- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Euro/Pound Looks For A Reversal

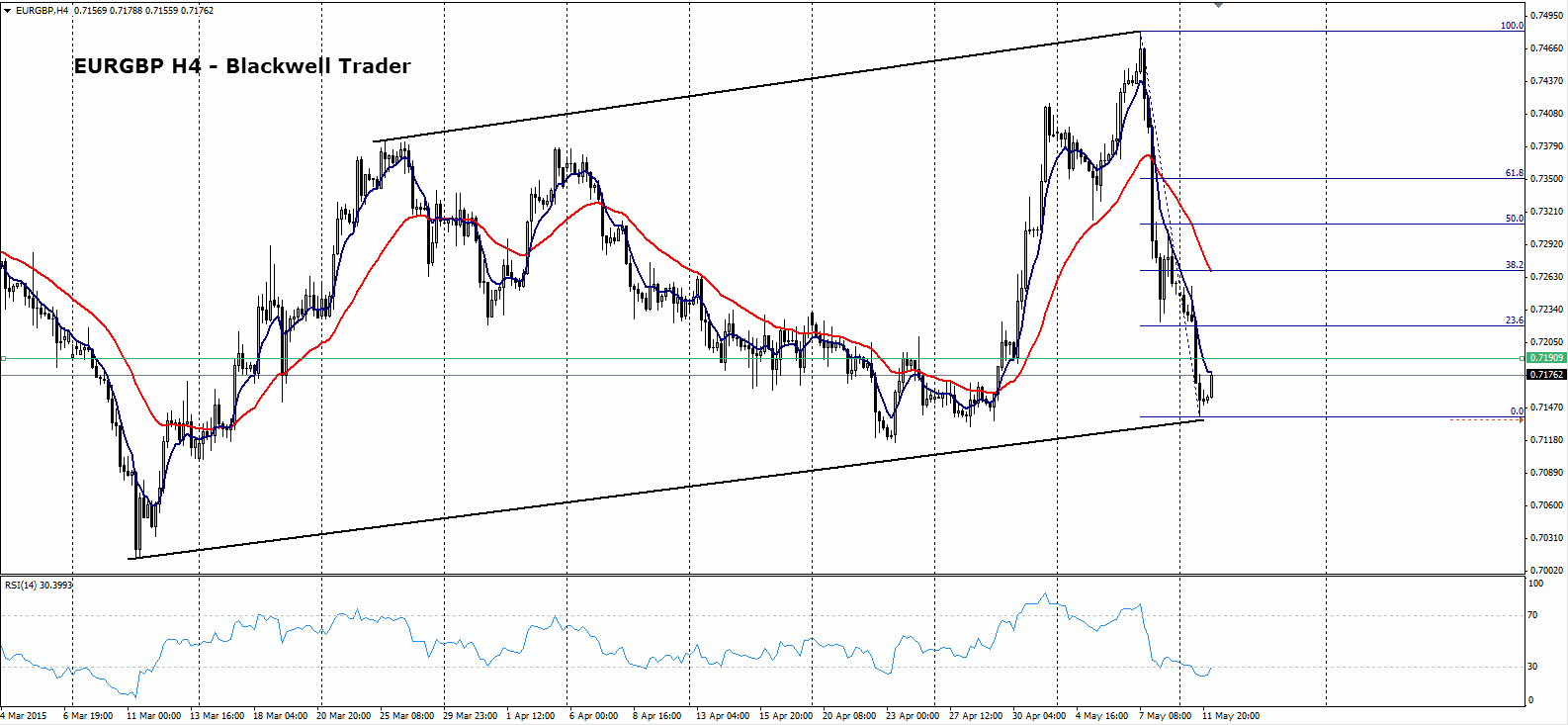

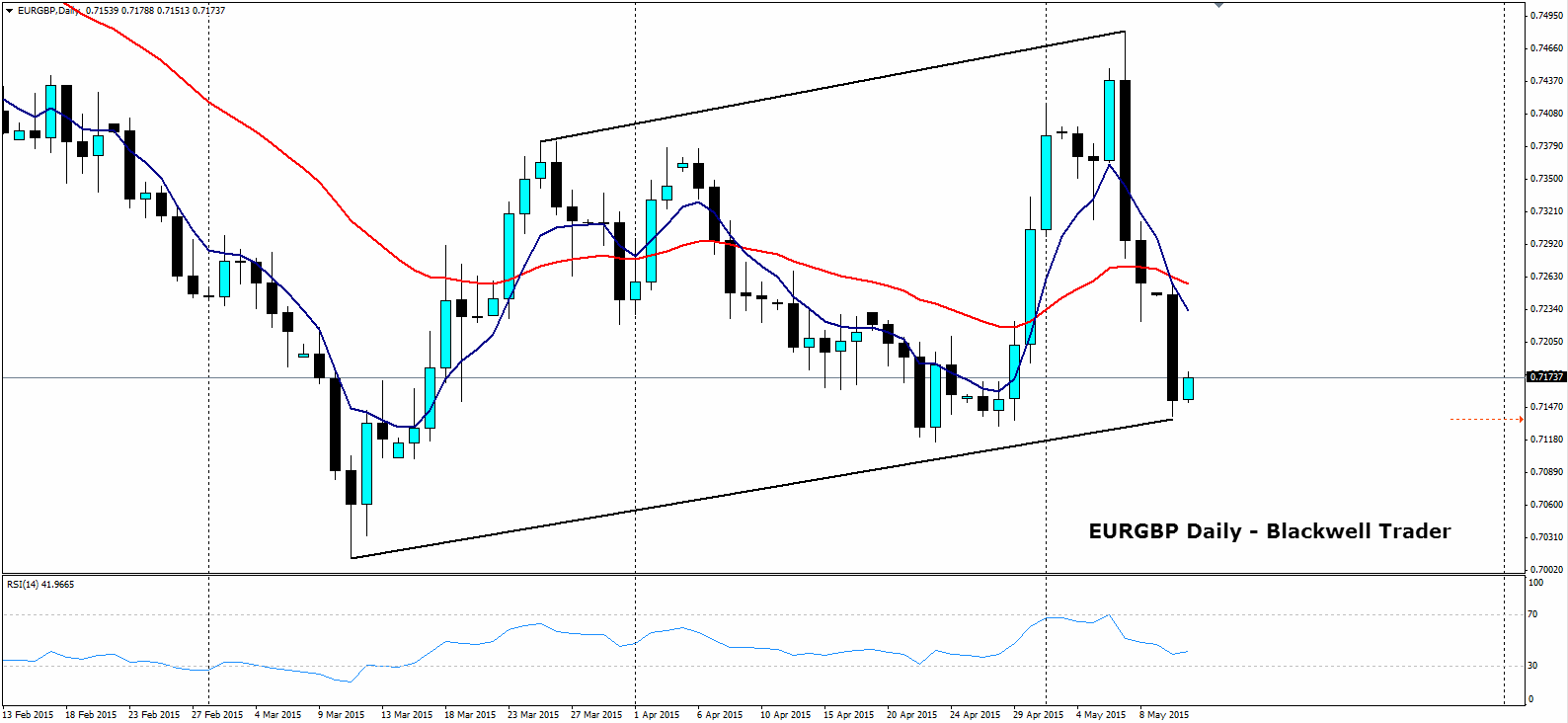

The euro-pound has recently fallen strongly down to a low of 0.7138, mainly in response to the post UK election euphoria and perceived pound strength. Seemingly defying any fundamental or technical analysis, the pound has appreciated strongly against all contenders and subsequently caused large selloffs in base currencies. Despite this, the euro-pound has finally found some support and is now looking to climb out of its doldrums.

The euro-pound appears to have found a bottom at 0.7138 and a Doji appears to be signalling a reversal to the long side. RSI is also starting to trend steadily north, out of oversold territory, signalling that a reversal of fortunes may be on the cards for the pair. The hourly charts show some definite buying activity with the 6SMA and 12SMA crossing whilst price starts to trend higher.

The first obstacle that the pair will need to surmount, to continue moving higher, is a resistance level at 0.7225 and 0.7260. A close above these levels may well signal a strong, bullish run, to the top of the current channel. However, any long-side push is going to face some significant risks, with Greece remaining top of the list.

Despite a slight improvement in the Greek debt negotiating positions, the risk of a Grexit still weighs heavily over the market. This is especially prescient considering that Germany has now started to suggest that a referendum should be undertaken by Greece over austerity. Any referendum over the matter is likely to turn into a vote over Greece’s future within the eurozone. This sort of uncertainty would likely cause great volatility within the euro-pound and put the potential for a strong retracement at risk.

Ultimately, reversal patterns can be hard to pick, especially considering some of the overarching risk factors that are at play in the eurozone. However, the charts are exhibiting some definite bias to the long side.

Related Articles

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

The US stock market stabilized yesterday, but there were no significant moves during the US session as speculators remained neutral ahead of Nvidia (NASDAQ:NVDA) earnings, which...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.