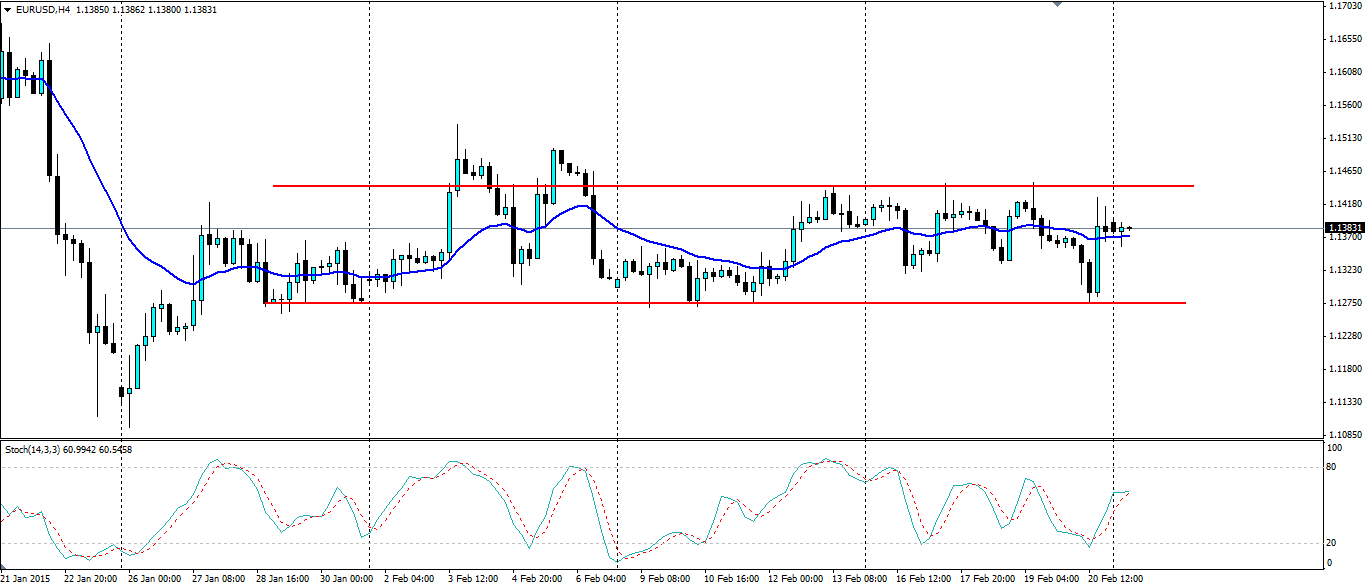

The euro has formed a channel between clearly defined support and resistance lines. With the threat of Greece exiting the euro now put on hold, these levels look like they will hold. Why not make the most of them?

(Source: Blackwell Trader)

Greece has been given a four month reprieve from the threat of bankruptcy. But all that really means is that in four months we will be in the same situation we have been in for the last two weeks. That explains the muted response from the market to the news. With that threat removed for now, the euro is likely to keep bouncing between the channel shown above.

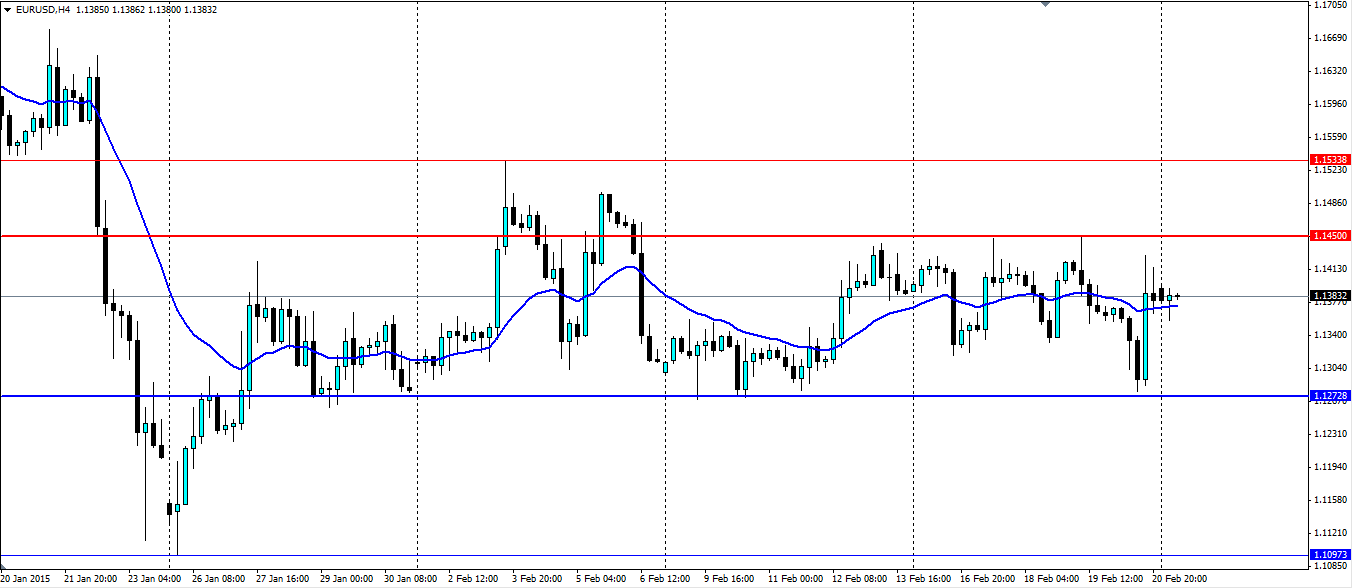

The support level at 1.1272 has been tested several times over the last month and has held firm. A limit order with a stop loss not far below this level will be a good way to take advantage of another test of this line. If the price heads back to the top it will net a 175 pip gain.

The same applies to the top of the channel. There have been several rejections off the 1.1450 level recently and a sell limit order will take advantage of a rejection off this level. Ensure a stop loss is set not far above to limit any downside losses from a breakout.

There is some news to watch out for in the coming week that could cause a breakout. Both ECB President Mario Draghi and Fed Chairwoman Janet Yellen are due to speak and could shift the market either way. Also US CPI on Wednesday could see dollar strength return if it comes in positive.

(Source: Blackwell Trader)

The EUR/USD pair is looking to respect the upper and lower support/resistance levels of a channel that could provide some predictable trading opportunities.