- US inflation is expected to rise to 3.3%

- ECB singing a dovish tune ahead of the September meeting

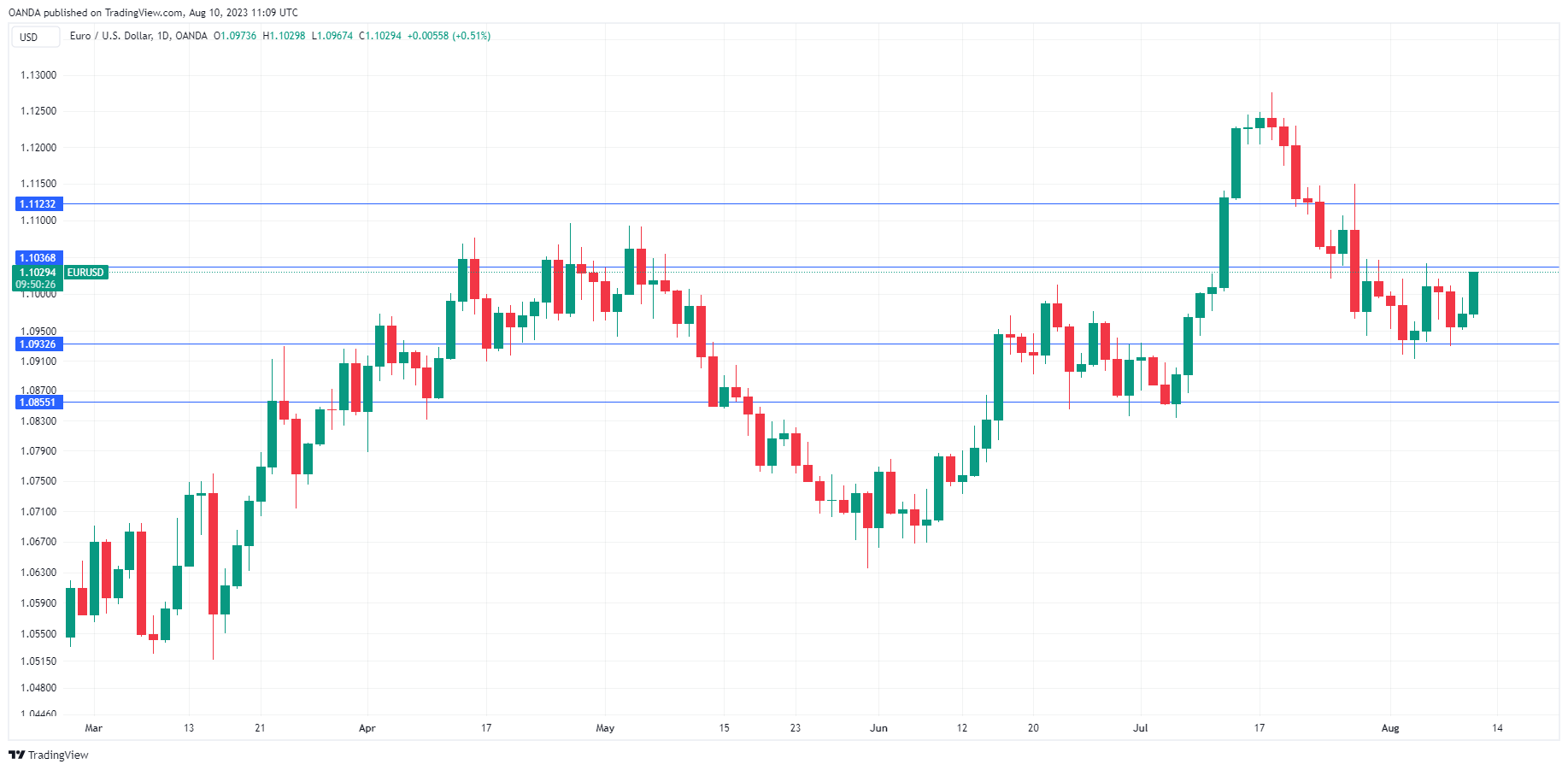

The euro has climbed higher on Thursday. In the European session, EUR/USD is trading at 1.1020, up 0.43%. On the data calendar, there are no economic releases out of the eurozone today. The US releases the July inflation report.

US inflation expected to climb to 3.3%

The Fed has achieved much of its objective in wrestling inflation to lower levels. Inflation has eased to 3% but pushing it down to the 2% target could be difficult. We’ll get a look at July inflation later today, with headline CPI expected to accelerate to 3.3% in July, up from 3.0% in June. Core inflation, which the Fed pays particular attention to, is expected to remain at 4.8%. The Fed is expected to take a pause at the September meeting and barring a shock to the upside, the inflation release should cement a pause at next month’s meeting.

Will the ECB backtrack on tightening?

The European Central Bank hasn’t been as aggressive as the Federal Reserve and other major central banks, but the current cash rate of 4.25% is nothing to sneeze at. The ECB has raised rates nine straight times since July 2022, including two oversize hikes of 0.75%. In June, ECB President Lagarde sounded hawkish, saying that the central bank still had “ground to cover” and that a July rate hike was likely. The ECB followed through with an increase at the July meeting but said that a pause in September was a possibility.

The reason the ECB is sounding more dovish is the soft eurozone economy. Although the 2% inflation target is still far off, there are growing concerns that further hikes will tip the economy into a recession. In the past, it has been southern European countries such as Greece which have dragged down the eurozone economy. Now, fingers are pointing at Germany, the largest and most powerful economy in the bloc.

In years past, the German locomotive helped the eurozone get back on its feet, but now Germany is being referred to as the “sick man of Europe”. Germany’s economy contracted in the second quarter, the only G7 member to show negative growth in Q2.

The German manufacturing and construction sectors are in decline and growth in the services sector has been weak. The slump in China’s economy has only made matters worse. Germany’s economic troubles have dampened eurozone growth and have raised fears that a soft landing for the eurozone could be in jeopardy.

EUR/USD Technical

- EUR/USD is putting pressure on resistance at 1.1036. Above, there is resistance at 1.1123

- There is support at 1.0932 and 1.0855