The euro saw significant gains against the US dollar throughout yesterday's trading session, as investors continue to digest last week's disappointing nonfarm payrolls data. The EUR/USD moved up more than 100 pips over the course of the day, and was able to come within reach of the 1.2500 level. Turning to today, traders will want to pay attention to the US ISM Non-Manufacturing PMI. The PMI is considered an accurate gauge of economic health. Should the end result come in below expectations, it may lead to speculations that the Fed will soon initiate a new round of quantitative easing, which could weigh on the greenback.

Economic News

USD - Dollar Extends Bearish MovementThe US dollar extended its downward momentum throughout yesterday's trading session, as weak unemployment data released last week has led to fears that the US economic recovery is losing momentum. Against the Japanese yen, the dollar briefly dropped below the psychologically significant 80.00 level during the morning session. The greenback was able to stage a slight upward correction later in the day and eventually stabilized around 78.20. The AUD/USD was up almost 100 pips during the European session yesterday, reaching as high as 0.9745, before moving downward and stabilizing around 0.9725.

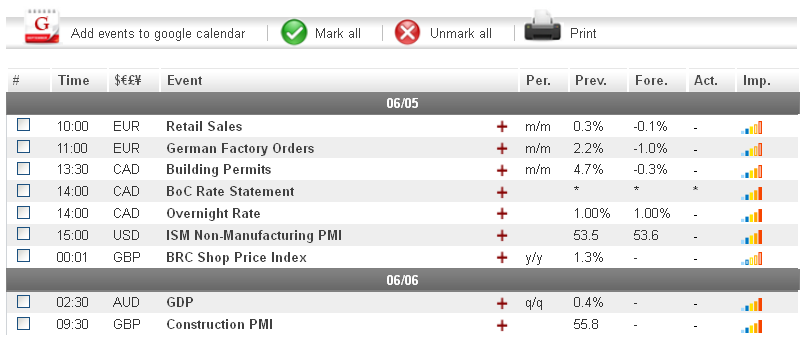

Turning to today, traders will want to keep an eye on the US ISM Non-Manufacturing PMI, set to be released at 14:00 GMT. Analysts are predicting that the figure will come in around 53.6, which if true, would represent industry expansion and could help the dollar recover some of its recent losses. That being said, should the figure come in below expectations, it may cause investors to further doubt the USD's status as a safe-haven currency and could result in additional downward movement for the greenback.

EUR - Euro Stages Upward Correction

The euro was able to move up vs. its main currency rivals throughout the day yesterday, but analysts were quick to warn that any gains may be short lived ahead of potentially significant eurozone news set to be released later in the week. In addition to the more than 100 pip gain against the US dollar, the euro also advanced more than 50 pips against the GBP and 95 pips against the CAD. By the end of the European session, the EUR/GBP was trading around the 0.8115 level, while the EUR/CAD was at 1.2990.

Taking a look at the rest of the week, euro traders will want to pay close attention to the eurozone Minimum Bid Rate on Wednesday followed by a Spanish bond auction on Thursday. Some analysts are predicting that the European Central Bank may cut interest rates when they meet on Wednesday. If true, it could cause the euro to come under renewed pressure. Furthermore, investors will be carefully monitoring the Spanish bond auction for clues as to the state of that country's debt issues. Unless the auction goes smoothly, the euro could see downward movement towards the end of the week.

Gold - Gold Sees Gains Amid Concerns Regarding Economic Recovery

Gold was able to largely hold onto its gains from last week during trading yesterday, as investors concerned with the pace of the global economic recovery continued to shift their funds to the precious metal. Investors are now treating gold as a safe-haven following disappointing employment data out of the US last week which resulted in the greenback tumbling. After reaching as high as $1628 an ounce yesterday morning, gold saw slight downward movement and spent most of the afternoon trading at the $1610 level.

Turning to today, traders will want to monitor what direction the USD takes. With investors concerned that the Fed is getting ready to initiate a new round of quantitative easing to stimulate growth in the US, any disappointing American news could lead to dollar losses, which could benefit gold's status as a safe-haven and lead to additional gains for the precious metal.

Crude Oil - Crude Oil Sees Upward Movement

After weeks of steadily declines, the price of crude oil saw some upward movement during European trading yesterday. Analysts attributed the bullish movement to dollar weakness following last week's worse-than-expected nonfarm payrolls figure. After dropping as low as $81.17 a barrel during early morning trading, the price of oil steadily increased, and eventually reached as high as $83.70.

Turning to today, oil traders will want to pay attention to the US ISM Non-Manufacturing PMI, set to be released at 14:00. Should the figure come in below expectations, the USD could come under renewed pressure which may result in oil extending its bullish movement. Typically, the price of oil increases when the dollar is weak, as the commodity becomes cheaper for international buyers.

Technical News

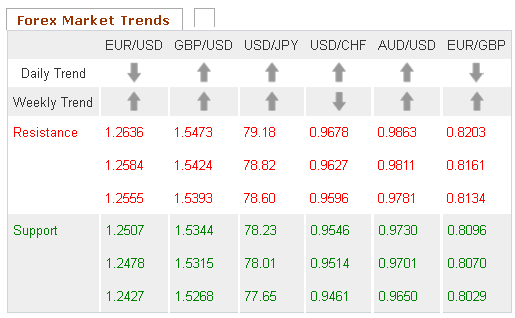

EUR/USDThe Williams Percent Range on the weekly chart is in the oversold zone, indicating that this pair could see upward movement in the coming days. This theory is supported by the Slow Stochastic on the same chart, which has formed a bullish cross. Going long may be the wise choice for this pair.

GBP/USD

In a sign that this pair could see an upward correction in the near future, the Relative Strength Index on the daily chart has dropped into oversold territory. Furthermore, the Williams Percent Range on the weekly chart is currently at the -90 level. Opening long positions may be a good idea for this pair.

USD/JPY

While the Williams Percent Range on the weekly chart is pointing to a possible upward correction in the coming days, most other long-term technical indicators are in neutral territory. Traders may want to take a wait and see approach for this pair, as a clearer picture may present itself shortly.

USD/CHF

The Relative Strength Index on the weekly chart is approaching the overbought zone, indicating that this pair could see a downward correction in the near future. Additionally, the Slow Stochastic on the same chart appears to be forming a bearish cross. Traders will want to monitor these two indicators, as they may point to an impending downward correction.

The Wild Card

CHF/JPYThe daily chart's Slow Stochastic has formed a bullish cross, indicating that upward movement could occur in the near future. Furthermore, the Relative Strength Index on the same chart has dropped into oversold territory. This may be an excellent time for forex traders to open long positions, as an upward correction could be forthcoming.