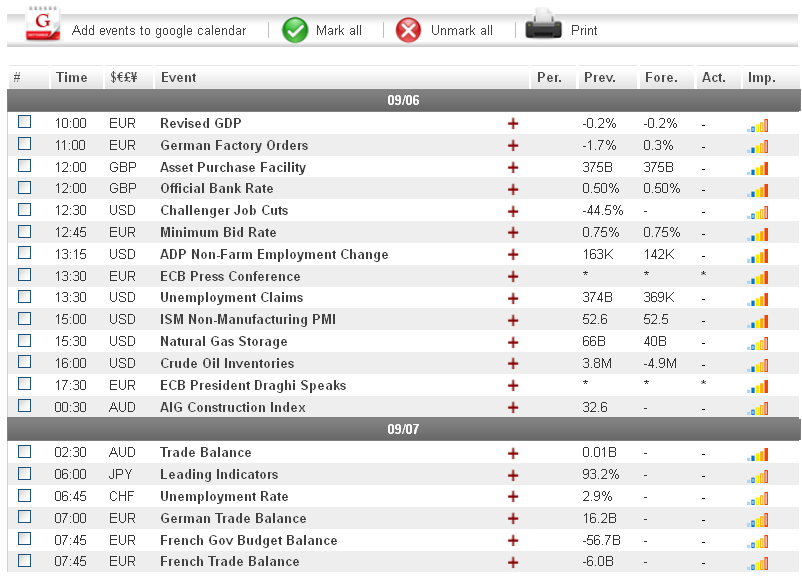

The euro rallied against virtually all of its main currency rivals during European trading yesterday, as details regarding the ECB's plan to lower borrowing costs in Italy and Spain began to surface. Today, in addition to the ECB Press Conference, where final plans to boost the eurozone economy are expected to be unveiled, traders will also want to pay attention to a batch of US news. The ADP Nonfarm Employment Change and ISM Non-Manufacturing PMI, set to be released at 12:15 and 14:00 GMT, could lead to losses for the dollar if they come in below their expected values.

Economic News

USD - ADP Data Set to Generate Volatility Today

The US dollar fell against several of its main currency rivals yesterday, as the release of details regarding the ECB's plan to boost the eurozone recovery led to risk taking in the marketplace. The USD/CHF fell more than 70 pips during the first part of the day to reach as low as 0.9529. A slight upward correction during the afternoon session took the greenback to the 0.9550 level. The EUR/USD managed to gain more than 100 pips during the European session to trade as high as 1.2611. A reversal later in the day brought the pair to the 1.2590 level.

Turning to today, while most analysts will be focusing on the ECB Press Conference, scheduled to take place at 12:30 GMT, dollar traders will not want to forget to pay attention to US news as well. The ADP Nonfarm Employment Change will be of particular importance. The ADP figure is considered a valid predictor of Friday's all-important Nonfarm Employment Change figure and has been known to lead to market volatility. If today's news comes in below the forecasted 141K, the dollar could see losses during mid-day trading.

EUR - ECB Press Conference May Help Euro Extend Gains

The euro saw gains across the board yesterday, as investors shifted their funds to riskier assets amid speculations regarding the ECB's plans to lower borrowing costs in the eurozone. The EUR/JPY advanced more than 80 pips over the course of the day to reach as high as 98.90. Against the British pound, the common-currency gained close to 40 pips before peaking at 0.7927. A slight downward correction later in the day brought the euro to the 0.7920 level.

Today, all eyes will be on the ECB Press Conference, scheduled to take place at 12:30 GMT, to see what the exact details are for plans to lower Spanish and Italian borrowing costs. Any indication from investors that the ECB did not go far enough with its plans to boost the eurozone recovery, could result in the euro reversing yesterday's gains. Tomorrow, euro traders should not forget to pay attention to the US Nonfarm Payrolls figure. If the figure comes in below expectations, the EUR/USD could see gains before markets close for the weekend.

Gold - Gold May Extend Gains Today

While concerns regarding an upcoming US jobs report led to minor losses for gold yesterday, the precious metal was able to quickly recover after details of the ECB's plan to stimulate growth in the eurozone were unveiled. By the end of the European session, gold was trading close to the $1693 level, very close to a recent six-month high of $1698.70.

Today, gold may be able to extend its recent gains if the ECB Press Conference results in risk taking among investors. That being said, gold traders will also want to pay attention to the US ADP Nonfarm Employment Change figure. A better than expected figure could lead to gains for the dollar, which may result in gold taking losses during afternoon trading.

Crude Oil - Fears Regarding Global Economic Health Send Oil Lower

The price of crude oil fell yesterday, as poor global economic indicators resulted in fears regarding future demand for the commodity. In addition to uncertainties regarding the euro-zone recovery, a slowing economy in China has caused investors to sell crude in recent days. After gaining close to $0.70 a barrel during the first part of the day, crude fell $1.40 during afternoon trading to reach as low as $94.24.

Today, oil traders will want to pay particular attention to US indicators. Specifically, the ADP Nonfarm Employment Change and ISM Non-Manufacturing PMI could lead to volatility for the commodity. Should any of the news come in above their forecasted levels, speculations that demand will go up in the US could result in gains for oil during afternoon trading.

Technical News

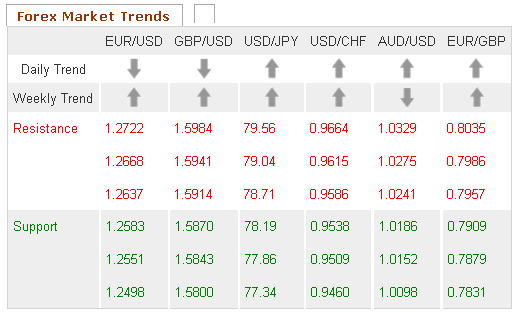

EUR/USD

The Williams Percent Range on the weekly chart has crossed into overbought territory, indicating that downward movement could occur in the near future. Furthermore, a bearish cross has formed on the daily chart's Slow Stochastic. Opening short positions may be the wise choice for this pair.

GBP/USD

While the weekly chart's Williams Percent Range has crossed over into overbought territory, signaling a possible downward correction, most other technical indicators show this pair range trading. Traders may want to take a wait and see approach, as a clearer picture may present itself in the near future.

USD/JPY

The Bollinger Bands on the weekly chart are narrowing, signaling a possible price shift for this pair in the coming days. Additionally, the Slow Stochastic on the daily chart has formed a bullish cross, indicating that the shift could be upward. Opening long positions may be the wise choice for this pair.

USD/CHF

Long-term technical indicators are providing mixed signals for this pair. While the MACD/OsMA on the weekly chart has formed a bearish cross, the Williams Percent Range on the same chart has dropped into oversold territory. Taking a wait and see approach may be the best choice at this time.

The Wild Card

USD/DKK

A bullish cross on the daily chart's Slow Stochastic indicates that this pair could see an upward correction in the near future. Furthermore, the Williams Percent Range on the same chart has crossed into oversold territory. Opening long positions may be the best option for forex traders today.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Rallies As Details Of ECB Plan Released

Published 09/06/2012, 03:25 AM

Updated 02/20/2017, 07:55 AM

Euro Rallies As Details Of ECB Plan Released

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.