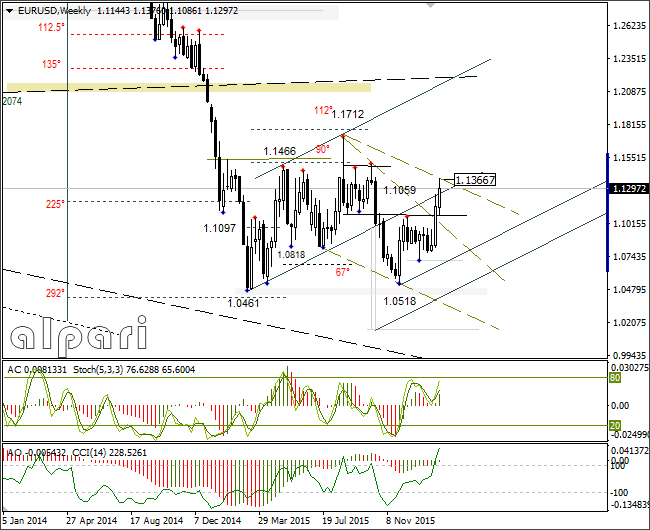

EUR/USD 1H

Yesterday’s Trading:

Thursday saw the market swinging all day before the yen bounced from 111 by 190 points. It was a day off in Japan, so there was no comment from the BoJ. I think that the bank made an intervention through its dealer, because the price doesn’t move from the place it has been at for three hours for no reason.

Due to a fall in the stock indices, the euro/dollar reached 1.1376. By the end of the day the rate returned to 1.1315. Janet Yellen had nothing new to say. The US indices closed the day down.

Main news of the day (EET):

- 09:00, German CPI for January and GDP for Q4;

- 12:00, Eurozone industrial production data for December and GDP for Q4;

- 15:30, US January retail sales;

- 17:00, US consumer confidence index from Reuters/Michigan for February, FOMC member Dudley to speak.

Market Expectations:

The euro/dollar is trading by the balance line on the hourly at 1.1297. A candle with a long upper shade and a bullish body has formed on the daily. Due to this, we need to wait for the confirmation. A close of the day below 1.1286 will see a euro sales signal with a 1.1200 target form. If the euro fall is accompanied by a fall in gold below 1120, we will be heading beneath 1.1080. Today’s news worth a look includes the GDP figures from the Eurozone and Germany for Q4.

Technical Analysis:

- Intraday target maximum: 1.1333 (current Asian), minimum: 1.1240, close: 1.1265;

- Intraday volatility for last 10 weeks: 102 points (4 figures).

The current euro/dollar quote is 1.13. The euro is balanced on the hourly. The dollar is strengthening after yesterday’s weakening against secure assets. The US indices are down slightly, so it’s likely that Europe will close up. Moreover, Brent is up to $31.70. If the indices head north, the euro will head south. A correctional movement before the weekend will begin.

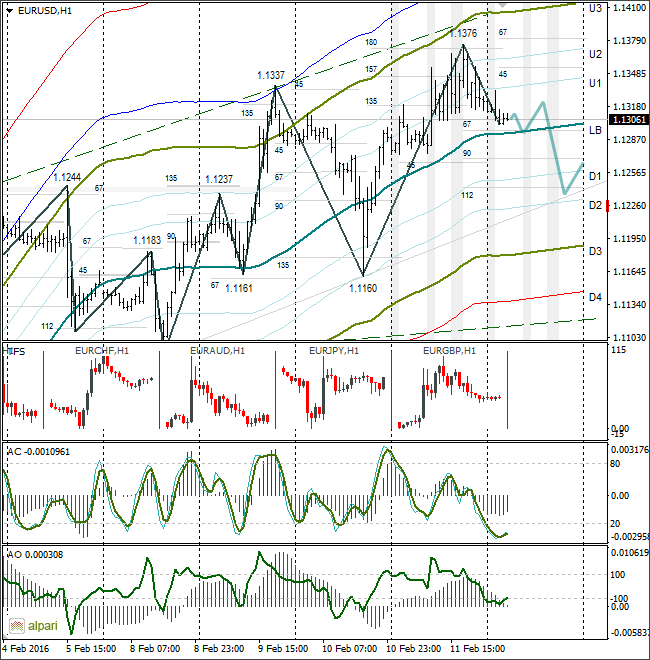

EUR/GBP 1H

The euro/pound has reached the U4. The price returned from here to the LB as we saw on 9th February. In my forecast I’ve gone for a weakening of the euro to 0.7758. If I’m right about the direction of the pair, my scenario for the euro/dollar will come off.

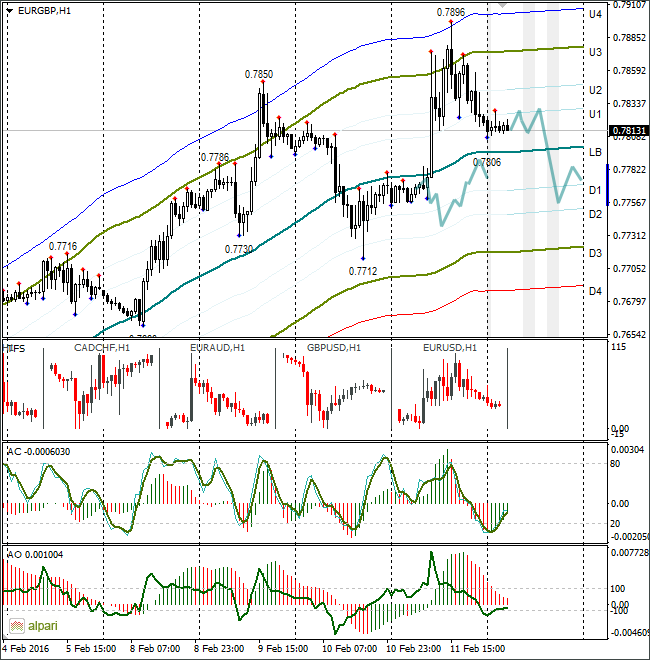

Daily

An inverted candle formation is visible on the daily. The 1.1370 target along the upper limit of the channel has been taken. There’s just a close of the day below 1.1286 left. After this we can consider a fall of the euro to 1.1200 and then to 1.1080. If the day closes above 1.1286, ready yourself for a strengthening of the euro to 1.1471/75.

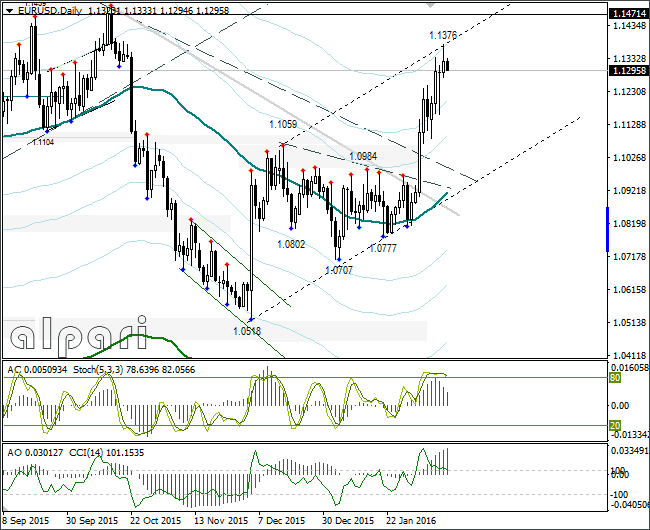

Weekly

The target was reached. Now we need to wait for the week to close. It’s better to partially fix profit on long positions. If the day closes above 1.1286 we can sit it out to 1.1470.