The September euro rallied overnight after initial Greek election results seemed to indicate a win by the pro-bailout, pro-euro party. The euphoria died quickly however as the air was let out of the rally balloon as traders quickly turned their focus on Spain and Italy.

A drop in Spanish and Italian stock markets coupled with the sharp rise in Spanish government bonds encouraged traders to fade the rally in the euro, demonstrating that they had already moved past the Greek elections. As Spanish government bond yields reached euro-era highs above 7 percent, traders expressed their concerns about Spain’s fiscal and banking system problems. Traders are once again looking toward the european Central Bank for aid to stop the steep rise in bond yields.

The 7 percent level is critical as many feel the country cannot operate with yields this high, putting it in a position to receive a bailout. In the recent past, Greece, Ireland and Portugal sought international bailouts after their 10-year bond yields went beyond the 7 percent level.

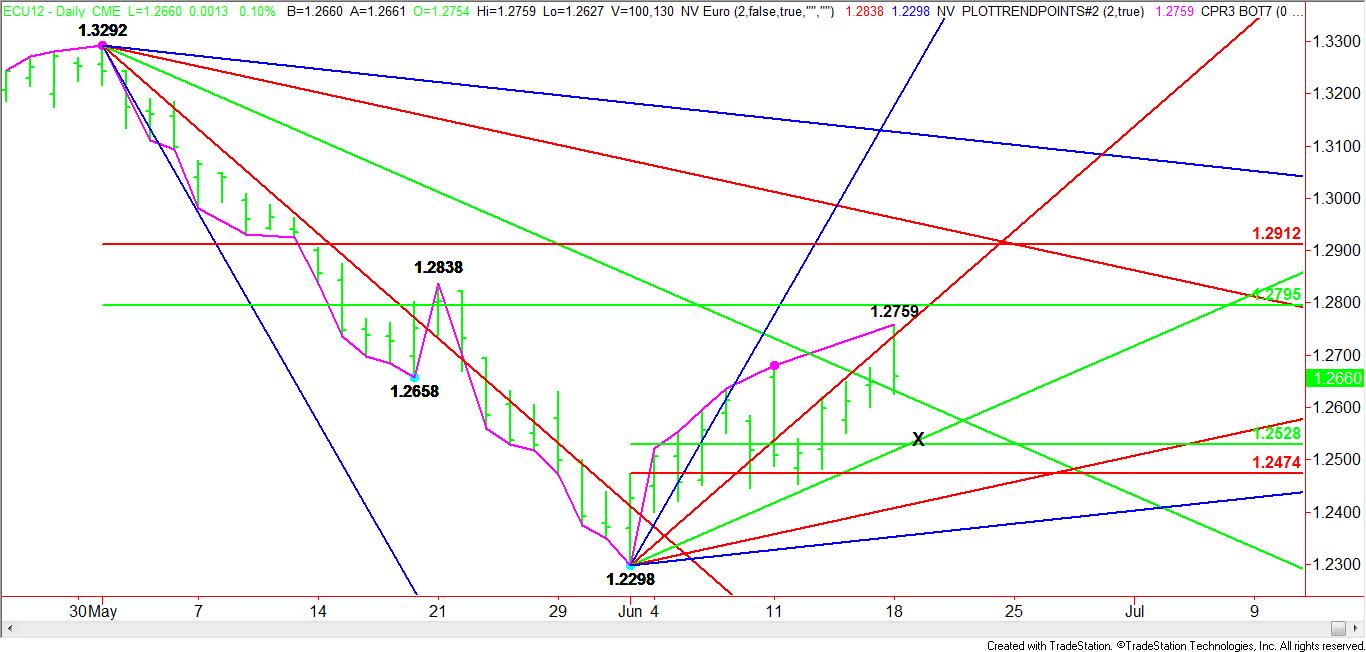

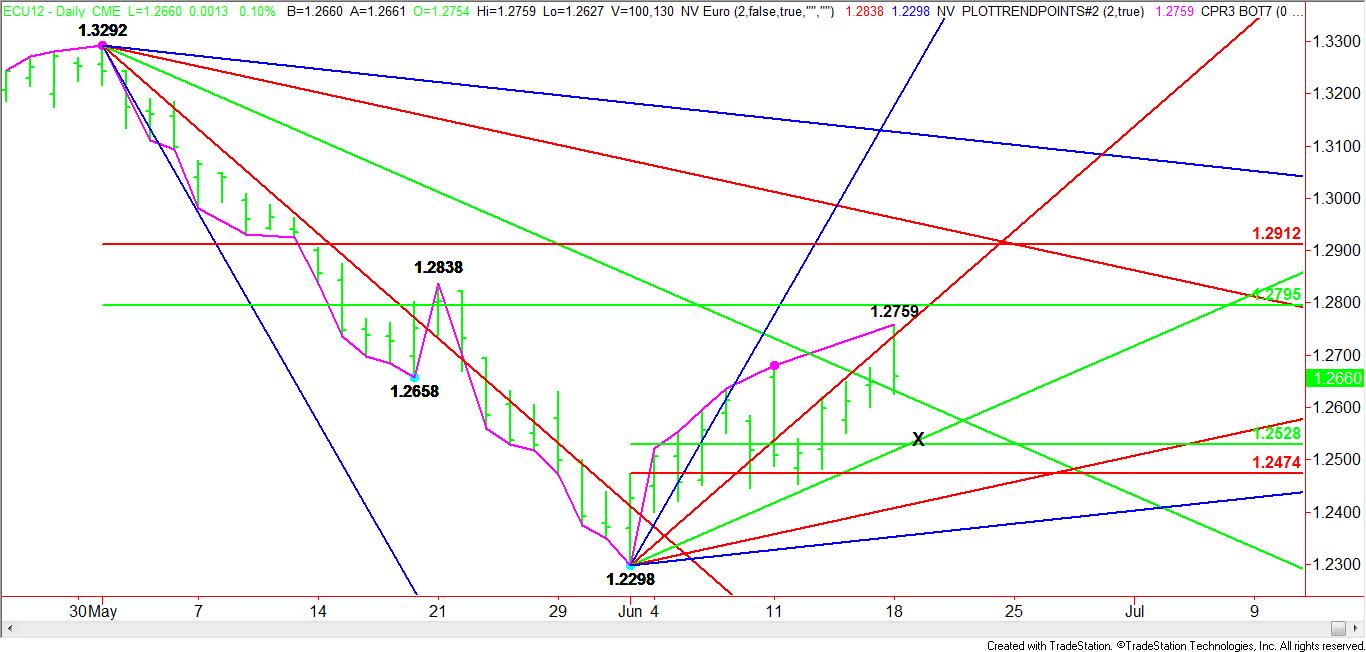

Technically, the September euro surged through a major downtrending Gann angle at 1.2632. This helped propel the single currency through a steep uptrending Gann angle at 1.2738. After failing to reach a critical 50% level at 1.2795, momentum shifted as short-traders reapplied pressure.

Despite the eleven day rally from the 1.2298 bottom, the main trend in the euro never turned up. This is clear evidence that the recent rally was driven by short-covering. Some speculative buying may have been involved in the rally, but for the most part, the move was created by weak traders covering their shorts in an over-reaction to the possibility that central banks would intervene to boost the euro.

With sentiment shifting back to the downside, traders should watch for a 50 to 61.8 percent correction of the rally from 1.2298 to 1.2759. This potential target zone is 1.2528 to 1.2474. Additionally, uptrending Gann angle support comes in at 1.2519. This creates a potential downside target and support cluster at 1.2528 to 1.2519.

