The half-life of weekend rumours around plans and actions that the ECB may take to deal with the debt crisis is rapidly decreasing alongside the impact that they have on the single currency. The most recent rumour over the weekend was that the ECB is planning to cap European peripheral bond yields by intervening in the secondary market.

Although the report had no official sources commenting within it, it was enough to drive bond yields lower and put the euro back towards 1.24 against the dollar with GBP/EUR back in the low 1.27s. The German Finance Ministry did come and spoil the party halfway through the day, however, by saying that it was unaware of any plans to target bond yields.

The Bundesbank also stuck its oar in, although this was through the publication of its latest monthly report which simply happened to be coming out on the same day. The Buba said that they saw “significant” risks in ECB bond buying programs but this was not enough to put the euro too much lower and the single currency is demonstrating some admirable resilience at the moment.

Elsewhere, the only real headlines have come from Australia overnight with the publication of the latest minutes from the Reserve Bank of Australia meeting. The lack of comment surrounding the recent strength of AUD has pushed cross AUD higher with support coming from the lack of chatter about interest rate cuts as well.

Once again, there is very little to look forward to today with UK public finances the main data issuance. Things to hot up tomorrow with the minutes from the latest Fed meeting and Friday sees the latest publication of UK GDP for Q2.

With the dearth of data and poor summer volumes it seems almost too obvious to say that today will see currencies remain range-bound through today’s session at least. But they will unfortunately.

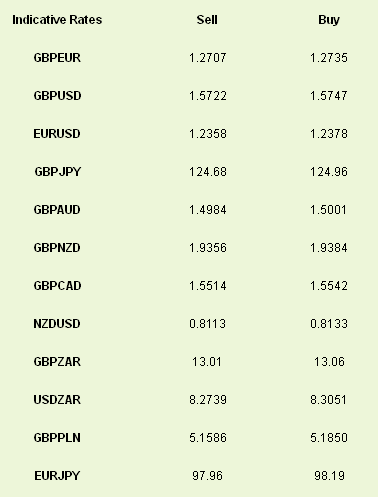

Latest exchange rates at time of writing:

Although the report had no official sources commenting within it, it was enough to drive bond yields lower and put the euro back towards 1.24 against the dollar with GBP/EUR back in the low 1.27s. The German Finance Ministry did come and spoil the party halfway through the day, however, by saying that it was unaware of any plans to target bond yields.

The Bundesbank also stuck its oar in, although this was through the publication of its latest monthly report which simply happened to be coming out on the same day. The Buba said that they saw “significant” risks in ECB bond buying programs but this was not enough to put the euro too much lower and the single currency is demonstrating some admirable resilience at the moment.

Elsewhere, the only real headlines have come from Australia overnight with the publication of the latest minutes from the Reserve Bank of Australia meeting. The lack of comment surrounding the recent strength of AUD has pushed cross AUD higher with support coming from the lack of chatter about interest rate cuts as well.

Once again, there is very little to look forward to today with UK public finances the main data issuance. Things to hot up tomorrow with the minutes from the latest Fed meeting and Friday sees the latest publication of UK GDP for Q2.

With the dearth of data and poor summer volumes it seems almost too obvious to say that today will see currencies remain range-bound through today’s session at least. But they will unfortunately.

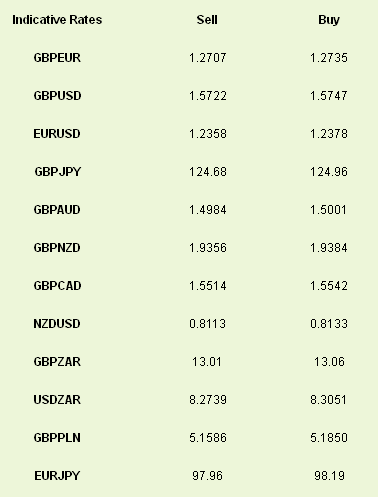

Latest exchange rates at time of writing: