We expect The Kraft Heinz Company (NASDAQ:KHC) to beat expectations when it reports first-quarter 2016 results on May 4, after the market closes.

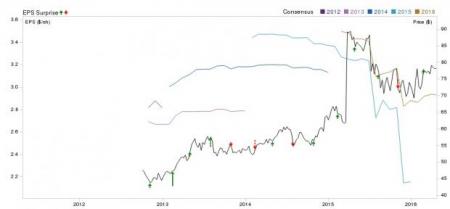

Last quarter, the company delivered a positive earnings surprise of 6.90%.

Despite lackluster sales figures, the packaged food company delivered positive earnings surprises in three of the past four quarters with an average surprise of 1.08%.

Let’s see how things are shaping up for the upcoming announcement.

Why a Likely Positive Surprise?

Our proven model shows that Kraft Heinz is likely to beat earnings because it has the right combination of two key components.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate (62 cents per share) and the Zacks Consensus Estimate (61 cents), stands at +1.64%. This is a meaningful and leading indicator of a likely positive earnings surprise.

Zacks Rank: Kraft Heinz has a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) and 3 have a significantly higher chance of beating earnings.

Conversely, the Sell-rated stocks (Zacks Rank #4 and 5) should never be considered going into an earnings announcement.

The combination of Kraft Heinz’s Zacks Rank #3 and +1.64% ESP makes us confident of an earnings beat.

Currently, the stock is trading at $78.36. We expect the release to lead to stock movement.

What's Driving the Better-than-Expected Earnings?

Kraft Heinz has been seeing top-line weakness over the past many quarters. The company is witnessing lower volumes and share losses in the U.S. due to weak category trends. Reduced spending by the U.S. shoppers and a shift in consumer preference toward natural and organic ingredients over packaged and processed food have been hurting the company’s business. Category trends and market share performance are likely to remain under pressure in the first quarter and through the rest of 2016.

Foreign exchange is a major headwind for Kraft Heinz’s sales as a significant percentage of its revenues is generated outside the U.S. With almost all the foreign currencies deteriorating in comparison with the U.S. dollar, foreign exchange is expected to continue to be a headwind for revenues, thereby limiting top-line growth in the first quarter.

Despite relatively soft sales, cost savings have led to better margins, mainly in the developed markets of the U.S. and Europe. We expect the trend to continue in the first quarter. Kraft Heinz has implemented many cost-saving initiatives including the integration of Kraft Foods and Heinz..

Though currency headwinds and weak consumption trends are expected to linger in 2016, management expects to address these issues through innovation, go-to-market capabilities and removal of inefficient spending.

Stocks to Consider

Some stocks in the consumer staples sector that have both a positive Earnings ESP and a favorable Zacks Rank include:

Pinnacle Foods Inc. (NYSE:PF) with an Earnings ESP of +5.00% and a Zacks Rank #3.

Hormel Foods Corp. (NYSE:HRL) with an Earnings ESP of +5.26% and a Zacks Rank #1.

Nu Skin Enterprises Inc. (NYSE:NUS) with an Earnings ESP of +8.11% and a Zacks Rank #2.

NU SKIN ENTERP (NUS): Free Stock Analysis Report

HORMEL FOODS CP (HRL): Free Stock Analysis Report

PINNACLE FOODS (PF): Free Stock Analysis Report

KRAFT HEINZ CO (KHC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research