• There are significant headwinds to the euro area economies at the moment and most indicators currently signal that the euro area is in the middle of a recession.

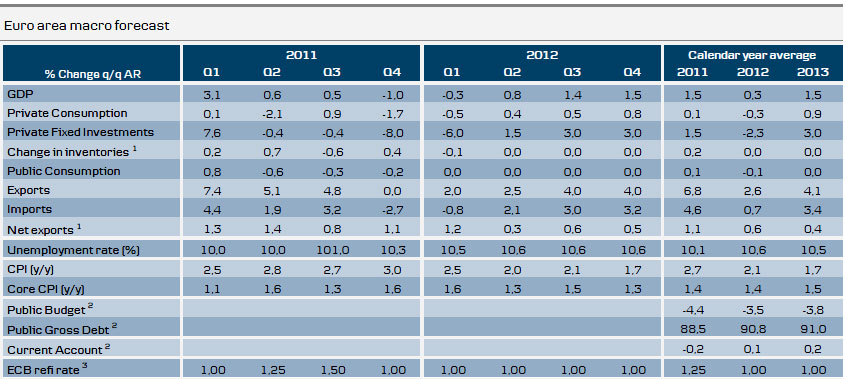

• However, we expect the recession to be fairly short and therefore keep our growth forecast unchanged at 1.5% for 2011 and 0.3% for 2012. In 2013 the gradual recovery is set to continue and we expect growth of 1.5%.

• The fiscal drag in the euro area is substantial, but contrary to popular belief it will not intensify in 2012. We estimate the fiscal drag on GDP in 2011 to be 1.5%-point falling to 1.0%-point in 2012.

• Since the debt crisis peak in late autumn we have moved one step back from the edge, following the introduction of 3-year LTROs. However, an array of critical events can influence sentiment in the coming months.

• The most important are the bank recapitalisation, the bond auctions in Italy and Spain and finalisation and implementation of the “fiscal compact”.

• We expect the ECB to have delivered the last cut in this cycle. The 3-year LTROs will ensure ample liquidity and the SMP purchases will be stepped up if sentiment deteriorates again.

There can be no doubt that there are significant headwinds to the euro-area economies at the moment and most indicators currently signal that the euro area is in the middle of a recession. However, as we outlined in our Forecast update published on 9 November 2011, we expect the recession to be fairly short. This remains our main scenario and we therefore keep our growth forecast unchanged at 1.5% for 2011 and 0.3% for 2012. In 2013 the gradual recovery is set to continue and we expect growth of 1.5%, so just around trend level.

Most growth indicators currently paint a bleak picture. Euro area PMIs and German Ifo expectations are at recession levels. However, the recent stabilisation is in line with our expectation that the sharpest drop in production happened in Q4. Composite PMI rose from 47.9 in November to 48.3 in December. The leading new orders - inventory balances have turned and started to improve, which normally leads the improvement in headline PMIs. Our PMI models point towards moderate increases in the coming months. It is somewhat comforting that the PMIs seem to have bottomed out and that we will not experience the same low levels as we did in 2008/09. Based on our hard and soft data models we expect negative growth in Q4 of -0.3% q/q and -0.1% in Q1 before returning to positive growth in Q2.

It is in particular investments and private consumption that are suffering in Q4 and Q1. The European Commission’s consumer confidence indicator has been falling steadily since July and in December it was at the same downbeat level as in the autumn of 2009. Retail sales show the same pattern. After the recent decline in November euro area retail sales are down by 2.5% compared to a year ago. Unemployment has risen to a new euro era high of 10.3%, which weighs on consumption. We expect private consumption to fall by 0.4% q/q in Q4 and 0.1% in Q1, before a gradual recovery sets in.

Investments are usually very sensitive to market sentiment and our model points to a sharp drop. We forecast investments will drop by 2.0% q/q in Q4 and 1.5% in Q1.

However, during 2012 some of the headwinds are going to turn into tailwinds. There are five reasons why we expect the recession to be short:

1. US recovery normally leads the euro area

2. Emerging Markets drive stronger export growth

3. Fiscal headwind is significant – but it is starting to decline

4. Financial headwinds are expected to ease in the second half of 2012

5. The recession is partly due to previous “overproduction”.

Europe seems to be unable to pull itself out of the recession currently, so the euro area is very much dependent on the rest of the world as a growth driver. If stronger growth in the rest of the world fails to materialise, it is possible that the euro area will remain in recessionary territory for a prolonged period. Especially Emerging Markets will play an important role. The slowdown here has been dampening growth in 2011, but the Emerging Markets are expected to boost exports and growth in 2012. The continued recovery in the US will support growth as well.

