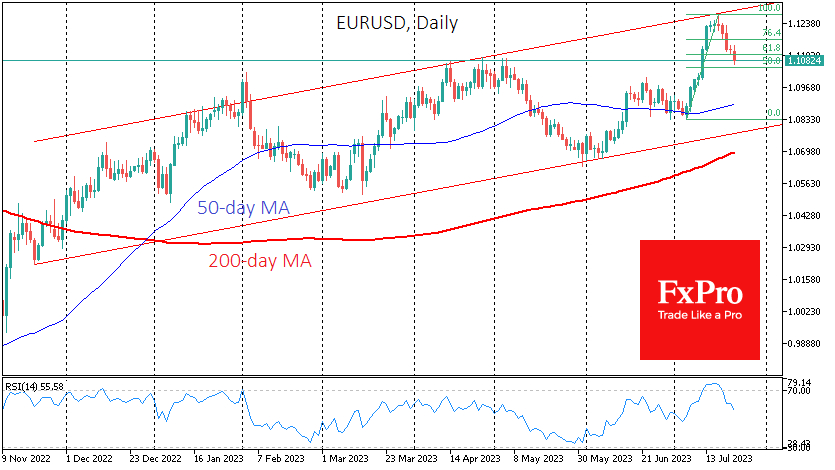

The EUR/USD on Monday, dropping to 1.1070 following the release of weak economic data. After losing for five consecutive sessions, the EURUSD has given back almost half of its gains from the 6th to the 18th, and the pair's further momentum will largely depend on comments from the ECB and the Fed in the second half of the week.

Preliminary estimates of the July PMI business activity indices triggered a fresh wave of disappointment and selling in the single currency, as they were painfully weaker than expected. The composite index for France fell to 46.6 from 47.2 the previous month, against expectations for a rise to 47.8. The indicator points to the sharpest contraction in business activity since November 2020.

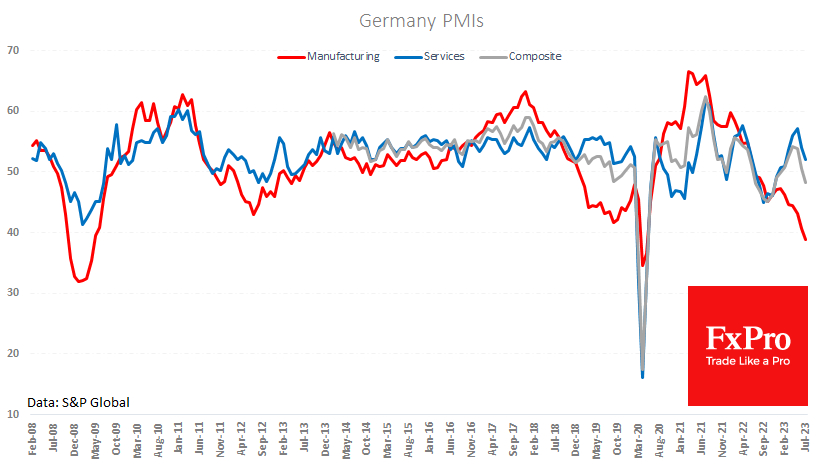

The situation is similar in Germany. There, the composite index fell from 50.6 to 48.3, marking a shift from expansion to contraction, while the average forecast pointed to a correction to 50.3 (weak growth).

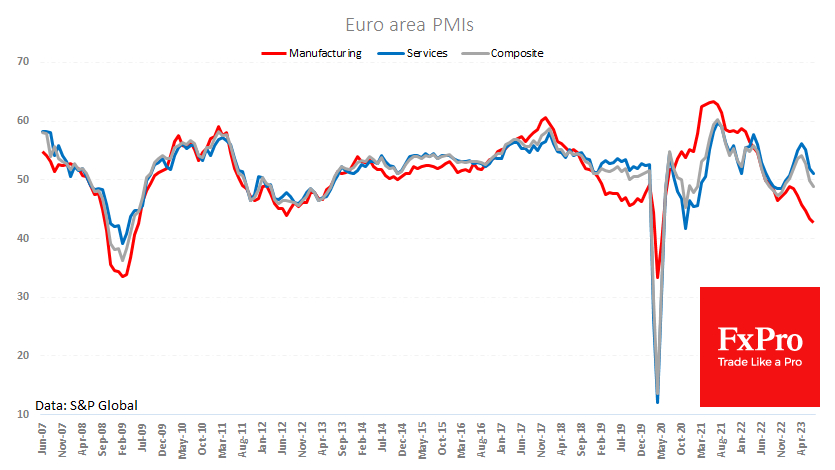

In the euro area, the manufacturing PMI fell to 42.7 from 43.4 the previous month and against expectations of 43.5. Excluding the coronavirus shock, the index was only lower between October 2008 and June 2009. But the central bank was cutting interest rates sharply at that time to support the economy and boost inflation. Nowadays, despite the alarming signals from the economy, the ECB continues to see the fight against inflation as its most important task.

Historical experience suggests that the current policies of the major central banks are justified in the long term but carry the risk of excessive pressure on the economy in the short term. The sell-off in the euro, which began immediately after the French data and intensified after the German data, suggests a reassessment of the outlook for monetary policy.

Speculators are probably rushing to bet that the ECB will be forced to soften its hawkish stance on further policy tightening, which is immediately bearish for the euro. However, investors and traders should remember that the ECB has been methodically tightening in recent months as the economic outlook for the region has weakened.

Technically, the euro's decline is a retreat from the upper boundary of the ascending channel in which the pair has been trading since last November and a correction after accumulated overbought conditions on the daily timeframe. Potential targets for the bears are 1.0900, near the 50-day moving average, and 1.0850, the area of previous lows and the channel’s lower boundary. Only a break below this level will allow us to discuss a long-term uptrend change.

At the same time, it cannot be ruled out that the pair will stay above 1.1050, turning the local extremes of April and May into solid support.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Retreats Inside Uptrend on Weak PMIs

Published 07/24/2023, 08:35 AM

Euro Retreats Inside Uptrend on Weak PMIs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.