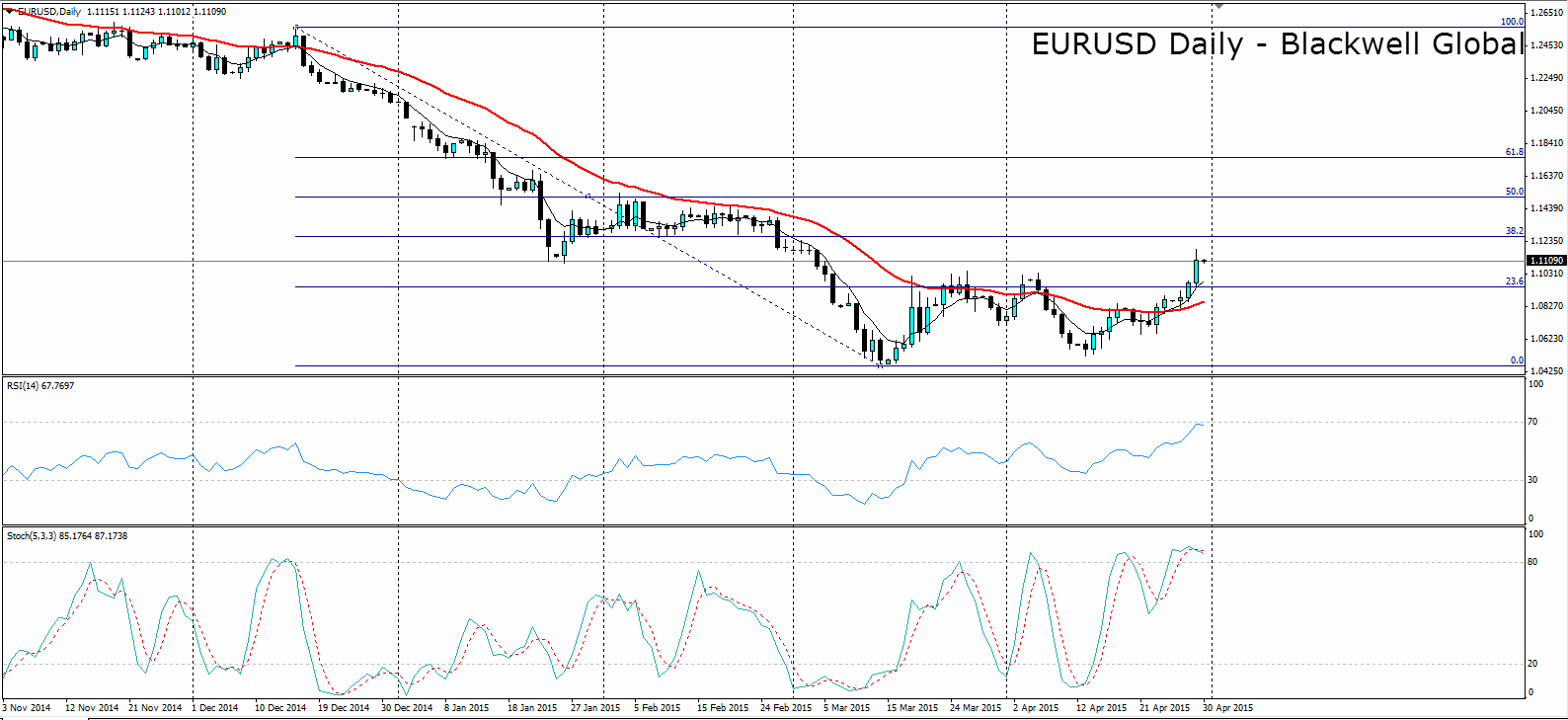

The euro’s concerted climb, through the top of the month and half’s high, caught many traders by surprise today. The FOMC’s decision to leave rates unchanged along with the poor US GDP result at 0.2% left the market in dollar sell off mode. Subsequently, the euro climbed through 1.1100, proving, yet again, that the pair is currently driven by US weakness rather than European strength.

Despite the strong rally, the euro faltered and declined back towards support at 1.11 demonstrating that the bears are still very much in control. Despite many market pundits lauding the new rise of the euro, I am less convinced and see plenty of downside action left to play out in the coming days.

In the near-term, resistance exists at 1.1266, in the form of the 38.2% Fibonacci retracement level, will likely act to cap any further gains. A breakthrough of that resistance places the 50.0% level, at 1.1515, into play. Considering the euro’s broadly bearish trend, any upward move must be seen in the context of temporary corrections and an opportunity to find short entries.