Fiscal tightening will start to decrease

The fiscal drag in the euro area is substantial, but contrary to popular belief it is not expected to intensify in 2012. Judging from forecasts from the EU Commission the maximum drag is in 2011 and will ease gradually in coming years. A simple approach to estimate the fiscal effect is to use the change in the cyclically-adjusted primary budget balance (CAPB). Our calculations are based on fiscal policy multipliers estimated in a 2009 ECB working paper.

Based on these data we estimate the fiscal drag on GDP in 2011 to be 1.5%-point falling to 1.0%-point in 2012. The fiscal consolidation was substantial in 2011 and the negative impact on growth in H2 was significant. The tightening will continue, but to a lesser extent going forward. For example, in Spain the CAPB increased from -5.1% of GDP in 2010 to an estimated -2.3% of GDP in 2011 – a tightening of 2.8 percentage points. In 2012 the CAPB is forecasted to rise to -1.7%, which is an increase of only 0.6 percentage points implying that fiscal tightening will be less significant. The tightening in 2011 will also have a negative spill over effect in 2012, but even taking this into account the accumulated outcome in Spain will be a softening– and hence contribute to a lift in the GDP growth rate.

Interestingly, even the strongest country in the region – Germany – was tightening its policy quite significantly in 2011. The CAPB is expected to rise to 1.1% (surplus!) in 2011 from -1.0% in 2010. However, as in Spain, fiscal tightening in Germany is planned to ease a bit in 2012.

Still many issues are left unsolved

Since the debt crisis peak in late autumn we have moved one step back from the edge, following the introduction of the 3-year LTROs in December. Nevertheless, we have an array of critical events in the coming months, that will attract market attention. The bond issuance in Italy and Spain is due to be stepped up in 2012. The total issuance in these two countries amounts to around EUR450bn in 2012, and in Q1 alone it is set to be just below EUR150bn. During most of the autumn the SMP purchases have on average been around equal the total issuance of Italy and Spain. However, since the 3-year LTROs were introduced ECB has decreased its purchases. If sentiments deteriorates again ECB would most likely again step up its purchases considerably in Q1.

The bank recapitalisation in Europe will take place during H1. A detailed plan on what banks intend to do to reach targets will have to be submitted by 20 January. In order to reach the targets banks should first aim at using private sources of funding, including retained earnings, reduced bonuses and new issuances of equity. Banks for which this is not an option should rely on official support from their national governments and only as a last resort the EFSF can be used. The capital shortfall estimated by the EBA is set to be EUR115bn,The shortfall is biggest in Greece (EUR30bn), followed by Spain (EUR26bn), Italy (EUR15bn) and Germany (EUR13bn).

There are a number of details following the last EU summit that need to be spelled out and implemented. So far it is not clear what role the EU institutions should play and what will be required from the European Court of Justice to approve the “golden rules” (structural deficit should not exceed 0.5%). Finally, the implementation risk remains very high and historically these processes have had a tendency to take longer than planned even though EU leaders are calling for a speedy process.

Finally,EFSF’s role in the secondary market and the role of the IMF need to be clarified. The EFSF “partial risk protection” model was set to be implemented in December and the second option, the a “co-investment approach” was set to be implemented in January. Since the announcement in November there has been very little news on the EFSF.

The European crisis remains one of confidence. If it were to go away tomorrow it would require: 1) that public finances could be restored overnight, 2) that the euro-area leaders speak with one voice and 3) that credible back stop facilities, for instance via the ECB, could be established. This is clearly not going to happen.

ECB has brought relief to short end with 3Y LTROs

We expect the ECB to have delivered the last cut in this cycle. Macro data appear to have stopped deteriorating and market sentiment has improved in recent weeks. If a slow economic recovery materialises, as we expect, the ECB will not cut rates any more, but will keep the refinancing rate at 1% for a prolonged period of time. However, the risk is still tilted to the downside.

The 36-month LTROs announced at the December Governing Council meeting in combination with a substantial easing of capital requirements was the most ambitious move from the ECB to combat the crisis so far. The introduction has brought relief to the market and effectively reduced yields in particularly in the short end. At the January meeting Draghi underlined that ECB expects a substantial demand at the second LTRO on 29 February. This should ensure ample liquidity. Furthermore the SMP purchases can be stepped up if sentiment deteriorates again.

We expect inflation to stay above target in the coming months before falling below 2%. So the inflation outlook is in line with the ECB target and monetary policy can continue to remain very accommodative for a prolonged period of time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Recession Expected to be Short

Published 01/23/2012, 12:01 PM

Updated 05/14/2017, 06:45 AM

Euro Recession Expected to be Short

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.