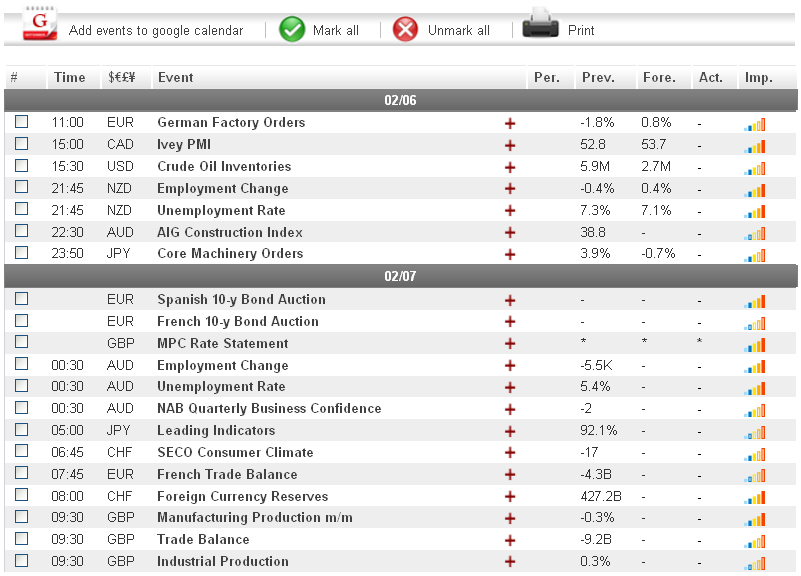

The euro was able to stage an upward correction against most of its main currency rivals yesterday, following the release of a better than expected Spanish Services PMI which renewed confidence in the strength of the euro-zone economic recovery. Still, analysts were quick to warn that the bullish trend may be temporary before tomorrow's ECB press conference. Today, the main piece of economic news is likely to be the German Factory Orders figure, set to be released at 11:00 GMT. A better than expected result could lead to additional euro gains.

Economic News

USD - Dollar Renews Bullish Trend vs. Yen

Risk taking in the marketplace following positive euro-zone news caused the USD/JPY to renew its bullish movement during the European session yesterday. The pair gained more than 100 pips during morning trading, eventually reaching as high as 93.50 before dropping back to the 93.20 level at the beginning of the afternoon session. Against the Swiss franc, the dollar lost close to 40 pips during the first part of the day, eventually trading as low as 0.9072, before bouncing back to 0.9090 later in the day.

Today, dollar traders will want to pay attention to economic news out of the euro-zone and its impact on risk taking in the marketplace. While any better than expected news could drive the USD/JPY higher, it could also result in the dollar taking losses against its higher-yielding currency rivals. Later in the week, investors will be watching the US Trade Balance figure for clues as to the current state of the US economic recovery, with a positive result likely to boost the greenback.

EUR - Euro Turns Bullish Once Again

The euro turned bullish against several of its main currency rivals during the European session yesterday, following the release of a better than expected Spanish Services PMI which renewed confidence in the strength of the euro-zone economic recovery. Against the US dollar, the common-currency gained more than 100 pips during morning trading to eventually reach as high as 1.3566 before dropping back to the 1.3520 level. The EUR/JPY advanced more than 250 pips before peaking at 126.71 and dropping back to 125.95.

Today, the main piece of euro-zone news is likely to be the German Factory Orders figure, set to be released at 11:00 GMT. With analysts expecting the indicator to come in at 0.8%, significantly higher than last month's, the euro may be able to extend its bullish trend today. Tomorrow, traders will not want to forget to pay attention to the ECB press conference, scheduled to take place at 13:30 GMT. Any positive signs out of the press conference regarding the economic recovery in the euro-zone are likely to boost the currency further.

Gold - Gold Stages Bullish Recovery

The price of gold was able to stage an upward recovery during European trading yesterday, following positive euro-zone news which boosted riskier assets. The precious metal advanced more than $11 an ounce during morning trading, eventually reaching as high as $1684.70 before dropping back to $1680.50 during afternoon trading.

Today, euro-zone news is once again likely to have the biggest impact on gold prices. If the German factory orders figure comes in above the expected 0.8%, the precious metal is likely to extend yesterday's bullish momentum.

