The EUR/USD smashed through resistance overnight on the back of US dollar weakness, but it may have been an over extension in many traders books.

While many had expected lower lows they will likely be disappointed by the recent ranging higher of the Euro and how slow the trend has got as of late, but there is still plenty of opportunity on the chart to profit from market movements – which is generally the case in trading.

After breaking last night’s floor in the market and then pulling back to sit under resistance, the market has been mucking about when it comes to its next direction. Many would argue that it will shift lower and I’m inclined to agree with the majority given Europe's lack of attention to the threat of deflation and the rather dull ECB which has so far failed to fight the problem head on.

Elevating the problems further was talk over night of election problems in Greece, where there are fears the the left wing party Syriza may be able to get back into power. The problem with this is that it is anti-austerity, which means it would clash with the heads of Europe again about the bailout and would likely ask for radical changes. All of this would shake up financial markets all across Europe and send people scurrying into safe haven assets.

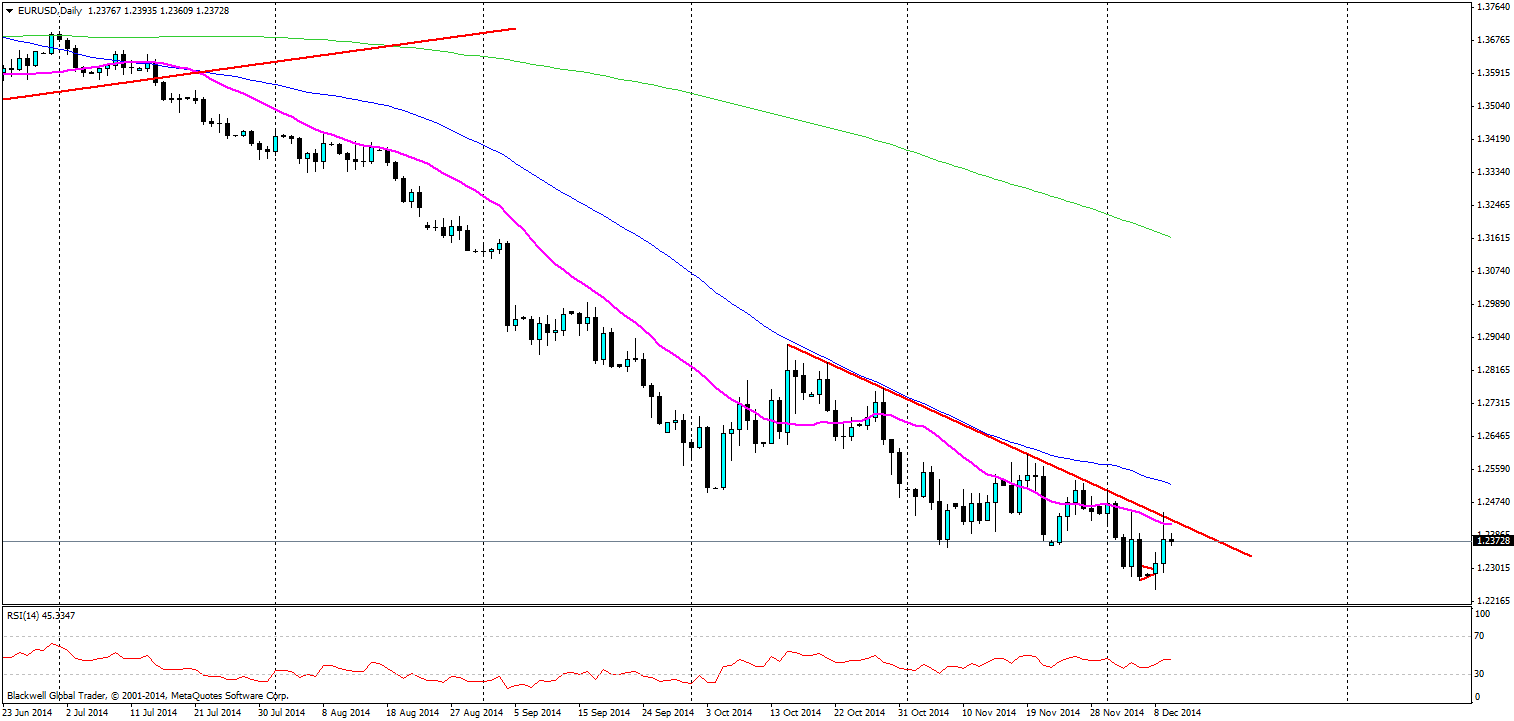

On the charts it’s clear to see there is a trend line with a strong 20 day MA going down the charts with the trend. What is also clear is that we are currently are looking at lower lows.The question is how to go about playing the EUR/USD?

I believe that the answer is better seen on the 4H chart for the EUR/USD.

Source: Blackwell Trader (EUR/USD, H4)

As we can see here the trend line is very strong and very tight with tests of the trend line basically being market entry points for traders, we may see some more volatility over the coming days with the Greek elections, but any touch of this trend line should be treated as a probable entry point for the market.

So if you’re looking to play the EUR/USD pay attention to the trend line and on top of that, the level we are on which is acting as support and resistance on and off; and on a side note be careful of Greek news as it generally brings with it volatility.