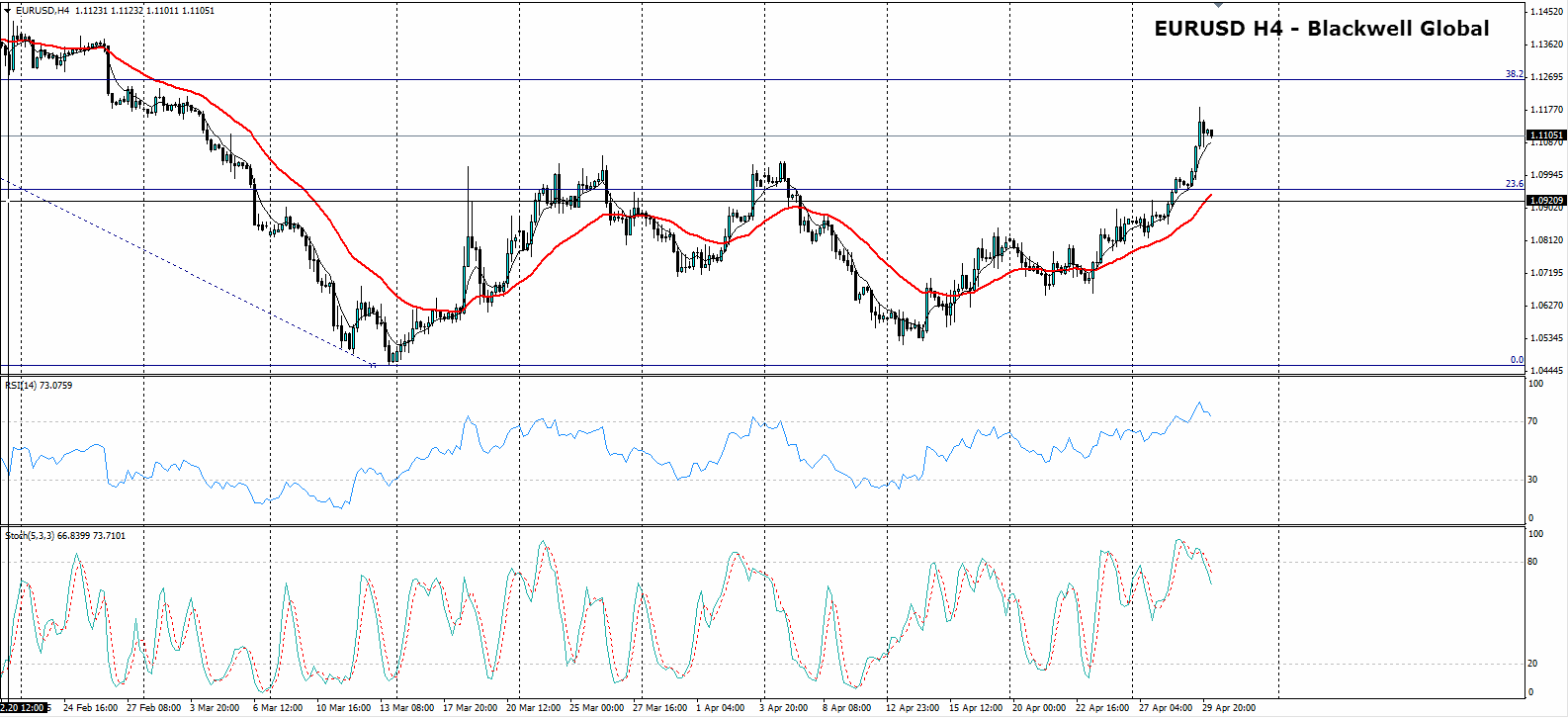

Looking at the 4 hourly charts, it shows the bears starting to win the battle as both RSI and stochastic oscillators have crossed into over-sold territory and have started to trend lower. A strong move below 1.11, and 30SMA crossover, would signal that a potential fall back towards the 23.6% support level is in play. Any further bearish indicator signals is likely to signal that a short biased opportunity is imminent.

Ultimately, technical indicators are likely to dominate the euro in the coming days as eagle eyed bears look to profit from the intra-day shorts. However, watch out for the Eurozone Flash CPI estimate and US Unemployment claims data, due out later today, as it is likely to impact the pair.