With euro investors shrugging off the good news from Spain, traders should watch for downside momentum to build throughout the day with the possibility of a massive closing price reversal top. In addition, look for volume to rise as the market falls, setting up the possibility of a volatile outside move day.

A drop in Spanish and Italian stock markets coupled with the sharp rise in Spanish government bonds encouraged traders to fade the rally in the euro, demonstrating that they had already moved past the Greek elections. As Spanish government bond yields reached euro-era highs above 7 percent, traders expressed their concerns about Spain’s fiscal and banking system problems. Traders are once again looking toward the european Central Bank for aid to stop the steep rise in bond yields.

The 7 percent level is critical as many feel the country cannot operate with yields this high, putting it in a position to receive a bailout. In the recent past, Greece, Ireland and Portugal sought international bailouts after their 10-year bond yields went beyond the 7 percent level.

Technically, the September euro surged through a major downtrending Gann angle at 1.2632. This helped propel the single currency through a steep uptrending Gann angle at 1.2738. After failing to reach a critical 50% level at 1.2795, momentum shifted as short-traders reapplied pressure.

Despite the eleven day rally from the 1.2298 bottom, the main trend in the euro never turned up. This is clear evidence that the recent rally was driven by short-covering. Some speculative buying may have been involved in the rally, but for the most part, the move was created by weak traders covering their shorts in an over-reaction to the possibility that central banks would intervene to boost the euro.

With sentiment shifting back to the downside, traders should watch for a 50 to 61.8 percent correction of the rally from 1.2298 to 1.2759. This potential target zone is 1.2528 to 1.2474. Additionally, uptrending Gann angle support comes in at 1.2519. This creates a potential downside target and support cluster at 1.2528 to 1.2519.

With euro investors shrugging off the good news from Spain, traders should watch for downside momentum to build throughout the day with the possibility of a massive closing price reversal top. In addition, look for volume to rise as the market falls, setting up the possibility of a volatile outside move day.