- Stock markets power higher, flying against hawkish Fed

- Crunch time for euro, PMI surveys set to reveal war damage

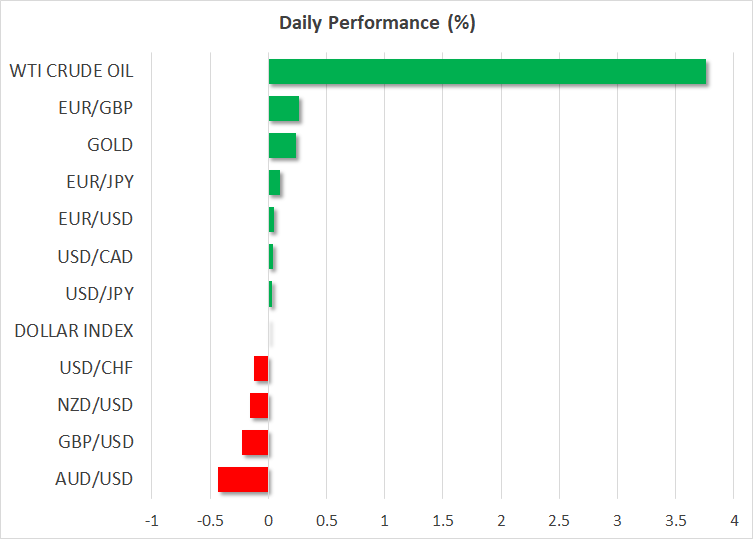

- Oil spikes higher as EU considers joining Russian embargo

Equity markets advance

Wall Street extended its winning streak on Friday, undeterred by signals that the Fed is about to slam on the brakes to get spiraling inflation under control. The flagship S&P 500 closed the week with gains exceeding 6%, drawing power from a collapse in implied volatility after the Fed laid out its plans for interest rates.

Several FOMC officials have spoken since the last meeting and even the most dovish members like Kashkari seem comfortable raising rates another six times this year. That’s precisely what money markets are pricing in at this stage.

With equity markets rallying even as rate hike expectations grow, it seems like investors are cheering the Fed onwards. There’s a new school of thought that says stock markets are encouraged by the Fed stepping up its game, as a heavy hand now implies inflation won’t be a problem for the economy in the long run.

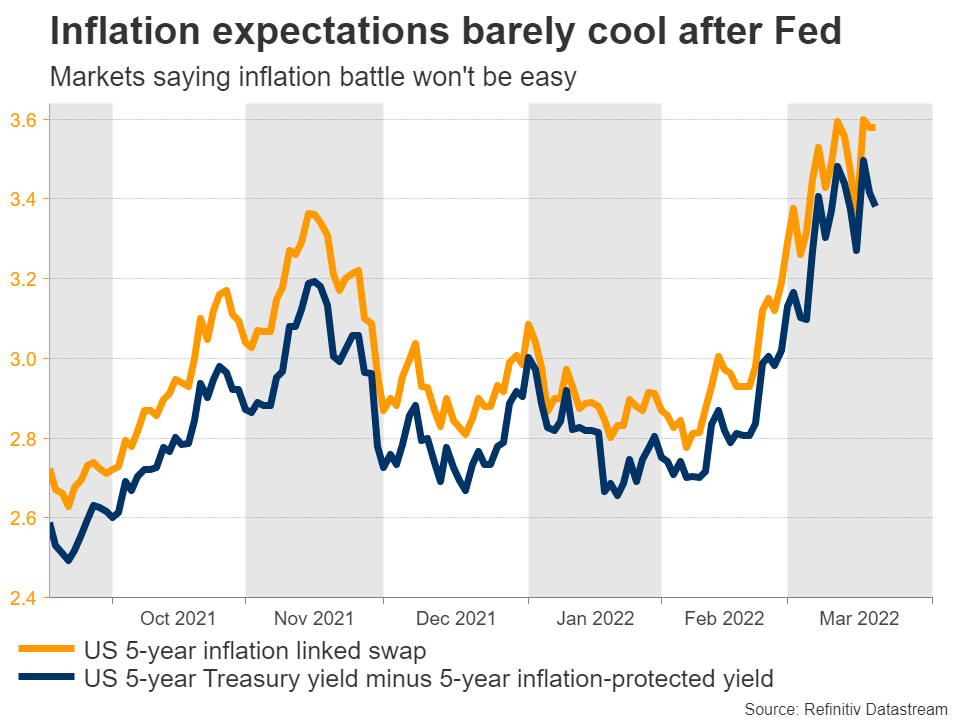

The flaw with that line of thinking is that market-based measures of inflation expectations haven’t cooled much. With inflation expectations staying elevated, real yields remain subdued deep in negative territory, enabling the powerful rally in equity markets and especially in the most beaten-down growth stocks.

To put it simply, investors think the Fed will struggle to win its battle against inflation. That leaves equities as the main game in town, since bond holders could suffer even more in such an environment and commodity trades are already overcrowded.

Euro braces for tough week

In the currency arena, the euro miraculously came out on top last week amid speculation for a ceasefire in Ukraine, but its luck may be running out. The latest PMI business surveys will be released on Thursday and the forecasts for the euro area seem overly optimistic.

Economists expect the Eurozone composite PMI to dip only slightly in March and to remain comfortably in expansionary territory, which seems unrealistic considering that the data was collected after the war erupted and sanctions were imposed. This sets up the euro for a bigger fall if the PMIs ‘surprisingly’ sink into contractionary waters, reflecting the tremendous uncertainty among businesses.

Overall, investors continue to grapple with the same themes - war and peace, recession worries, and what inflation means for different central banks. The verdict is that the Bank of Japan will lag behind everyone else in the normalization game, hence why the yen has become the market’s punching bag lately.

Oil spikes higher, Powell speaks

In the commodity sphere, the threat of even stronger sanctions against Russia has lit another fire under oil prices. The European Union is considering whether to join the United States in banning Russian oil, adding to the sense of scarcity that’s tormenting energy markets.

Complicating matters further, the peace negotiations in Ukraine have stalled, the deal with Iran that would revive lost production seems stuck, and US shale players are not rushing to raise their own output despite soaring prices.

As for today, market participants will tune in for a speech by Fed Chairman Powell at 16:00 GMT. The big debate right now is whether the Fed will hike rates by 50 basis points in May. Money markets are currently split on this prospect, so Powell’s remarks could be crucial in tipping the scales and consequently, deciding the dollar’s next move.