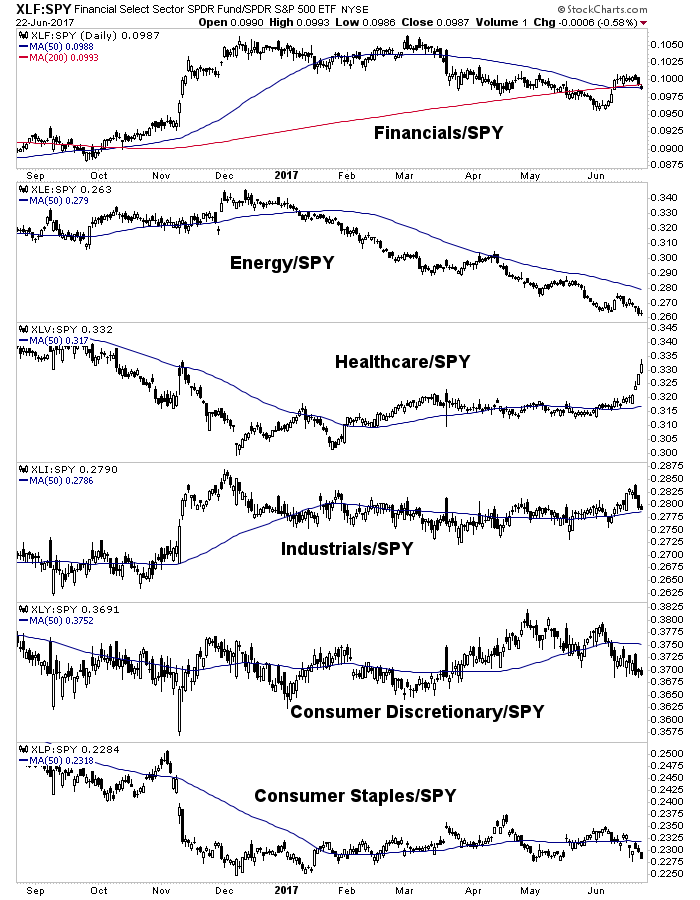

Currently, markets are on a speculative frenzy and indeed, I’ve been participating — with ongoing risk management in the form of profit taking, loss limitation, rotation and CASH. Speaking of rotation, the latest rotation has been into healthcare, which we tracked every step of the way using our ‘vs. SPY’ charts and some good old fashioned fundamental discussion relating to interest rates and my personal experience as a former supplier to medical device companies.

Here is the daily ‘vs. SPY’ chart from NFTRH’s Market Internals segment showing Healthcare (XLV, 3rd panel) becoming relatively overbought with momos finally catching on (as they always do, eventually).

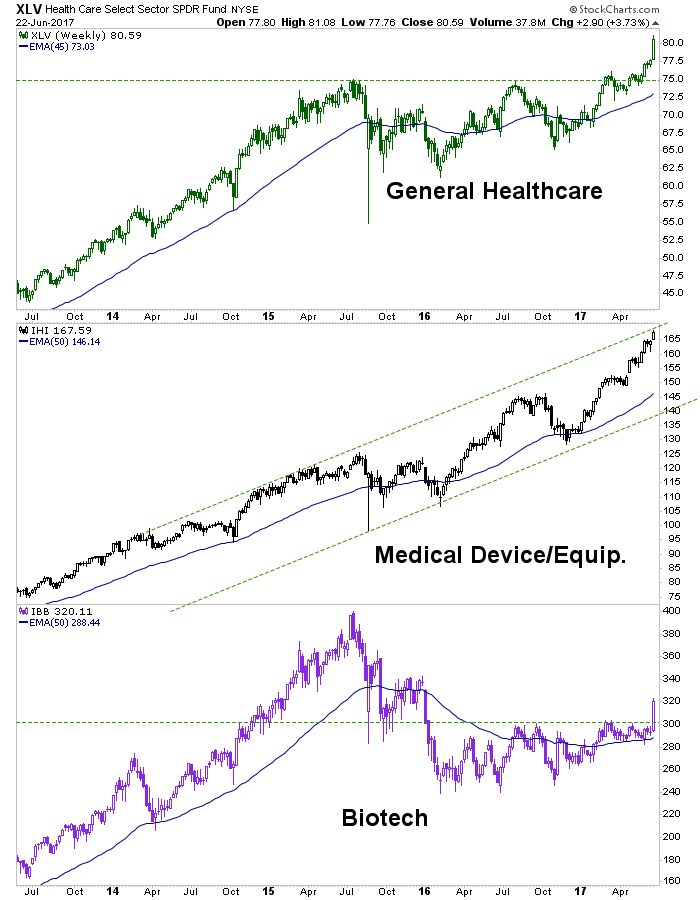

And a weekly view of the nominal Healthcare sector. We were well prepared for the eventual breakout in XLV, have been bullish on the Medical Device sector (IHI) all along, but especially since the election due to a now-favorable political backdrop (and a likely removal of Obamacare’s funding taxation that burdened the sector) and most recently, Biotech (our target on IBB is 350).

What are the implications if the euro fades as expected and Uncle Buck rides with the Gold/Silver ratio later this summer. The US stock market has been rotating for weeks now… FANG → Financials → Industrials → Healthcare → ?

The fun and games, in the form of sector rotation and rolling momentum, would be terminated for as long as the Horsemen would ride. In other words, at some point a correction is going to come about that will not spare any/many sectors.