Investing.com’s stocks of the week

The shifting sands of the Greek political landscape seem to slipping back towards the less extreme parties if the most recent opinion polling data is to be trusted. The Syriza party, who are in favour of renegotiating the most recent bailout plan with the EU/ECB/IMF troika now sit in 2nd place behind the New Democracy party having been in the lead since the elections earlier this month.

This development should calm markets a bit today however, significant event risk is still attached to the outcome of the 2nd Greek election and as we get closer to June 17th, the rarer opinion polls become and the more difficult the outcome becomes to predict. For now, risk seems to be back in favour albeit lightly.

Fears over the European and, in particular, the Spanish banking system flared up once again over the weekend. On Friday, the stricken Bankia announced that the Spanish government would inject EUR19bn into the company in a bid to keep the bank afloat. Bankia is basically locked out of the overnight funding markets as other banks believe, quite rightly, that it is knocking on heaven’s door and will not lend to it.

The Spanish authorities are now planning to give Bankia government backed debt that can be taken to the ECB and used as collateral against further funding. We’re unsure what the ECB will make of this plan but it is unlikely to be calm.

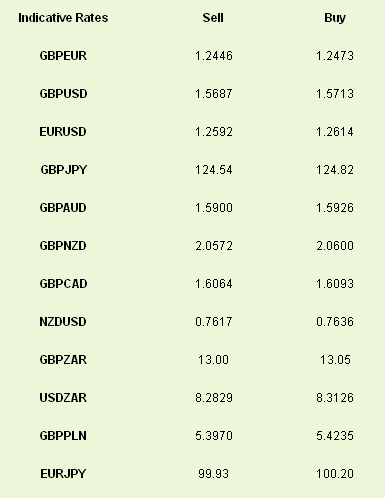

The plan, alongside the Greek political news, has popped EURUSD back above the 1.26 level with GBPEUR now back below 1.25. Asian trading was quiet overnight although it seems traders did a lot of short-covering; squaring up positions that were betting that the euro would continue to lose value. This will have helped the single currencies rebound and will lead to a further squeeze on the bears.

Today is Memorial day in the US and therefore expected to be a quiet day, although an Italian bond auction at around 10am could provide some fun and games. Later in the week we have the start of the run of the PMIs and the US jobs report on Friday with the main political hurdle likely to be that of the Irish referendum on the EU fiscal compact that new French President Francois Hollande wants changed. The ‘yes’ camp should win but the margin of victory will largely determine whether the markets see the win as a positive or not.

Latest exchange rates at time of writing