Crude Oil - Risk Taking Boosts Oil Prices

Crude oil advanced more than $1 an ounce during European trading yesterday, after a better than expected Spanish Services PMI encouraged investors to shift their funds to riskier assets. The commodity traded as high as $97.04 before dropping back to the $96.75 level during afternoon trading.

Turning to today, the US Crude Oil Inventories figure is likely to have the biggest impact on crude oil prices. If the indicator comes in at or above last week's 5.9M, investors are likely to interpret the news as a sign that US demand for oil is dropping, which would likely result in the oil prices turning bearish.

Technical News

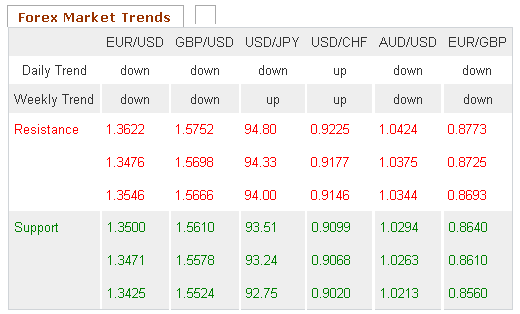

EUR/USD

The weekly chart's Slow Stochastic is close to forming a bearish cross, indicating that a downward correction could occur in the near future. Additionally, the same chart's Relative Strength Index has crossed into overbought territory. Opening long positions may be the smart choice for this pair.

GBP/USD

The Williams Percent Range on the weekly chart has fallen into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the MACD/OsMA on the daily chart appears close to forming a bullish cross. Traders may want to open long positions.

USD/JPY

The Relative Strength Index on the weekly chart has cross into overbought territory, indicating that a downward correction could occur in the coming days. This theory is supported by the Slow Stochastic on the same chart, which has formed a bearish cross. Opening short positions may be the smart choice for this pair.

USD/CHF

While the weekly chart's Williams Percent Range has crossed over into oversold territory, most other long-term technical indicators place this pair in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

The Wild Card

USD/ZAR

The Slow Stochastic on the daily chart is close to forming a bullish cross, indicating that an upward correction could take place in the near future. This theory is supported by the Williams Percent Range on the same chart, which has fallen into oversold territory. Opening long positions may be the best choice for forex traders today.

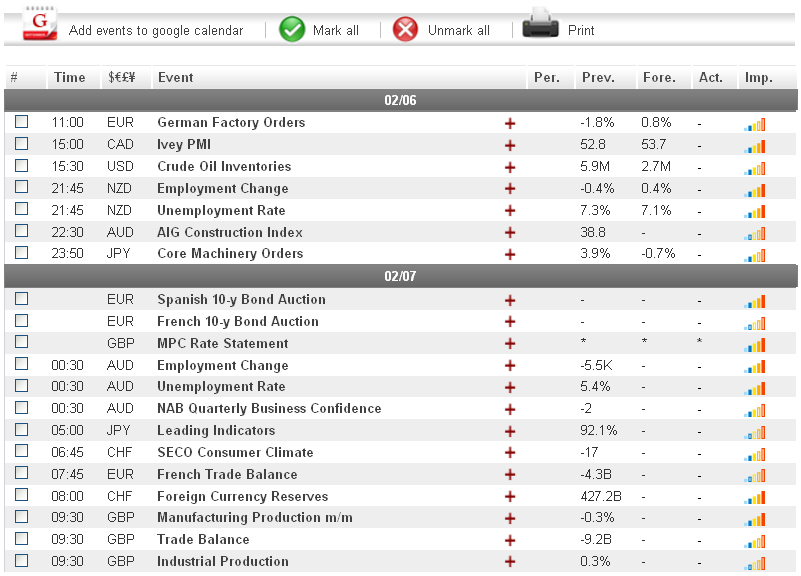

Economic News

USD - Dollar Renews Bullish Trend vs. Yen

Risk taking in the marketplace following positive euro-zone news caused the USD/JPY to renew its bullish movement during the European session yesterday. The pair gained more than 100 pips during morning trading, eventually reaching as high as 93.50 before dropping back to the 93.20 level at the beginning of the afternoon session. Against the Swiss franc, the dollar lost close to 40 pips during the first part of the day, eventually trading as low as 0.9072, before bouncing back to 0.9090 later in the day.

