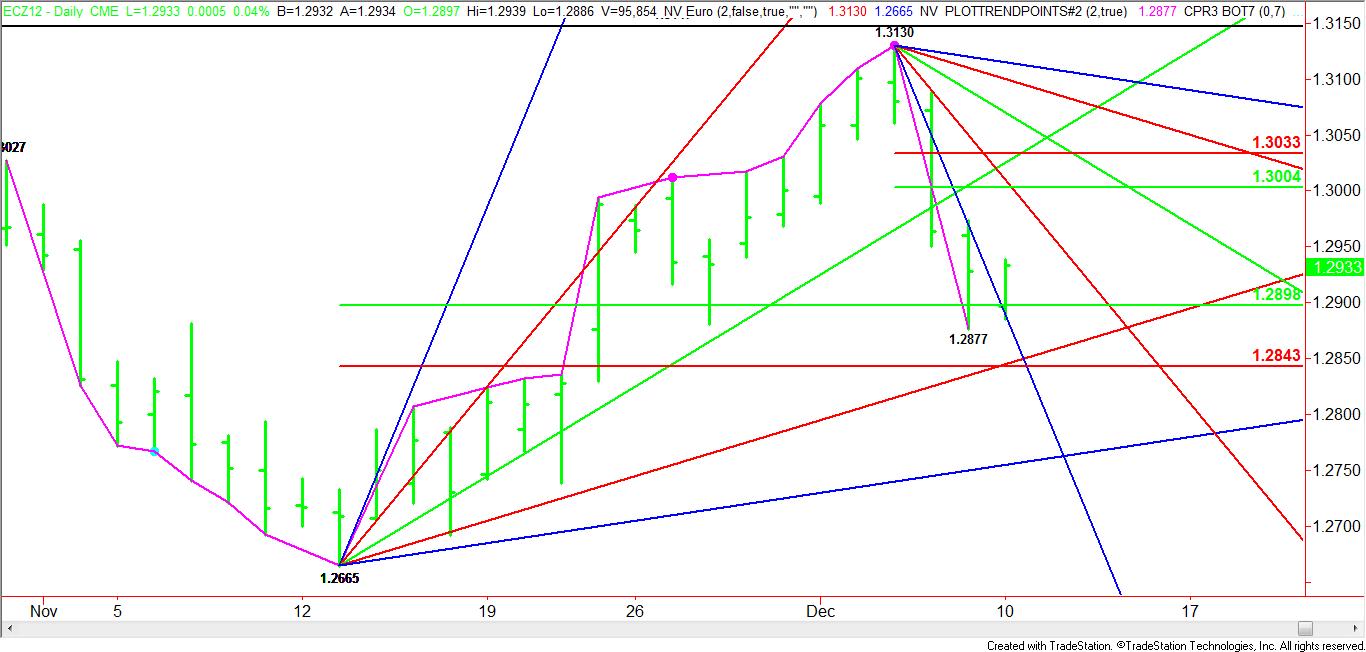

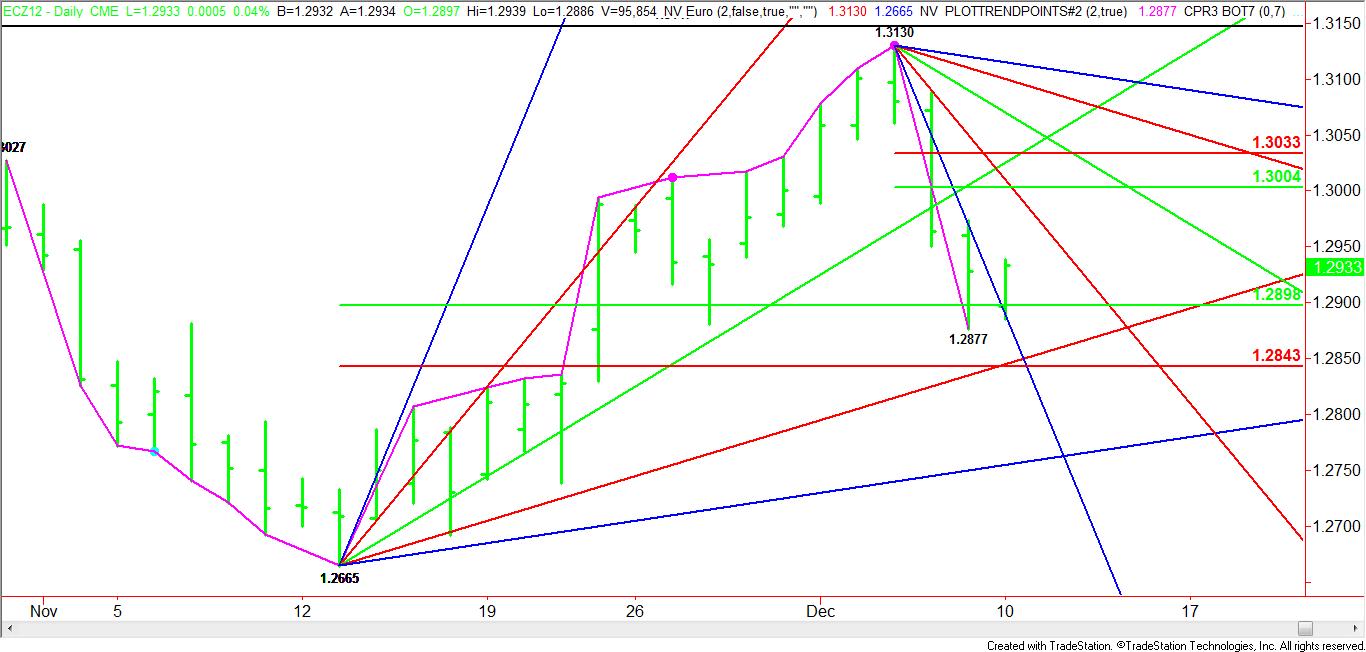

The December euro is mounting a strong comeback following last week’s hard sell-off. The strong rally is occurring after the market survived a test of a major retracement zone. So far all we are looking at is an inside trading day, however, increased upside momentum will put the market in a position to retrace the recent break from 1.3130.

Last Wednesday, the December euro formed a closing price reversal top on the daily chart. The market then proceeded to retrace a little more than 50% of the rally from 1.2665 to 1.3130. This target price was 1.2898 and the actual low was 1.2877.

With a new short-term range forming between 1.3130 and 1.2877, anticipation is building for a possible retracement back to 1.3004 to 1.3033. A test of this area will be important because bearish traders may decide to sell in this zone and produce a secondary lower-top or bullish traders will decide to finally bite the bullet and buy strength in an effort to break through 1.3100 with conviction.

Another sign of building strength is the euro’s breakout over a steep downtrending Gann angle at 1.2890. This sets up the possibility of a rally into the next angle at 1.3010. Yesterday, a price cluster formed at 1.3004 to 1.3010, this is a potential upside target and could prove to be strong resistance if today’s moves are only short-covering and fresh sellers decide to announce their presence with authority.

Last Wednesday, the December euro formed a closing price reversal top on the daily chart. The market then proceeded to retrace a little more than 50% of the rally from 1.2665 to 1.3130. This target price was 1.2898 and the actual low was 1.2877.

With a new short-term range forming between 1.3130 and 1.2877, anticipation is building for a possible retracement back to 1.3004 to 1.3033. A test of this area will be important because bearish traders may decide to sell in this zone and produce a secondary lower-top or bullish traders will decide to finally bite the bullet and buy strength in an effort to break through 1.3100 with conviction.

Another sign of building strength is the euro’s breakout over a steep downtrending Gann angle at 1.2890. This sets up the possibility of a rally into the next angle at 1.3010. Yesterday, a price cluster formed at 1.3004 to 1.3010, this is a potential upside target and could prove to be strong resistance if today’s moves are only short-covering and fresh sellers decide to announce their presence with authority.