Today, dollar traders will want to pay attention to economic news out of the euro-zone and its impact on risk taking in the marketplace. While any better than expected news could drive the USD/JPY higher, it could also result in the dollar taking losses against its higher-yielding currency rivals. Later in the week, investors will be watching the US Trade Balance figure for clues as to the current state of the US economic recovery, with a positive result likely to boost the greenback.

EUR - Euro Turns Bullish Once Again

The euro turned bullish against several of its main currency rivals during the European session yesterday, following the release of a better than expected Spanish Services PMI which renewed confidence in the strength of the euro-zone economic recovery. Against the US dollar, the common-currency gained more than 100 pips during morning trading to eventually reach as high as 1.3566 before dropping back to the 1.3520 level. The EUR/JPY advanced more than 250 pips before peaking at 126.71 and dropping back to 125.95.

Today, the main piece of euro-zone news is likely to be the German Factory Orders figure, set to be released at 11:00 GMT. With analysts expecting the indicator to come in at 0.8%, significantly higher than last month's, the euro may be able to extend its bullish trend today. Tomorrow, traders will not want to forget to pay attention to the ECB press conference, scheduled to take place at 13:30 GMT. Any positive signs out of the press conference regarding the economic recovery in the euro-zone are likely to boost the currency further.

Gold - Gold Stages Bullish Recovery

The price of gold was able to stage an upward recovery during European trading yesterday, following positive euro-zone news which boosted riskier assets. The precious metal advanced more than $11 an ounce during morning trading, eventually reaching as high as $1684.70 before dropping back to $1680.50 during afternoon trading.

Today, euro-zone news is once again likely to have the biggest impact on gold prices. If the German factory orders figure comes in above the expected 0.8%, the precious metal is likely to extend yesterday's bullish momentum.

Crude Oil - Risk Taking Boosts Oil Prices

Crude oil advanced more than $1 an ounce during European trading yesterday, after a better than expected Spanish Services PMI encouraged investors to shift their funds to riskier assets. The commodity traded as high as $97.04 before dropping back to the $96.75 level during afternoon trading.

Turning to today, the US Crude Oil Inventories figure is likely to have the biggest impact on crude oil prices. If the indicator comes in at or above last week's 5.9M, investors are likely to interpret the news as a sign that US demand for oil is dropping, which would likely result in the oil prices turning bearish.

Technical News

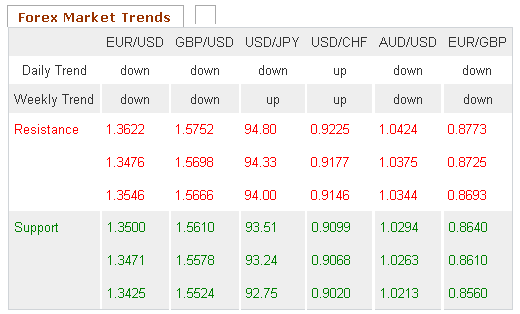

EUR/USD

The weekly chart's Slow Stochastic is close to forming a bearish cross, indicating that a downward correction could occur in the near future. Additionally, the same chart's Relative Strength Index has crossed into overbought territory. Opening long positions may be the smart choice for this pair.

GBP/USD

The Williams Percent Range on the weekly chart has fallen into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the MACD/OsMA on the daily chart appears close to forming a bullish cross. Traders may want to open long positions.

USD/JPY

The Relative Strength Index on the weekly chart has cross into overbought territory, indicating that a downward correction could occur in the coming days. This theory is supported by the Slow Stochastic on the same chart, which has formed a bearish cross. Opening short positions may be the smart choice for this pair.

USD/CHF

While the weekly chart's Williams Percent Range has crossed over into oversold territory, most other long-term technical indicators place this pair in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

The Wild Card

USD/ZAR

The Slow Stochastic on the daily chart is close to forming a bullish cross, indicating that an upward correction could take place in the near future. This theory is supported by the Williams Percent Range on the same chart, which has fallen into oversold territory. Opening long positions may be the best choice for forex traders today.